|

What's up Jump In Nation! We've got another #JumpIn Stories interview, where we profile individuals who have taken the leap and jumped into real estate investing. These investors have taken action (arguably the toughest part), and are doing everything they can to create a life of financial independence. Introducing, Gabe. Gabe and I go back to the days when I was just getting into the Indianapolis market and purchased My First Property. We've stayed in touch ever since then and even use the same property manager. It's been really fun to see how Gabe has grown and progressed since we first met! So, let's get started! Gabe, tell us a little about yourself. I’ve been happily married since 2014 to my beautiful wife Claudine, who I met at Rutgers University in New Jersey, where I went to undergraduate school. We have two daughters, Zuri and Aria, who are 1 and 3 years old respectively. I am a pharmacist by training and a drug safety specialist by trade. I became interested in real estate investing in 2014 after reading “Rich Dad Poor Dad” by Robert Kiyosaki. Where do you invest? At this time we invest in Indianapolis, IN. Why did you Jump Into real estate? I jumped into real estate with my wife in pursuit of financial freedom. Financial freedom to us is that day when our passive monthly income is equal to or greater than our monthly cost of living. More simply, passive income >= to expenses. What's your investing strategy? Since 2018 we have been employing the long distance BRRRR strategy. BRRRR stands for buy, rehab, rent, refinance, repeat. B- Buy a property for a discount (the property is usually distressed in some way) R- Rehab the property to increase it’s market value R- Rent it out to a well-screened tenant R- Refinance the property with a long-term, fully amortized, fixed rate mortgage (30 year term) R- Repeat the process with another property We have been implementing this strategy with vacant, single family houses in safe blue collar areas. Why do you invest outside of your local market? We live in northern New Jersey where property values are high in comparison to rental rates. New Jersey taxes are pretty high as well. We looked for a market that had these elements:

We feel that investing in Indianapolis gives us a good chance to earn solid cashflow. What's the first step you took to invest in long-distance real estate? The first step I took was to get educated through reading and listening to audiobooks and podcasts centered on real estate investing and personal development. I wanted to get knowledgeable about how to buy and hold real estate for passive income, and I also knew I needed to become a better leader for my family and future businesses. What's been the worst moment as a real estate investor? My first move after starting to get educated was to partner with two guys I met through a close friend in an attempt to flip seven houses simultaneously to build up enough capital for a down payment on an apartment building. This went horribly wrong, and my wife and I lost about $150,000 in the process. We had borrowed from close friends and family members and promised huge returns. In the end, we paid back every dime, including the interest we promised. It took us from December 2015 through August 2017 to pay back all of our lenders. The pain of making such a huge mistake was tremendous, but we made it through with our integrity intact, which no one can put a price on. What's your greatest takeaway from that moment? I learned the value of taking ownership when things go wrong. We found out our partners were using funds meant for renovation to pay off “investors” we didn’t know about, buy jewelry, and eat at expensive restaurants. They eventually began selling the properties without telling us. Allowing myself to even be in a situation like that was so ridiculous it’s laughable when I think about it today. Believe me while we were going through it, there were way more tears than laughter. For the longest, I blamed everyone but myself. Once I started to take accountability, I began to feel like I was gaining back a sense of power. It was an expensive takeaway but well worth it. How has real estate changed your life? Real estate has opened my mind to the endless possibilities that life has to offer. It has given me a practical roadmap to financial freedom. If you could learn any real estate related skill right now, what would it be? My current skill I am honing is the ability to analyze multifamily properties (5 units and larger). In order to achieve financial freedom through buy and hold real estate, I have come to the realization that purchasing multifamily properties can accelerate the process, so I am preparing myself by learning to analyze them. If you had an extra $100,000 right now what would you do with it? I would keep it in an account until I increase my knowledge and network to the point when my wife and I are ready to buy an apartment building. What's the best book you've read recently? Why? I love to read so it’s tough to choose one. On the financial/ RE investing side I would say “Fake” by Robert Kiyosaki In the book, Kiyosaki discusses: -Fake money (fiat currency like the dollar) vs. real money (gold/silver) -Fake teachers (those who teach but have never had any real-world experience in what they teach) vs. real teachers (those who teach what they have actually done) -Derivatives (mutual funds, etc) vs. buy and hold real estate. The book makes one stop and think about the advantages of choosing real over fake. On the personal development side, “The Fifth Agreement” by don Miguel Ruiz. This one discusses the power of doubting negative “agreements” that we have made internally that hinder us from creating the best life for ourselves and everyone around us. What's your end goal? I don’t know that I have an “end goal” per se. I have accomplished a couple of significant goals I set for myself throughout my life, and the sense of peace from accomplishing them has always been temporary. It is becoming clearer to me that learning to enjoy the process of working toward a goal IS the goal. I seek to grow as a husband, father, and leader on a consistent basis. I want to raise emotionally healthy children that add value to society in powerful ways. That being said….if I happen to amass a 10,000 unit portfolio along the way, then I’ll take it. What's your greatest real estate advice? It might not seem like real estate advice, as it has to do more with mindset. Focus on your “why” and never give up. And there you have it folks!

THANK YOU Gabe for sharing your story and taking time to connect with Jump In Real Estate and the community. Best of luck, happy investing, and can't wait to see how your journey progresses! -Tyler

