|

After unexpectedly discovering My First Property as being vacant without ANY notice from my property manager, I put in motion a plan to turn around this investment ASAP. My immediate priorities were: 1. Formalize agreement to have new property manager take over My First Property - DONE 3/26/18 2. Re-key front door, side door, and secure garage - DONE 3/28/18 3. Assess repairs needed and prepare scope of work - DONE 3/28/18 4. Evaluate repairs, budget, and After Repair Value - DONE 3/28/18 5. Decide to rent (preferred) or sell My First Property - DONE As you can see...#5 is kind of a big deal. And judging by the title of this post, I think you know what I decided. I'm selling My First Property. But, before we dig into all of the details of that last statement, let's rewind a little. I had to be patient. And confident in my decisions. After interviewing multiple property management companies in Indianapolis, I officially terminated my previous company. The key here: I didn't fire my old company until I hired a new one. Like they say, don't quit your job until you have another one lined up. With a new property manager (PM) in place, we focused on securing the asset. Vacant properties can attract squatters, and sure enough, I'm pretty sure I had one in my garage. We re-keyed the front and side doors. Also, placed a new lock on the garage. My PM then assessed the whole property for repair and maintenance needs. I requested a FULL EVALUATION of the property. As in, I wanted to know everything and anything that could use some work, repairs, or renovation. For $299, this Scope of Work was a necessary step in evaluating next steps to get this property turned around. Here are some big ticket items summarized in the Scope of Work I received:

Take a look at the actual Scope of Work BELOW:

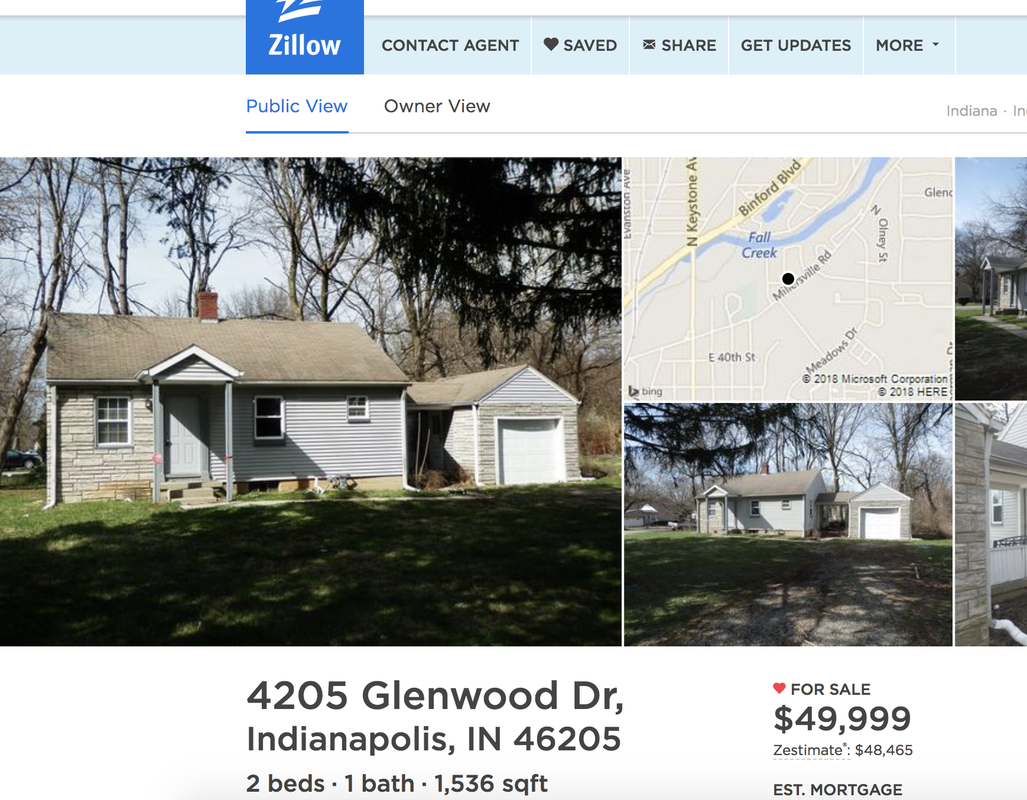

$16,741 for a complete renovation? WOW. Crazy. Insane. Again, this quote was for a COMPLETE renovation, but HOLY CR@P! I was not expecting this. With the assumption that My First Property could still be rented for $750/month, taking into account the money I'd invested, and the 11 months of rental income I saved, I determined my maximum renovation budget would be $7,000. What were my renovation priorities with that type of budget? Roof/Soffitt/Facia Repair: $2,200 Bedrooms: $800 New Bathroom: $2,139 Kitchen: $1,047 Dumpster labor/load: $612 TOTAL: $6,798 At the same time, I had to evaluate all options: 1. Renovate the place, rent it, and hold. 2. Renovate the place and sell it. 3. Sell it "as is" I already had my renovation budget, so working with my realtor, we determined After Repair Value (ARV) and current value. Now the toughest decision... Put more money into this investment, turn it around, and save it? Or take the past year an a half as a learning experience, cash out, and allocate my resources toward my next investment? Well, My First Property is now listed for sale. Why? Because I'm ready to take what I learned and apply it for the future. I made mistakes, but am better prepared now than I ever have been. What was the biggest downfall here? Working with a bad property management company. They were non-communicative. Never checked up on the property. And were not a good partner to work with. I did not vet, interview, or truly know the operation they were running before blindly deciding to work with them. I will never make that mistake again. Can this property still cash flow? Of course! Is it a good investment for someone? Yes, with great property management and a few thousand bucks in repairs. On paper, the numbers are still amazing. It's selling for under $50,000 and was renting for $750/month. Water heater, furnace, electrical panel, and PEX piping all replaced in January of 2017. The property across the street is valued at $90k+ and its neighbors are at $60k+. It's two blocks from a new YMCA, two blocks from three charter schools, and right down the street from a new grocery store. Check out the Zillow Listing HERE. Questions? Comments? Interest? Let me know! And feel free to email me at: JumpInRealEstateNow@gmail.com Happy Investing! -Tyler

0 Comments

In 2016 I purchased My First Property with the help of a turnkey company. They assisted in acquisition, renovation, and pushed me to work with their preferred property management company. Boy, was I stupid in blindly working with their property manager without vetting them. And YES, it ended up biting me in the ass! My property became unexpectedly vacant without any notice and there was a squatter in my garage. How do you guarantee no return on your investment? Own a vacant property that’s managed poorly. So, I got right to work in finding a NEW property manager. If you’re looking for a property manager, don’t take this process lightly. Here’s my step-by-step guide: A. Get Property Management Company Leads There are multiple ways to figure out who the best property managers in town are. Here are three resources to target your next property manager:

B. Scour their Websites To better vet your property management company leads, take a look at their website. Is it well maintained? Are they transparent with their fee structure? Is it easy for you AND tenants to contact them? Can tenants pay online? Is it a mom and pop shop? Or a massive national company? C. Interview your Top Leads Now, it’s time to give them a call or meet them in person! DO NOT SKIP THIS STEP! You must truly vet and interview each company. Your property manager essentially runs your real estate business day-to-day, so understand the importance, and make the right hire! Here are a number of questions that helped me select my new property manager: 1. What are the various services that you offer to your clients? Know exactly how this company plans to market, inspect, lease, manage, maintain, and maybe even sell your property. 2. How many rental units do you manage? Too few units and they could be inexperienced or losing clients. Too many, and you might get lost in the shuffle. I think 200-600 units is the sweet spot. 3. How do you determine rent amount? Rent = cash flow. Not sure much needs to be said here, but determining the appropriate rent amount is crucial to your investment. Your PM needs to be an expert in the rental market. 4. Are you currently an active real estate investor in your market? Is the property manager an investor who understands the mentality of a landlord? If so, that’s an added bonus in my book. And honestly, probably should be a requirement. 5. Under what conditions can I cancel my management contract? Understand exactly how you can get out of a contract if needed. 6. What are the management fees and/or pricing options when the property is being rented? Pretty self-explanatory. You MUST understand all costs and expenses when investing in real estate. 7. Are there fees when the property has no tenants? Some property management companies charge a monthly fee even if the place is VACANT. I only work with property managers that get their fee on COLLECTED RENT. 8. What miscellaneous fees could I be charged for the management of my property? Again, pretty self-explanatory. You MUST understand all costs and expenses when investing in real estate. 9. Do I have to sell my property with you if I want to list it? Some property managers will require you to sell your property with them. Be clear on this agreement before hiring them. 10. Do you offer direct deposit for your owners? This should be a 100% yes. 11. How do you collect rent from tenants? Understand how rent is collected. If your property manager isn’t having tenants pay online that will slow down the speed in which you get paid and makes it easier for tenants to miss payment. Also, from a tenant’s perspective, an easy way to make a rent payment is just a major benefit. 12. Do you conduct property inspections? And, if you do, what charge is associated with them? Routine inspections are key in owning rental property. You’ll want to catch issues before they spiral out of control. You should be saving some of your cash flow for repairs every month so it's encouraged you actually use some of it responsibly for long-term sustainability. Don't wait for your gutters to fall off before putting money into them...clean them once every 6 months! 13. Do you offer eviction warranty (also called a “screening guarantee”)? Some companies offer this warranty that will save you in an eviction process. But, needing this is completely up to what you’re comfortable with. 14. What steps do you take to market properties? Your property manager should be advertising through multiple channels. 15. How long are your properties typically vacant? 2-4 weeks should be the average time needed to get your property rented. Any longer and your rent may be too high or your property manager is not effectively marketing it. 16. What are your income and screening requirements for applicants? There should be a standard policy on tenant income requirements. 17. What control do I have over the tenant lease agreement? Your property manager should allow you some input in the lease agreement. A big one for me is regarding pets: I typically have a no pet policy. 18. Do you mark-up maintenance and repairs? Understand if your property management company makes a profit anytime maintenance is performed. This will factor into your overall return on investment. 19. How often will I get updates on my portfolio? You should be able to get updates on your portfolio as often as you want. After all, it is your property. PRINTABLE VERSION OF THESE QUESTIONS

D. Make a Decision and Hire Now that you’ve found property manager leads, vetted them, and interviewed them, it’s time to make a decision. Weigh their fees, experience, number of properties, customer service, and your gut. Who do you want to work with? And most importantly, who do you trust? BONUS TIP If you have multiple properties, hire multiple property managers to oversee portions of your portfolio. For example: I have two properties and two different property managers. This limits risk as you’re not relying on one PM to manage your whole portfolio. But, the greatest benefit is you can go through a little “test run” with each PM and see how they are different. This will help you determine the best PM for your long-term goals. Hopefully this helps you in selecting the best Property Manager out there! If you have any questions, leave a comment below, shoot me an email, or send me a tweet! Happy Investing! -Tyler Well, it's officially been a year since I closed on my first rental property. By now, you should know the full story (which is still ongoing...), so let's get to the bottom line...how much money have I made? How much have I lost? Was it worth it?? Here's a quick snapshot of the numbers

All in all, I'd say it's been a pretty successful year on paper. If you take my Total Rent Collected ($750 x 9 months) MINUS my Total Expenses (*which includes a trip to Indianapolis to visit my property*), I've got a pretty nice cash flow of $313 per month (EVEN with a 3 month vacancy for renovation). Here's a general breakdown of my expenses over the past 12 months:

*UPDATE* It's definitely not all rainbows and butterflies! These numbers on paper look good, but the property is now officially vacant, to my surprise! I'm working through a plan right now to get it back up and running. Has the last year been a piece of cake? Heck to the NO. At times, it's been the complete opposite of stress-free. There were many moments of being nervous, scared, and uncertain. Long-distance communication started off rough initially with my property management team, and it still continues. Meaning...it might be time to make a switch. SOON. But, it's forced me to be proactive, hold people accountable, and build a new network of individuals locally and in Indianapolis. I've met so many great people throughout the past year and a number of them have become some of my best friends. A bunch of us are going to a go cart track in a few weeks to hang out, laugh, have a good time...oh yeah, and chat real estate. A few of the biggest takeaways from my first year in real estate: BUILD A REAL ESTATE NETWORK. Meet as many people as you can that are in the industry, regardless of their age or experience. Attend Real Estate Investing meetings, or better yet, pick your favorite bar and host your own (I did!). Pick up the phone, send emails, and talk with complete strangers you meet online. My first mentor was a random guy in Dubai who just wanted to Skype (what's up Morgan!). Utilize one of the most valuable online real estate resources: BiggerPockets. Never stop learning, whether that's through podcasts, blogs, YouTube, books etc...you literally NEED to get in the habit of learning something new each and every day. Never stop growing. Crunch the numbers. If you're planning to Jump In and use the buy and hold strategy, make sure you're cash-flowing right away. Just because you can get $1,000 per month in rent, doesn't mean you actually GET $1,000 in your pocket. Factor in property taxes, mortgage, insurance, property management, vacancy, maintenance, capital expenses. Do your homework and learn how to analyze property HERE! Hire an amazing property manager. Your rental property is a business. You are the CEO. But, your property manager runs the day to day. Without great property management, your business will not succeed. Period. Interview multiple property management companies, talk to referrals, ask as many questions as you need answered, after all, you're trusting them with your investment and you money. Luckily, I have a step-by-step guide on How to Hire Your Next Property Manager HERE. Welp, it's been one heck of a year, I wouldn't trade it for anything, but I've got to go and acquire property #2...leave a comment below, shoot me an email, let me know how you're doing. Peace. Happy Investing. -Tyler Real quick...if you haven't read Chapter I of "Why Real Estate?" I'd strongly recommend you go back for some context. You'll see the journey I took to arrive at real estate and why it's best for my long-term goals. Now that you know I'm 100% ALL IN on real estate, let's talk about the amazing value this investment vehicle provides. Here are 11 great benefits of investing in real estate: 1. Consistent cash flow. This is the primary reason that got me hooked on buy-and-hold real estate. Don't get me wrong, this is by no means guaranteed. You need a lot going your way to achieve this, but with a great property manager (that finds great tenants and is quick on maintenance requests) and a property with sound infrastructure (limiting capital expenses), you'll watch the rent checks roll in every month. 2. Gain more leverage. Real estate is an investment where using the bank's money is a great option (but make sure to run your numbers!). The ability to make a down payment, leverage your capital, and increase your overall return on investment is amazing. 3. Tax-free Growth. Even if you buy a property with the purpose to hold it, long-run appreciation is realistic and you must consider a tax-deferred strategy. As an exit strategy, you can consider a 1031 exchange, charitable trust, or an installment sale to lesson your tax liability. 4. Tax free cash flow. Because of operating expenses, property taxes, insurance, mortgage interest deductions, and depreciation (even if the property gains value) your cash flow could be tax-free. Don't forget that rental real estate is a business. This means that travel expenses to check on your properties and payments to family members who manage your properties can be deductible as well. Often, an investor will never pay taxes on their cash flow and can wait for capital gains on the sale of the property in the future. 5. Tax write-offs against your other income. Depending on your classification as an Active Investor or Real Estate Professional, an overage of tax deductions can be used against your other income. But, before you dig too far here, please, please, please discuss this with your tax professional before investing. They're the experts. 6. Rental real estate is a forced retirement plan. Americans are terrible savers. But, we're great at consuming (read: The Millionaire Next Door...seriously). I read that most of America doesn't have $1,000 in savings...YIKES! Well, here's your chance to start thinking long-term. Saving for a rental property and acquiring one takes a significant commitment and determination. Jumping In to real estate in the long-run could be the greatest decision you've ever made to build future cash flow and wealth. 7. You have control. In real estate, you choose the investment market, you select the neighborhood, you buy the property, you agree on an acquisition price, you decide on renovation specifics, you pick a property manager, whom selects your tenant. This is your company. You are the CEO. Responsibility is 100% on you and with that, comes complete control. 8. Appreciation. Not always guaranteed, but rental properties normally appreciate in value with inflation. Increased value = reinvestment in higher value properties after you sell. Or, a sale can provide an equity line of credit to use for other investments. 9. Inflation-proof investment. Rents usually increase with inflation, while mortgage payments on the property remain stable if you have a fixed loan. This increases cash flow, without the increased expense for holding the property! When inflation goes up, it can mean more renters (as mortgages become more expensive). More renters = more demand for your rental = ability to increase rents. 10. Paying down loans - Paying down loans frees up more investment resources to increase leverage. You have can use the increased equity in one property to free up funds and invest in others. 11. Property improvement for equity (forced appreciation) - Many investors intentionally purchase properties below market value, because they require renovation. If you're smart, a nice little rehab will increase the value of the property, resulting in an immediate increase in equity. Now that you've read just a few of the greatest benefits of Real Estate, take a look at my in-depth journal of buying, renovating, and renting my first out-of-state property! -Tyler Why invest in Real Estate anyways? Why not just leave money in a safe savings account accruing a consistent (but, TINY) return? How about playing the stock market? Or giving it to Fidelity to let them do their thing? Well, to completely understand the "why real estate?" question, we have to start from the beginning. Let's start with The Journey. PART I It all started in 2016, when I made a concentrated effort to invest in myself. I was stuck in the routine of waking up, heading to work, coming home, eating dinner, falling asleep, repeat, repeat, repeat. While I was getting great short-term work experience in my industry, I wanted to better myself, grow, and gain overall knowledge in areas such as business, finance, and long-term investing. Because knowledge is power. What jump started everything? PODCASTS and BOOKS. Listening to podcasts at the gym instead of music became my norm. Reading books every night before sleep was part of my new routine. My Favorite Business Podcasts PART II I started REALLY thinking long-term. Where did I want to see myself in 10 year? 20 years? 30 years? What's my ideal lifestyle? And the answers were really simple...I wanted (and still want):

PART III How would I achieve those three long-term goals? It came down to finance and investing. I needed to: Increase monthly income: in addition to my W-2 salary, I began working for Instacart as a side hustle. A couple times a week (after work and on weekends), I was a personal shopper and delivered groceries. I also made a conscious effort to purge my old junk/clothes and sell them on Craigslist. $20 here and $15 there add up and helped me acquire My First Property. Reduce monthly expenses: for most of us, rent/mortgage is our biggest expense of the month. I was paying $1,300 a month in rent and needed to get that number down ASAP. SO, when my lease ended, I moved to a new apartment with 3 roommates for $800 a month. That's an additional $500 per month in my pocket! What else did I do? Common sense things...like brought lunch to work everyday instead of eating out. Also, bought a moped, which gets 90 miles per gallon, and limited my car driving. I could go a full month on one gallon of gas! Diversify income streams: I had to find multiple ways to bring in income so I wasn't relying solely on my full-time 9-5 job. This was partially addressed with my Instacart side-hustle, but I needed to do more. So I started a travel website and produced content, which brings in revenue. Take a look at yourself, and see where you can provide true VALUE to the world. Do people always ask you specific questions around certain topics? If they do, there's the foundation of your next business model. Bring in reoccurring income while not having to work full-time: well, this was ambitious and the ultimate goal. And I'll admit, I was struggling to address it. PART IV While I began to focus more on personal finance and long-term goals, I was frustrated every month. I'd get my pay check on the 1st, but watch half of it disappear straight to my landlord. However, through that frustration appeared the greatest gift. I saw the opportunity of real estate. My landlord was sitting back, relaxing, and collecting monthly checks, so why couldn't that be me? *BOOM* there was my answer to bringing in reoccurring income. I had to become a landlord. PART V One big problem: every property in my area (San Francisco) was well over $500,000. I didn't have that kind of money!! But, did that stop me? I had to get creative and think outside of the box. Three words: Always Keep Learning. PART VI Jumping head-first in to Real Estate, I started soaking up real estate podcasts, blogs, books, and anything I could get my hands on. Through my educational journey, I learned that buying out-of-state, where properties were more affordable, was a realistic possibility. PART VII I guess the rest is history. I jumped in, found a property in Indiana, renovated it, got it rented, and now collect monthly rental income. Read My First Property for an in-depth journal of buying, renovating, and renting my first out-of-state property, or continue to Part II below: What's been your "Journey" into the world of Real Estate investing? We'd love to hear your story in the comments section below! -Tyler When it comes to financing a rental property, there are a TON of options (which we'll discuss more in the future). But, a couple common methods (and the two that I personally weighed when deciding to invest) were CASH vs. MORTGAGE. Now, if you can't afford to purchase a property in all cash, then that makes your decision a little easier, but if you can...that adds to an interesting decision. Here are my advantages and disadvantages of buying a property all Cash vs. getting a Mortgage. Advantages of Cash