0 Comments

What's up Jump In Nation! We've got a special edition of #JumpIn Stories today, where I get the opportunity to interview a KEY member of my team. Shawn Huss from Chemical Bank is my lender and he's been instrumental in funding my investments in Indianapolis. I met Shawn through a referral while I was in Indianapolis on a market research trip and his team has provided a seamless experience throughout the years. Here we go! Introducing, Shawn. Shawn, tell us a little about yourself. I have been in the mortgage business for 25+ years. I graduated from Miami of Ohio with an Accounting degree. I have been married for 20 years with 2 dogs and no tax write offs! I enjoy traveling and playing sports competitively. How did you get into the mortgage industry? I got into the mortgage industry out of college as I had a sibling in the industry at the time. We still both work together for the same company doing mortgage loans. How long have you been in the lending business? I have been doing mortgage lending since 1993….26 years. I have been recognized as being ranked in the top 1% of ALL lenders in the country for the past 18 years. I have closed over $1.8B in loans over my 26 years. What’s the most important thing investors need to know about using leverage to fund an investment property? By using a mortgage to purchase investment property, this frees up your assets to purchase more properties to create additional income streams. What are some things investors overlook when it comes to using leverage? Many investors think owing the property free and clear is the best practice. I will joke with clients that they are 100% financed if they own the property free and clear as their assets are tied up in the property. If they were to get the equity out of the property, they could possible buy 2 or 3 more properties and increase their monthly cash flow. What do you pride yourself in as a Mortgage Loan Officer? I take pride in customer service and in educating each buyer about the process and educating them on the advantages of using a mortgage to build their real estate portfolio. If I do the right things upfront for my client, they will come back to get a mortgage on their next property. Describe a moment when you went above and beyond for a client. We like to think we go above and beyond for every client. We enjoy being creative in helping those get mortgages that do not think they can get mortgages. I had one client that was not working, had their assets with their spouse, no credit, and we were able to help them get 8 mortgages using the leverage of the rents on the subject properties. What are some of your long-term goals? I just want to continue to provide a high level of customer service to all clients and continue to educate them on how to maximize their real estate portfolio. I have an excellent team behind me as we close 50 to 60 investor loans a month all over the country. What’s your greatest piece of real estate advice? Create a team of professionals that you can trust to have your best interest at heart and to be on YOUR TEAM! Especially in the investor world where you might not be in the same city as your investment, you need to have the confidence that issues will be taken care of. On the lender side, you need to have somebody knowledgeable in the investor world to make sure you are being educated on how to maximize mortgage loans to build a real estate portfolio. How can people contact you if they have any questions or want more information about your services? They can go to ShawnHuss.com which would take them to my Chemical Bank website where they can APPLY ONLINE or email or call me with any questions. And there you have it folks! Check out these key takeaways:

-Tyler What's up Jump In Nation! We've got another #JumpIn Stories interview, where we profile individuals who have taken the leap and jumped into real estate investing. These investors have taken action (arguably the toughest part), and are doing everything they can to create a life of financial independence. Introducing, Bo. Bo and I go back to the days when I was trying to stabilize My First Property after poor management and a vacant house. Since then, we've been talking back and forth and following each other for over a year now. He runs the website: BiggerCashFlow.com and puts out great content on his podcast as well! Let's get started! Bo, tell us a little about yourself. Hey guys! I was born in South Korea. My family and I immigrated to New Zealand when I was 5 and subsequently came to the USA when I was 11 (I wish I kept my British Accent, my Real Estate negotiations would be so much easier!). I grew up in Southern California all through high school and college where I received my Bachelors in Business Administration and Accounting. As a result, I currently work as a Senior Consultant for a mid-sized CPA firm and I have been working in this industry for about 6 years. Aside from work I love to travel with my wife, eat good food, and read a ton of books (mostly non-fiction business/self-help/real estate related). Where do you invest? I currently invest in the markets of Indianapolis, IN, Little Rock, AR, and Kansas City, MO. Why did you jump into real estate? I grew up with a very traditional way of thinking of going to college, getting good grades, and finding a job where I can climb up the corporate ladder for 30-40 years and hope for a lush retirement. However, seeing my dad and aunt start and maintain a business for over 10+ years starting from scratch and at times helping them both with their businesses, made me realize that I had the blood of an entrepreneur. I wasn’t entirely sure so I went to school for accounting to learn the language of business and get better at reading the numbers/financials. Through working 6+ years in the industry, I realized that there were trends in successful companies as well as high net worth individuals who invested their money, especially in real estate. After I got married, I quickly saved up a downpayment and bought my first primary residence. I “house hacked” and rented one of the rooms that allowed me to reduce my mortgage to levels close to my apartment lease payments. I soon had a lightbulb moment and wanted to create more passive income through real estate, but I knew Southern California was not a cash flowing market. As such, I started my journey of researching, buying, and holding out of state rental properties for the long term! What’s your investing strategy? My strategy is buy and hold real estate for cash flow. Not wholesaling, not flipping, just simply buy and hold. Based on 2 years of my experience investing in real estate, I see A LOT of wholesalers and flippers who make great money in real estate, much higher than the average W2 worker. However, when I talk to them, I realize they mostly say the same thing, they want to purchase buy and hold rentals, but they have to continuously flip for their income. They have created another job for themselves. As much as it is tempting to make a $15-25K profit on a flip, I BRRRR it and keep the equity for myself and for cash flow. Why do you invest outside of your local market? I invest out of state for a couple reasons: 1) California is not a great cash flow market. The rent to value ratios here can be anywhere from 0.3-0.5 if you’re lucky. I did the math and in most cases Id barely break even if I purchased a $400K townhouse/condo that rents for $2,000 factoring in all expenses, debt service and maintenance/vacancy reserves. Not to mention California is a very tenant friendly state, as such I have had friends with non-paying tenants file bankruptcy and cause them 6-7 months of losses. Imagine paying 6-7 months of mortgages, utilities, and legal fees on a $400K property! Ouch. Lastly, I invest out of state as the price points at $80-100K allow me to sleep easier at night. If I make a “mistake” on a $80-100K purchase, its nowhere near as painful as a $400-500K property. The potential upside may not be as high (appreciation), but I am in it for cash flow. What’s the first step you took to invest in long-distance real estate? The first thing I did was purchase a half dozen books on investing. I love to read so I bought: Book on Rental Property Investing, Millionaire REI, ABCs of REI, Long Distance REI, Retire Early with REI, and Raising Private Capital. Then I started to attend my local REI meetups (Tip: Go to meetup.com and you will find at least a dozen meetups in major metropolitan areas) and network with other experienced or novice real estate investors. I also signed up for a free BiggerPockets.com membership and messaged local investors and bought them coffee or lunch to pick their brain on real estate investing. At least 30-40% took me up on my offer and about 5 of them I talk to regularly about real estate investing. (Tangent: One of my friends told me a trick where you should spend 1/3 of your time with those who are a couple levels above you and where you want to be (mentors), 1/3 of your time with those on the same path as you (colleagues to help motivate and keep you accountable), and 1/3 of your time with those who are coming up behind you to give back, reinforce what you have learned by sharing your knowledge, and be thankful for the help you have received along the way.) What’s been your worst moment as a real estate investor? My worst moment would be when I trusted the wrong people and ended up losing about $5,000 on my first deal. The property itself was okay, as I recently got it appraised for $7K above purchase, however, Management was terrible and they placed an unqualified tenant who was eventually evicted and caused some major damage and stole all appliances. Further, this Property Manager did not winterize the property during the colder months causing a pipe to burst and damage the electrical and furnace in the basement. What’s your greatest takeaway from that moment? Like Ronald Reagan said, “trust, but verify.” I should have talked to a couple more investors where I would have found out they grew a bad reputation. However, I was blinded by the cash flow and fell in love with the property and ignored my gut. Overall, it was a good lesson learned as I quickly flew over to the market, built new relationships and now have a strong team in place. Your first one is always the worst, what's important is that you take action before you fall into analysis paralysis. How has real estate changed your life? Real Estate has definitely changed me in more ways than one. Most importantly, I have created pretty good cash flow (averaging a net of $3K/month) during the past year which has relieved me of my burden of “needing” to climb the corporate ladder for more safety and pay. I realized that being safe is dangerous, and taking calculated risks is the safer bet. I also realized that not many people know what they are talking about when they give advice, so you have to take a hard look at them and ask yourself if you would trade places with the person giving you advice. Not only talking about monetary things, but does that person seem fulfilled with their health, relationships, spiritually, and mentally. If not, don’t give up on your dreams or your desire to buy real estate, start a business, or create passive income because “Uncle Jack tried it in 2008 and lost all of his money.” It’s not what you know, but what you think you know that can hurt your growth. If you could learn any real estate related skill right now, what would it be? I would love to learn how to become a better marketer, negotiator, and capital fundraiser (doesn’t everyone, right? Ha). One of my mentors told me that “you have to ALWAYS be marketing (generating leads) and raising capital. It doesn’t matter if you don’t have a deal yet, or it doesn’t matter if you don’t have 10, 50, 100 units. Those two things are the lifeline of any business and you have to get better at it each day.” I took this to heart even when I only had 3 properties, and on my 4th one I raised private money, and my 5th-11th properties have all been off market deals (wholesalers, direct-to-owner marketing, broker relationships, and through social media). If you had an extra $100,000 what would you do with it? I would buy a duplex nearby where I live with 5% down, so that I can make my current primary a rental property. Even in an expensive market like Los Angeles, if you pick the right neighborhood and financing options, you can make the properties cash flow (e.g. 5% conventional financing househack). It may not be for everyone or for extremely expensive markets like SF or NY, but my primary residence has appreciated $70K since I bought it in 2017 and it was purchased with only 5% down (roughly $30K). I have realized major tax benefits, pride of ownership, rental income (house hack), appreciation, and debt paydown. Buy a tri or fourplex if you can. What’s the best book you’ve read recently? Why? Maxout by Ed Mylett. (I wrote a book review about it here: https://www.biggercashflow.com/recentposts/2018/8/30/books-005-maxoutyourlife-edmylett) The book is based on mindset, and not specifically, but I believe that 80% of anyones success begins with our thoughts. That’s why successful people shield what information they consume as they become thoughts, habits, and result in being our identity. Ed talks about creating positive habits, goal setting and developing a “will to win.” It definitely gets you pumped up to go out and life a “MAX OUT” life. I had the pleasure of hearing him speak at a real estate conference in San Diego and he has definitely inspired me to work 110% every single day as I am not creating something just for myself and my wife, but something for both our families and future generations to benefit from. Favorite Book Quote: “The average person has 75,000 thoughts every day, and 91% are exactly the same as the day before. It isn't hard to see why so many people stay in the exact spot in life as it relates to relationships, careers, finance, fitness, etc. Do you ever think about what you think about? Thoughts are like magnets; they draw to you that which you think about regularly. They also create the filters you see the world through. If you want real change, you must first change what you are thinking about.” What’s your end goal? My 5 year goal is to create $15K a month in passive cash flow. I currently started a blog at www.biggercashflow.com and also release weekly episodes on my Bigger Cash Flow podcast as I always wanted to be a personal financial advisor. I think I may grow this passionate out in some shape or form where I can help other people like me create passive income and chase what really matters to them. I had a quick conversation with my coworkers where I asked them, if money was no object (i.e. lets say you have $10K month in passive income far exceeding your expenses), what would you be doing right now? Initially, they gave me blank stares as nobody had asked them this question before, but eventually I got answers such as DJ, producer, blogger, full-time traveler, and actor. This made me realize that we may be trading up our dreams and passions for a paycheck to work in a cubicle building out someone else’s dream life. If I choose to work in that W2 job because I love it every single day, that is different, but for the many of us that may not feel that way, I think passive income is the answer. What’s your greatest piece of real estate advice? My advice would be to educate yourself (podcasts, audiobooks, REI meetups, pay a mentor if you have to – it all depends on everyone’s goals, resources, and ability), and take action, no matter how small, by your 3rd month. This can be in the form of underwriting 10 deals a week, making 5 offers, or buying a turnkey property. You may be wondering “what if all 5 offers get accepted?” that means your offer was too high. Making many offers may scare you, but make them at the right prices where if all of them were to be accepted, you’ll find a capital partner in no time. In summary, you don’t have to be great to start, but you have to START to be great. So JUMP IN REAL ESTATE! And there you have it folks!

THANK YOU Bo for sharing your story and taking time to connect with Jump In Real Estate and the community. Best of luck, happy investing, and can't wait to see how your journey progresses! -Tyler What's up Jump In Nation! We've got another special edition of #JumpIn Stories today, where I get the opportunity to interview a KEY member of my team in Indianapolis. John Engelke is my insurance agent, and he's been instrumental in analyzing properties for me and insuring them. His communication is TOP NOTCH, he's VERY responsive, and that's what I appreciate most from John as an out-of-state investor. He's also often been the first person on the ground in Indianapolis to check out potential investments for me and to send photos. Introducing, John! John, tell us a little about yourself. I relocated from Las Vegas to Indianapolis 5 years ago to marry my high school sweetheart, and couldn’t be happier that I did. How did you get into the insurance industry? After taking an early retirement from a major paper company, I quickly realized that golf was not going to be enough. I had been interested in the insurance industry for many years, and thanks to a good friend decided to give it a try. The rest is history. How long have you been in the insurance business? Over 10 years now. What’s the most important thing investors need to know about insurance? Protecting your financial risk couldn’t be more important. Not only should you properly protect the investment, but your liability as well. What are some things investors overlook when it comes to insurance? Protecting the full replacement value of the property. What do you pride yourself in as an insurance agent? It’s all about educating clients so they can make an informed decision. Insurance is not just about the numbers, but protecting the future of those I deal with. You’ve often driven out to properties before I even get them under contract to give me an accurate quote. I can’t thank you enough for that! Describe a moment when you went above and beyond for a client. The goal is to always go above and beyond. I’m an insurance customer and I know how I want to be taken care of, my clients should expect nothing less. What are some of your long-term goals? My long term business goals are to continue to educate, and help clients properly protect their major investments. What’s your greatest piece of real estate advice? If you can make it work it is best to physically take a look at the property. Many rely on others to do this for them, which can work, but how many end up with a property that is much less than expected. How can people contact you if they have any questions or want more information about your services? They can simply give me a call, or of course an email is a great way to start the conversation. John Engelke (317) 844-4402 [email protected] IF YOU NEED AN INSURANCE QUOTE, JOHN IS YOUR GUY! GET A FREE QUOTE BELOW! And there you have it folks! Check out these key takeaways:

-Tyler What's up Jump In Nation! We've got a special edition of #JumpIn Stories today, where I get the opportunity to interview a KEY member of my team in Indianapolis. Derek Gendig is my property manager and his company, EverGrow Property Management, has been instrumental in analyzing, assessing, marketing, leasing, renovations, and management. BASICALLY EVERYTHING I do in Indianapolis. A quick history about Derek and myself. We first connected in 2017, but I already had a property manager overseeing my portfolio at the time. Well, many of you already know the story, but I had to swiftly change property managers. And after multiple interviews, I selected Derek and EverGrow to take over. Introducing, Derek. Derek, tell us a little about yourself. I am an individual with an intense entrepreneurial spirit. I enjoy spending time with my family, fishing and playing soccer. With both of my parents born in Poland, I am first generation American. I’ve spent much of my life around construction & real estate. Hard work, honesty & passion are grass root values in my life. I find that I strive to be helpful to anyone I come in contact with. I thoroughly enjoy discussing new ideas with friends and strangers alike & encourage out-of-the-box thinking. How did you get into property management? There was a time that we were purchasing, rehabbing and selling 3 to 6 single family and small multi-family properties a month. Following up with the buyers after selling the homes, we were constantly hearing the same thing; the property was great, but the management companies they were hiring were woefully deficient, derelict or just outright criminal. Because these investments were not generating the anticipated income, our clients were not purchasing additional properties. We decided we had to provide better property management services than other local property management companies if we wanted to differentiate and grow. Are you an active real estate investor? We are active investors. Over the last 20 years we have purchased, rehabbed and sold over 1,000 properties. How long have you been in property management? We have been investors and licensed Real Estate Brokers for over 20 years. We have provided Property Management services since February 2012. What’s one mistake that you see new investors make? Purchasing the wrong class and/or type of property. The lower “C” and “D” class properties and small multi-family properties in these areas always look great on paper, but rarely perform as advertised. We always recommend “B” class properties (or better). These properties typically have a lower monthly cash flow but what they lack in cash flow is more than made up for in lower maintenance costs, higher tenant retention and area appreciation. What do you like about working with out-of-state landlords? What are some challenges? It’s taken years of financial reinvestment and hard work to develop the systems we now employ. It’s taken just as many years to acquire our experience. It’s taken an attentiveness to excellence to accumulate, refine, and draft documents that are of the highest standards. Having the chance to implement all of these things with people from all around the world and helping them to realize their financial goals is a special opportunity we have. We partner with investors to build mutually beneficial relationships. Being a part of their success and witnessing lifetime financial goals come to fruition is so special and is an extraordinary privilege we are very proud of! The biggest challenge we deal with is that out-of-state owners rarely know details about their properties and/or tenants. They are typically missing leases, ledgers, keys, etc. This is largely due to poor detail and communication on the part of the persons they’ve hired to help purchase and/or manage their investment properties. Hiring the right person or company always ends up being the best decision both financially and for peace of mind. What’s been your most challenging moment as a property manager? In the summer of 2018, we took on management of nearly 80 “D” class properties over a 3 month period. This situation was the result of a meltdown of an elaborate real estate scam perpetrated in Indianapolis on out-of-state investors. Many owners were stuck with horrible, non-rehabbed properties, terrible tenants and city violations, penalties and fines. We took on this excessive amount of properties and over a period of a year we’ve worked with the owners to help them rehab, lease or sell their properties and make the best out of a terrible situation. What are your greatest takeaways from that moment?

What are EverGrow’s key values?

What’s next for EverGrow? Evergrow is the latest & greatest version of Indianapolis Property Management Inc. As we’ve grown, learned from our experiences, listened to tenant and owner’s input, we’ve committed to further elevation of all aspects of our company. This includes the management portfolio itself. We recognized that lower-end properties are very difficult to fill with quality tenants, manage and make profitable for owners. We’ve set a minimum rental rate threshold of $800 a month for the properties we are willing to manage. It’s not easy to turn down business but it’s required to provide the quality and attention to the properties and owners we do manage for. The next step for Evergrow is to increase our management portfolio with these new criteria with a focus not only on working with quality properties but quality Owners. What’s your greatest real estate advice?