Disadvantages of Cash

Advantages of a Mortgage

Disadvantages of a Mortgage

So what's it going to be? Cash or Mortgage? Weigh your options, think about the pros and cons, and decide what's best for your investing future. Share your strategies in the comments section below! -Tyler Many people don't realize that owning real estate outside of their primary market is a feasible option, let alone an option with great potential upside. It's a way to spread out risk, earn better returns, take advantage of up-and-coming areas, and own in landlord friendly states. Now, I'm by no means an expert in real estate. I've only been doing this for a year, but here are five reasons to consider buying an out-of-state investment property: 1. Affordability: Look at the San Francisco Bay Area (where I live!), Seattle, or New York, and you'll see one major theme - housing is EXPENSIVE. Like, REALLY expensive $. Oh, and really competitive too. It's tough getting into those markets without cash or the right partner, but that shouldn't crush your dreams of becoming a real estate investor. Explore other cities and states that have a good acquisition price to rent ratio. A good place to start? The Midwest and South (USA). 2. Diversification: to protect your returns in real estate, or any investment really, it's smart to diversify. If you put all your money in one market, and it crashes, welp, there goes the value of all your real estate assets. By investing in different markets, your portfolio will be tied to multiple market cycles, and better protected against volatility in the long-term. 3. State Taxes: it's true, tax rates are different depending on state. Buying rental property in states or counties with lower property taxes (like Alabama, Colorado, or South Carolina) can generate extra savings and better returns. Because you have to file a tax return in the state you live in PLUS the state in which your investment property is in, states with lower income taxes can greatly impact your bottom line. 4. Entering Up-and-Coming Markets: there are a ton of up-and-coming cities out there right now. So, why not invest in one before it really blows up? Obviously, you can never predict the future, but here are some key indicators that could help in finding hot markets: -Companies are moving their headquarters there, or are opening up new branches -A decrease in average days properties are on the market -Job growth -Population growth 5. Rental Demand: some cities have a very strong rental market, where some are heavily owner occupied. Do your research around the country and figure out where populations prefer to rent. These are obviously areas in which your property will be in demand and very well may be outside of your home market. -Tyler Whether you're looking for your first property, your next property, or just trying to accelerate your voyage to financial freedom, you're going to need some cash. Here's where a good Side Hustle comes into play. We're in the age of the Side Hustle. Or the Gig Economy. Our generation is finding more and more ways to bring in revenue. We're diversifying our revenue streams. I love it! So, what exactly is "side hustle?" It's a way to make some extra money, outside of a full-time job, that either allows you flexibility to pursue a passion, or it could even BE your true passion. Take a look at these great side hustles that will accelerate your income and help you purchase your next property: Instacart My primary side hustle in 2016. Basically, I was a personal grocery shopper...I'd drive to stores, pick up specific items, check out, and deliver them. A couple times a week, I'd leave my office job for the day around 5:30pm and work from 6pm to 8pm. No, I didn't get rich off of Instacart, but an extra 40 bucks here, and an extra 50 bucks there definitely helped. Check it out and SIGN UP HERE. Lime Scooter Juicer Ever see those electric scooters zooming around town? They are EVERYWHERE in Oakland (where I live). Well, someone has to charge them at night. And that someone is ME. I'm a Lime Scooter Juicer! Yup, after work on my way home, I pick up a couple scooters here, and a couple there...bring them back to my place, plug them in, let them charge overnight, and drop them back off on the sidewalk in the morning. I get paid on a per-scooter basis and am pulling in $8 minimum per scooter. So, the 4 scooters I charged last night brought me $32 this morning...all for about an hour worth of work. I plan to make $500+ a month on this side hustle....and this money is going straight toward my next investment. To become a Lime Scooter Juicer, DOWNLOAD THE APP HERE and get $3 credit from me! I'd