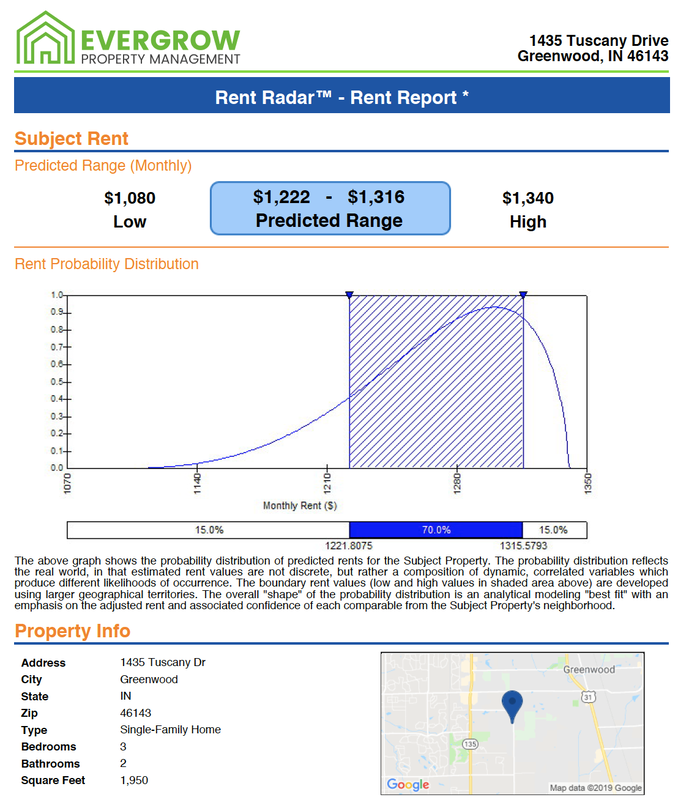

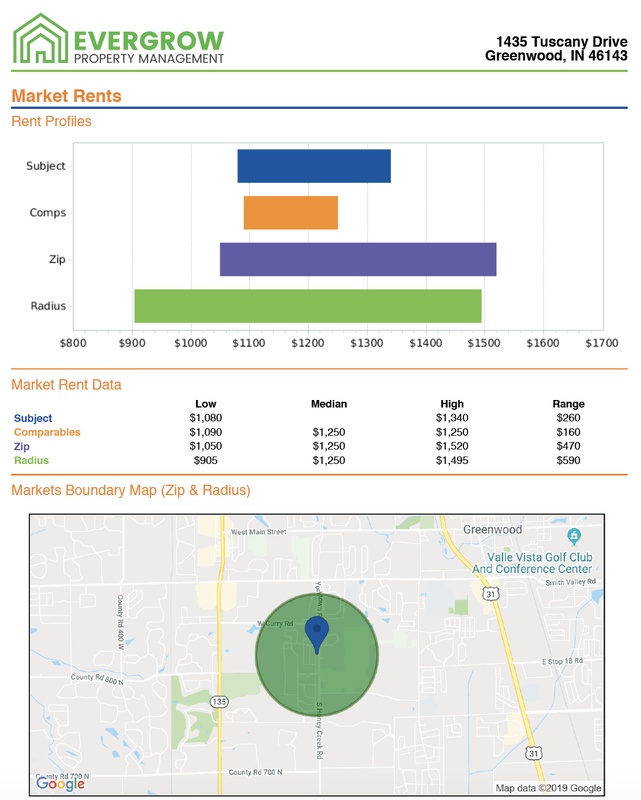

How can people contact you if they have any questions or want more information about your services? Derek Gendig Broker / Portfolio Manager Evergrow Property Management Inc. Email: [email protected] Office: 317-588-3300 x 102 Website: www.evergrowpm.com Or on BiggerPockets – Derek Gendig If you'd like Derek to analyze a property you are targeting as an investment, click on the link below and he'll provide you with a free report like this: And there you have it folks! Check out these key takeaways:

THANK YOU Derek for sharing your story and taking time to connect with Jump In Real Estate and the community. -Tyler What's up Jump In Nation! We've got another #JumpIn Stories interview, where we profile individuals who have taken the leap and jumped into real estate investing. These investors have taken action (arguably the toughest part), and are doing everything they can to create a life of financial independence. Introducing, Sunitha. A quick history about Sunitha and myself: we've never met in person. This is definitely a theme in my life (haha!) as I connect with dozens of people online through various real estate groups and networks. She's got a crazy cool story: dropping out of school in the 6th grade to pursue a tennis career, now finishing up her MBA at VIllanova, and investing in long-distance real estate. Read her story below! Sunitha, tell us a little about yourself. I live just outside of Boston and work in finance at a biopharmaceutical company in the city. I haven’t always been in New England – I grew up in Florida and in the last 12 years or so, I have lived in several different locations along the east coast and in several different countries. When I’m not working at my job or working on developing my real estate portfolio, I am usually studying – I have about six months until I graduate Villanova’s MBA program and that day cannot come soon enough! Although I am typically glued to a desk or a computer these days, that wasn’t always the case; I spent about nine years playing tennis professionally – hence, all of the moving around. I still love travelling, being active and exploring anything that is new, although my grueling schedule restricts my ability to do so…for now!! Where do you invest? The investments that I currently hold are just north of Indianapolis, about 40 minutes from downtown. At this juncture of my investment journey, I prefer the suburbs just outside of the city. Some of these suburbs are less “block-by-block” than within the Indianapolis city limits, meaning that neighborhoods typically have less potential to change when going from one street to the next. Indianapolis, like many cities, has areas that are fantastic on one street and far less desirable areas on the next street. As I haven’t seen a single property in person prior to purchasing, investing in the suburbs helps me feel more confident in the location of my investment. Why did you jump into real estate? Real estate is just my vehicle of choice on the road to financial freedom. During my years as a professional athlete, I never knew how much money I was going to make from one week to the next – my take home pay was always directly related to whether I would win my next match. Since I was self-funded, this dynamic was extremely stressful. There were times when I was on the road and in a different country, when I didn’t know if I would have the money to get home or have enough money to buy food for my entire trip. After I retired, I desperately needed stability, so I went back to school - I had dropped out after sixth grade in order to train full time and had a GED but no formal education after dropping out - got a degree and a job. It was great at first - I relished in knowing that I would receive money in my bank account, like clockwork. However, as I got to know my coworkers, I started to realize that sole dependency on my W-2 income might not be the best path. So many of my colleagues expressed dissatisfaction in their current situations for a variety of reasons, but felt unable to change their circumstances due to financial obligations: mortgages, children, dependent family members, and the like. If not for the financial burdens of these commitments, many of these individuals would have the freedom to select the career path and/or lifestyle that would optimize fulfillment. Luckily, I am still at a stage in life where I can influence my financial obligations to a larger extent and have decided that I wanted to position myself more optimally so that I can afford more choices in the future. Lastly, real estate is my vehicle of choice due to the fact that rents consistently rise over time, whereas the mortgage payment essentially stays fixed until the property is paid off. Therefore, over time, properties that are a good investment and profitable at the time of purchase only grow more profitable over time. Additionally, it is possible to influence the profitability of a properly, and as a result, the cash coming into your bank account. While stocks and index funds are also great options and important for a diversified portfolio, I prefer to invest more heavily in investments that I can influence to a greater degree. What's your investing strategy? I am focused on long term rentals that are undervalued, typically due to the fact that the property is physically distressed. This allows me to purchase the property at a lower price, hire out contractors to fix it up and then rent it to tenants. Completing all of this from a different part of the country can certainly be stressful and challenging, which is why it is important to have teams that you trust on the ground – they can recommend honest and reliable people to work with, whether those are general contractors, electricians, HVAC technicians, exterminators, and the like. I have also found them to be very helpful when verifying that work was completed and that I can release funds for the contractors work. Even utilizing before and after photos of the work can be misleading, so it is crucial to vet team members carefully. Why do you invest outside of your local market? I invest outside of Boston because Boston is one of the least affordable cities in the country - it consistently ranks within the top ten of most expensive cities to live in the US. I toyed with the idea of buying a property within an hour or two of the city, where price points become more affordable. However, depending on the time of day, spending an hour in the car will only get you five miles outside of the city. If I wanted to self-manage in order to minimize costs and needed to visit the property for any reason, getting out of the city could prove stressful, especially considering that I already had a full time job that doesn’t grant the flexibility of travelling to locations an hour away during off peak commuting hours. The more I thought about it, the more self managing under these circumstances sounded like another full time job and I wasn’t interested in investing in real estate just to gain another job. The only option would be to get a property manager. If I were to incur these costs, I might as well invest in a location that would be less expensive and provide higher cash returns! While that was the general thought process, I also took a more data/finance based approach to confirm that I didn’t want to be investing in the Boston market and that investing elsewhere would help me reach my goals more efficiently. A few of the things that I looked at were: 1. Price to rent ratios: In the Midwest, I can find properties off the MLS (Multiple Listing Service, where real estate agent list properties that they are selling) that will command gross monthly rents of 1%+ of the asking price and are located in good areas. That’s a starting point, because if it’s close to 1%, then I know that there is a chance of the property being profitable after mortgage expenses, property management, repairs, etc. Contrastingly, in Boston, there is NO WAY I will able to find a single family home or a duplex located well and commanding 1% of rents. 2. Economic fundamentals: I prefer markets with strong economic tendencies that are better than the national average. A few of the economic statistics I look at include population growth, job growth and industry diversity. 3. Competition: While the places I've looked into/am focusing on now demonstrate strong economic trends and are very competitive, I'm not looking in places that are heavy in foreign investor activity. There was a lot of foreign investor activity in Boston when I was trying to get started in real estate. As a result, I was seeing these investors come in, pay cash at asking or above and waive inspections and contingencies, just to get into desirable locations. These are not conditions where I could continually compete successfully, or even get into the market anytime soon, given the property values and cash requirements, so I needed to find a market with more accessible conditions. 4. Diversification: Essentially, $600k goes A LOT farther in different parts of the country. It might get me a duplex in an average area, a few miles outside of Boston or it could get me 7+ houses or an apartment building in the Midwest. Being able to buy more units in good areas for the same prices ensures that my risk can be further spread out across multiple units and/or multiple properties. One eviction or structural issue won’t hurt as much if I have other units bringing in positive cash flow. What's the first step you took to invest in long-distance real estate? The first step in my journey – which I strongly believe should be the first step in everyone’s journey – was to educate myself. Buying an income property, whether it is in your back yard or in another state, is a huge purchase that should not be taken lightly. There are many factors influencing whether a property will be a successful investment. It is important to understand these factors and how they can potentially influence the property’s performance. I spent more than a year learning about different markets, how to evaluate properties, what to look for in those who would be my “boots on the ground,” and the nuances of different investment strategies before I settled on a market and a strategy that would work for me. Even when I finally was able to find a property that met my needs, there was still so much that I didn’t know, but spending the time preparing and learning on the front end really helped to remove some of the risk in the investment. What's been your worst moment as a real estate investor? Buying a house in a flood plain! Dependent upon where on the flood plain a house is located, the house will require a flood insurance policy while it is under a mortgage. The cost of flood insurance can run up to $3,000 a year, so it can really wipe out the cash flow on a property. I typically avoid properties in flood plains like the plague, but was misinformed this time around and didn’t realize that I could check the location of a property relative to a flood plain. The property was purchased significantly under market and in a great location – flood plain not withstanding - so it’s not going to make or break my real estate ventures. It will require that I be flexible with my strategy and how I optimize this property, relative to my goals and the rest of my portfolio. What's your greatest takeaway from that moment? Extreme ownership is a principal that is referred to in a book of the same name. The book is written by two Navy Seals and at the heart of this principle is the fact that when things wrong, it is easy to point fingers and blame people. However, this tactic doesn’t help, as the mistakes have already been made and, as the investor, you are the only person responsible and bearing the full consequences of the success or failure of the property. As a result, the only thing to do at that moment is to fully accept the responsibility for the situation, learn how to mitigate the risk of making that error again, and develop a plan to win from that position. At this point, after all of the I’s have been dotted and all of the T’s have been crossed, I am the one who owns a property and I should’ve found a way to confirm the information I had been provided. This led me to two takeaways: 1. If an important question has been answered, ask for the assumptions or information that supports that answer – I could’ve asked where the assumption regarding the home being outside of the flood plain came from, or for an image of the location of the home on a flood plain map. Sometimes, especially as a newbie, it can seem tough or overly demanding to make these additional requests. However, the investor is the one holding the property and assuming all the risks associated with it at the end of the day. If your team doesn’t understand this and put in the extra effort to help you understand and mitigate those risks, then it’s time to find a new team who will help you reach your goals. 2. Have an exit strategy. I like to know that if things don’t pan out as expected, I can still sell the house profitably if needed. This has saved me a lot of stress and worry over the house in the flood plain, as I know that I can make a decent profit should I decide that releasing the property would be the best decision for the business. How has real estate changed your life? I’m still in the early stages of this journey so I wouldn’t say the impact has been substantial enough to change my life, but it has been rewarding to see the profits rolling in each month. While it takes a lot of front end work to evaluate the market, find the deals, complete the rehabs, etc etc, the level of effort to earn the profits declines once the property is stabilized. Much of the time, I don’t put in more than a few hours of work each month to earn these profits. Seeing how well this business model works is really refreshing and it is exciting to thinking about the freedom that I can eventually gain once I am able to operate this business on a larger scale. If you could learn any real estate related skill right now, what would it be? There are so many that it is hard to choose just one! At this point, I think I would prefer to have the ability to eyeball rehab cost estimates. Rehabs going over cost can destroy the profitability for a property and organizing for a contractor visit to provide bids before closing on the property can be challenging…being able to assess the cost of fixes on my own would save a lot of headaches! If you had an extra $100,000 cash right now, what would you do? Buy more houses!! What's the best book you've read recently? Why? I really love Tribe of Mentors. It allows access into the minds of the successful, across a multitude of professions and industries. As the reader makes their way through the book, it is possible to pick out themes and commonalities in the actions taken to be successful. What's your end goal? Financial Freedom! I have a net income goal for my portfolio and once I reach that goal, it will be time to reassess my life. There are certainly things that I will be incorporating into my life once I hit that dollar figure, such as dedicated time to non-profit work. However, the end goal is to have the freedom to assess my life at that time and do what I WANT to do at that point, and release what I NEED to do in order to meet my financial obligations. What's your greatest piece of real estate advice? Be a good person. Success in this in arena is heavily influenced by relationships. In order to make the best decisions possible, especially as a newcomer, the insight of others can help you make more money or save you from costly mistakes to the tune of thousands of dollars. There’s the opportunity to make a lot of money in this area, which influences many to cut corners or to not repay the help others have given them. That approach is very short sighted – looking to add value to those who have lent a hand or paying to forward to help others is invaluable to any investors career, in terms of dollars and fulfilling long term relationships. And there you have it folks! Check out these key takeaways that I just picked up:

THANK YOU Suni for sharing your story and taking time to connect with Jump In Real Estate and the community. Best of luck, happy investing, and can't wait to see how your journey progresses! -Tyler What's up Jump In Nation! We've got another #JumpIn Stories interview, where we profile individuals who have taken the leap and jumped into real estate investing. These investors have taken action (arguably the toughest part), and are doing everything they can to create a life of financial independence. Introducing, Lionel! A quick history about Lionel and myself: we've never met in person. He lives on the East Coast. I live on the West Coast. But, we connected online, have similar goals, similar mindsets, and both invest in the same market (Indianapolis). I've been following Lionel's journey from afar and he's doing some amazing things in the real estate space right now, especially at a young age. Impressed by the action he's taken, I HAD TO connect with him and learn more about his strategies, motivations, and goals. So, without further ado... Lionel, tell us a little about yourself. I was born in Brooklyn and raised in Queens, it’s all part of the same city, but we New Yorkers make it a point to identify which borough we represent. I currently live with my girlfriend in Elmhurst, in the works to move to Long Island City with a more favorable commute to and view of the Big Apple. I hold an accounting role in PepsiCo. I always joke with my girlfriend, who works in a hospital as an R.N., that I save numbers while she saves lives. I love photography, driving on winding roads with my Subaru, hanging out at cafés, friends and family gatherings and talking about anything related to real estate or life hacks (credit card reward points, interest savings, househacking etc.). Fun Fact: I am a Leo and my nickname has been “Lion” since childhood. Where do you invest? I currently only invest in Indianapolis, Indiana. To be specific, I invest in the east side of Marion County outside of the loop. Why did you jump into real estate? My reason for jumping into real estate was a little self-serving, I didn’t have an “Aha” moment. I’ve held a number of different kinds of jobs from school until post-graduation: sales, canvasser, retail, operations and finance/accounting. I’m very aware of the amount of effort that a person puts into something they do whether it’d be as simple as folding a pile of sweaters or as complex as presenting financial statements. However, that work that somebody may have put a lot of pride into could very well be unrecognized at their job. Career advancement in many industries is based on performance and performance is based on recognition. I wanted to find something that was “simple”, where I can have more control over the expected results. Investing in real estate gave me the opportunity create success on my own terms. What's your investing strategy? From a rental perspective, I invest in undervalued properties in good outer township areas (with good being subjective) with a potential to add value. The reason why I invest in those types of properties is because I use the BRRR strategy. BRRR is an acronym for Buy, Rehab, Rent, Refinance (and Repeat with an extra “R” if you wish) created by Brandon Turner from BiggerPockets. The main goal of this is to return as much of your initial investment as possible. If you buy lower than market value, you create room for equity from the buy-side. Likewise paired with a good potential to improve the property and build equity you give yourself a better shot at returning all of your original capital to repeat the process. Now that you’ve spent all of your hard-earned cash to buy and repair, how do you get the money back to finish the BRRR? You find a smaller bank who would be willing to do a cash-out refinance for an investment property and pull about 75% of the appraised value out. This example is actually how I purchased my 3rd rental property using the equity from my 1st rental property purchased just about (1) year ago in September 2017. Why do you invest outside of your local market? I chose Indianapolis and not NYC because the rent to value ratio still makes sense in good neighborhoods. My current short-term goal isn’t to maximize my “paper” net worth (although I wouldn’t mind!). I invest more for the cash flow which means that I want my money working as hard as it can to bring the best cash return. However, I want to make it clear that I’m not talking about investing in the cheapest areas and making the +2% rule every month (gross rents per month >2% of property value). On the contrary, an Alpha++ city such as NYC can barely scrape a 0.5% ratio on a rental property in a decent area. I only buy properties in areas that I believe will be a good and sustainable long-term hold. All markets are known to have cycles where values of assets will swing. The more cash inflow I have, the more properly hedged I am in the event of a devaluation or recession. And who knows…with the extra income I could possibly pick up MORE undervalued properties in the process. What's the first step you took to invest in long-distance real estate? My very long first step was cold calling every single category of this “team” that has yet to be formed, months in advance. As a newbie, I struggled to convey what it really was that I wanted from a professional and vendor. But it was around this time where I was able to find many of the patient and helpful business partners that I work with today. What's been your worst moment as a real estate investor? So...fast forward to April of 2018, I’ve been working with my property management team for roughly (7) months for both of my properties. I’ve noticed a few statement discrepancies throughout this time, all of which brought me upside (so I didn’t mind). They have a very strange process where they occasionally carry down prior statement items which have already been cleared. All to say that it wreaks havoc to my bookkeeping process and is also the source of their repeated mistakes. I kept telling myself, as long as I can make sense of what’s going on and that these accounting errors aren’t negatively impacting me…I’m fine right? (Surprise! Murphy’s Law knocking on the door). A pretty sizeable clearing error finally landed on the wrong side of the statement and now I’m trying to get in touch with them. Several e-mails and plenty of “ring to voicemail” calls later, I get a follow-up email that they’re going to “look into it”. It took nearly a month to get this resolved and needless to say, I was not very happy with the error and the lack of communication. However, there was only one person to blame and that was myself...(can’t say I didn’t see this coming). What's your greatest takeaway from that moment? I clearly understood where their mistakes were, but I justified it from the potential upside of this error that I’ve been receiving. Luckily I only had (2) properties signed with them at the time, but what if I’ve owned (20)...could I really spend days every month to sift through their statements to look for errors? Simply put: If there are warning signs, heed them. I’m very happy to say that another group has taken over management of my properties and their attention to detail and work align with my expectations. How has real estate changed your life? Real estate has been more of a mental shift than a financial shift in my life. My view of money and wealth has been reshaped ever since last year and I understand what I value the most, getting to F.I. (Financial Independence). I’m trying to live off a set amount and all of the extra will be rolled back into investments. If you could learn any real estate related skill right now, what would it be? That skill would have to be, having a better understanding of market conditions from a micro and macro level and knowing how to lever that into my investing. If I can learn that skill and be able to tie it with my deal analysis (which I think I’m pretty decent at), I believe I can supercharge my progress. If you had an extra $100,000 cash right now, what would you do? I would probably just throw this $100,000 into my acquisition fund and use cash to successfully BRRR another property. What's the best book you've read recently? Why? The best book that I’m still reading is The Miracle Morning. The author explains how getting up early can truly change your life. I’ve always preferred to wake up early but aside from work it would rarely happen on weekends with the week being so hectic (who wouldn’t want to just sleep in?). I found myself with short days where I didn’t feel productive and it was frustrating. My girlfriend was a night shift R.N. for (2) years and recently transitioned into day shifts. I piggybacked off her new schedule and started waking up when she did…at 5:30 a.m. and that’s been my routine ever since. Now I’m finishing things around midday whereas it used to be before midnight. The feeling is great because I have this extra time that I can allocate to family and friends or to think about side gigs or real estate. The tips and tricks that you learn from this book can apply to anything that you do. Sometimes building a good business starts with improving yourself. What's your end goal? Honestly I’ve never thought of my end goal. I’d say financial independence from W-2 income would be my long-term goal, but I do not plan to be stagnant after I’ve achieved that milestone. One thing I learned was to keep setting goals and to keep challenging yourself even if it seems like it’s impossible. What's your greatest piece of real estate advice? If you have a gut feeling or this itch to do real estate or whatever it is you’re passionate about, don’t wait. One of the best decisions I’ve ever made in my life was when I decided to take action and Jump Into Real Estate. And there you have it folks! Check out these key takeaways that I just picked up:

THANK YOU Lionel for sharing your story and taking time to connect with Jump In Real Estate and the community. Best of luck, happy investing, and can't wait to see how your journey progresses! -Tyler Hello hello Jump In Nation! We've got the very-own creator of this blog as our first #JumpIn Stories Interview. So...that's awkward. Time to get used to writing in the 3rd person. But anyways, this is the first in a series of Real Estate Investor interviews, where we'll profile individuals who have jumped in to real estate investing. They've taken a chance and are doing everything they can to create a life of financial independence. So, with that, let's Jump In! Tyler, tell us a little about yourself. I was born and raised in the San Francisco Bay Area, and apart from a short stint in Southern California for college, have been here my whole life. I currently live with my girlfriend in awesome Oakland, CA and work in The City (San Francisco) in the world of college athletics. I love the outdoors, photography, my friends, family, and talking about real estate, finance, and person growth. I question everything and try to figure out the root of how and why things in this world work. Where do do you live? Where do you invest? I live in the beautiful (and EXTREMELY expensive) San Francisco Bay Area, but invest in Indianapolis, Indiana. Why did you jump in to real estate? It's pretty clear that there's great financial potential in owning rental property. It really hit me hard a few years ago when I was paying $1,300/month to share a home with multiple roommates. Yes, location was a key factor in why my rent was so high, but again, it proved the power of rental property. By the time our lease ended, I remember mentioning to my landlord that she made $66,000 off of us over a year and a half. She joked that it paid for her children's college...but it really did! I needed to get on the other side of the table, become a landlord, and start building a rental portfolio ASAP. I know it's not going to be a piece of cake (and it hasn't been!), but monthly rent checks rolling in and appreciation can set you up for a bright financial future. That's why I am so focused on adding income streams. Ultimately, I want to continue to increase monthly income, decrease my monthly expenses drastically, and road trip the US in a van! #VanLife for the win! I've also grown to love the numerous aspects of real estate: acquisition, inspection, renovation, marketing, efficiency, systems, different strategies...it truly is like running your own business. What's your investing strategy? I invest out-of-state where property acquisition prices are much more manageable than my local market. I make sure each property I own is cash flow positive, so even if I may not be getting amazing appreciation, I'm bringing in monthly profit. Simply: I buy and hold properties that cash flow. Why do you invest outside of your local market? I touched on this a little in the previous question, but the biggest reason is property acquisition price to rent ratio. Basically, I can get a cash flowing property that brings in monthly cash flow. The rental market is also very strong in Indianapolis, so there's a lesser chance of vacancy issues. Population growth, and job growth are also steadily increasing, which is a great sign when selecting a market. How do you invest in long-distance real estate? It comes down to your connections "on the ground." You need STRONG relationships with people you can trust. After all, this team is part of your investment. Literally. They are just as impactful to your return on investment as the actual property. Unfortunately, I've learned the hard way, so be sure to properly vet your agents, property managers, contractors, etc. Visit the market you want to invest in. Meet people face-to-face. Broadcast your vision, goals, and priorities so people know what you are trying to accomplish. What's been your worst moment as a real estate investor? Wow, this is still fresh in my mind. I would say it was the moment I got confirmation that my 1st property was vacant and had a lock box on the front door. Why was this my worst moment? Because I found out about this reality without any communication from my property manager. No email, not phone call, nothing.... What? WHAT!? WHAAAATTTT?!?!?!?!???!!! And the cherry on top? The property technically wasn't completely vacant....there was a squatter in the garage.... What's your one takeaway from that moment? Do thorough due diligence when selecting a property management company. Vet a number of property managers, interview them, ask them questions, really lay down the interrogation. After-all, these are the individuals that are running your investment day-to-day. If ANY red flags pop up, it may already be too late. As the saying goes..."Hire slow, fire fast!" Also, build your real estate network! How did I find out about my property being vacant? I got a tip from a connection I made online. Then I sent a 3rd party property manager to immediately investigate. They are now taking over management of this particular property and we're working to turn things around. How has real estate changed your life? I have a clearer vision and path toward the life I want. I see the great power of real estate, whether it's buying rental property, flipping it, or wholesaling, etc. And I see that it's something anyone can jump in to. I realized it's tough to retire early by just socking away a little savings here and there...you've got to diversify and find additional ways to bring in income. If you had an extra $100,000 cash right now, what would you do? I'd buy three more rental properties in the $100,000 range (that's about $25,000 down each). They'd also have to cash flow $200+ each. Then, I'd throw another $10,000 in savings and $15,000 in Wealthfront.` What's the best book you've read recently? Why? Do audiobooks count?? I just finished The Millionaire Next Door. Now, this won't be an edge-of-your-seat type of book, but it's a fascinating piece of work on what the world's wealthiest individuals have in common. One big thing that stuck: the world's wealthiest people...are NOT the ones driving the brand new Mercedes, do NOT have the nicest suits, or the diamond watches. Nope, it's more likely the guy next to you on the bus taking public transportation to work. Because he's not increasing spending as his income rises. He's not picking up that $550 per month car lease after a promotion. He's putting his money into appreciating assets and staying way far away from expensive material things. The image of wealth in our society is totally skewed in reality. What's your end goal? This is still very much TBD. Who knows what my priorities will be in 2 years, 5 years, 3 decades? BUT, I'm looking forward to becoming financially stable in all areas of my life so I can take more time to work on the things I want to pursue. And of course I want more time to hang out with family and friends, and TRAVEL at will. What's your greatest piece of real estate advice? Build strong connections and relationships with individuals of various degrees of experience. Meet investor vets, talk with newbies, find people who are in a similar situation as yours. This group will help you through your investing career and be your guidance group. Life and investing is all about connections. It's soooooo cliche, but NETWORK, NETWORK, NETWORK! Also, you better completely understand your numbers! Thanks for reading everyone! We'd love to hear your feedback on these interviews. Are they cool? Valuable? Lame? What questions would you like to hear?

Let us know in the comments section below! -Tyler |

Investing |

Jump In |