recommend trying a scooter at least once before signing up to become a Lime Scooter Juicer to increase your chances of getting the job. Rover My girlfriend's primary side hustle. She loves dogs, so naturally, taking care of them, walking them, and getting paid for it is a natural fit. She's built numerous relationships with local dog owners too, so you could (if you want) skip the middle man (Rover) after you build your network and keep 100% of the revenue. Shopkick This is a shopping rewards app, so I wouldn't technically count it as a side hustle. But, it's a vehicle to bring in extra cash. How does it work? Earn points by walking into specific stores (it uses GPS technology), and scanning certain items. You can then redeem these points for rewards such as Amazon, Walmart, and Target gift cards. Here's how I use the app: if I head out for a little lunch break at work, I'll stop by a store and scan a couple items. That way I'm making some extra cash on my lunch break! DOWNLOAD THE APP HERE. Uber/Lyft (Ridesharing) I can't personally speak on life as a rideshare driver, since I've never been one, but the thought of it has ALWAYS been intriguing. Partially because I feel like I'd get a chance to meet such a wide variety of people. Life's all about connections. And you'd be paid for it! My thought though: make sure you have a fuel efficient car. *UPDATE* I actually signed up and am driving for Uber now! I'm experimenting with the whole "networking" opportunity of being stuck in a car with strangers. I'll let you know how it goes! Airbnb Also can't speak for using Airbnb as a side hustle, but if you have an extra room at your place...why not consider renting it out and making a little extra cash? Sign up to be a new HOST HERE. And if you just want to use Airbnb for your next trip, SIGN UP HERE for $40 OFF! Etsy Are you creative and can create a tangible product? Maybe it's time to start selling it online. Start your mini-business today! Craigslist Go through your closet, look under your bed, take a peek in the garage, and get rid of all the crap you haven't touched in a year. De-clutter your life! And add some digits to you bank account. Also - if you're at a garage sale, try to bargain down items that you can later flip for a higher price on Craigslist. Believe me, some people do this for a living. Taskrabbit Basically, people will post a job (such as...I need help constructing my Ikea table!) and you'll take on that task for a set price. Write Content and Start a Blog What questions do your friends always ask you? What skills or experience do you have that are unique? Answering these questions could be the foundation for a new online business. Take this blog for example: people still find it crazy that I buy real estate 2,000+ miles away from where I live. So, what'd I do about it? I started writing content, providing value, and building community. With consistant writing and an engaging audience, you can monetize your website through advertisements, affiliate links, ebooks, and online courses. This list of Side Hustles could go on forever... Bottom line: if you are struggling to save for a rental property, or want to accelerate your savings as I did, finding a side hustle can be critical in your investment career. So get yourself a side hustle! And check out this solid list of 99 side hustle ideas HERE! Do you have a unique side hustle? What is it? Leave a comment below! -Tyler When you live in a hot market, it's almost impossible to find a cash-flowing property. Some people are fine with breaking even (or taking a loss) on their investment, in hopes of appreciation. But, I find it very important to cash flow from Day 1. Nothing in real estate is guaranteed, and you definitely can't assume appreciation. After you've decided to Jump In and invest in rental real estate (long-distance or not), the first thing you need to choose is a market. One thing you need to remember, from Chris Clothier of Memphis Invest, is "cheap houses don't make a great market." The condition of the market is exponentially more important than the actual property. So, where are you going to invest your hard-earned money? This is not a question to be taken lightly as it can make or break your investment journey. You HAVE TO develop a relationship with the market you decide to enter and have strong connections on the ground. In my case, I traveled more than 2,300 miles away from my home market. Here's key criteria when selecting a market! 1. Steady Population Growth: Google your city name and take a look at population stats. You want to be in a city that's growing, as that proves demand. Population growth = more jobs, more renters, and it's a place where people WANT to live. 2. Diverse Economy: If your city is tied down to a single job industry, or one major company, what happens if that industry/company go obsolete? Jobs are eliminated...and say "bye bye" to renters. Choose a city with plenty of employers, industries, and occupations. 3. Entertainment Factor: This goes back to demand and desirability of your city. People want to live in a fun city, because where you live, largely dictates your life. Look for professional sports teams, major universities, night life, a music scene, etc. In my case, Indianapolis has an NFL team (Colts), an NBA team (Pacers), major universities (Butler, IUPUI), and up-and-coming hipster neighborhoods where hot restaurants and bars are popping up. 4. Rent to Acquisition Price Ratio: VERY VERY VERY important because this is where cash-flow is created. A general rule of thumb: find a market where properties bring in AT LEAST 1% of their purchase price in rent. For example: a rental property for $100,000 should bring in at least $1,000/month in rent. 5. Relatively Low Cost of Living: a market where the average cost of housing is no more than three times the average income of someone living there, shows that housing is still affordable. This is where you can buy a house, renovate it, rent it, and make a return on investment. These are the basics I look at when choosing a market. But, you must DO your due diligence. DO your research. MEET and TALK with people who have invested in your target market and with the individuals who are going to be your "boots on the ground." Most importantly - VISIT your market. Make connections, drive through town, see each neighborhood, soak up as much as you can. If you're prepared to plop down your money outside of your home market, you better know where it's going. -Tyler When it comes to investment strategies in real estate, there are a ton of options. One of the most common tactics, and the strategy I've chosen is Buy and Hold investing. So, what exactly is the buy and hold strategy? It's the process of acquiring real estate, to own and profit from by renting it out to tenants. It requires leg-work in selecting a property, financing it, and possibly renovating it. But when managed well, you could see years and years of consistent monthly returns. As long as your monthly rent is more than expenses, you've got yourself cash flow. This strategy is definitely a long-term play and requires patience, but can set you up for a bright future. Benefits 1. Monthly Income: each month, any rent that exceeds your expenses provides you with income. Here's the best part: if you have great property management in place, your rental checks could come in without much labor on your part. 2. Equity Buildup: your tenant is paying down your mortgage every month, meaning your equity in the property increases each month. Tenants even pay down your interest, which is tax deductible. 3. Wealth Creation: if you buy in the right market and neighborhood, your property could appreciate every year. The longer you hold the property, the greater the potential for appreciation. 4. No Urgency to Sell: as opposed to house-flipping which requires speed, buy and hold investing is long-term. Why is this a benefit? Well, if there's a market crash that impacts your home value, rents usually stay relatively stable, still bringing in consistent cash flow. This allows you to wait out a crash until market correction. In Buy and Hold, I always tell myself to not think about the overall property value as long as it cash flows. Appreciation is just icing on the cake! Disadvantages 1. Tenant Issues: it's no piece of cake having to deal with tenants. Some tenants can be very high maintenance and require a lot of your time. Without quality property management in place, don't be surprised by random calls at night and late (or missing) rent. Who wants that?? 2. Maintenance Issues: no property is maintenance free, especially if you keep it long-term. A new furnace or a new roof become realistic expenses the longer you hold your property. So be sure to set aside a portion of your rent every month to cover capital expenses! 3. Liability: you can be liable for injuries or damage on your property, which can lead to legal action. Obviously, this is true regardless of what real estate investing strategy you choose as the owner of property, but the longer you hold a property, the more likely something could happen. Buy and Hold real estate investing is just one tactic that investors can choose. What's your strategy of choice? Leave a comment below! -Tyler |

||||||||||||||||||

Investing |

Jump In |