|

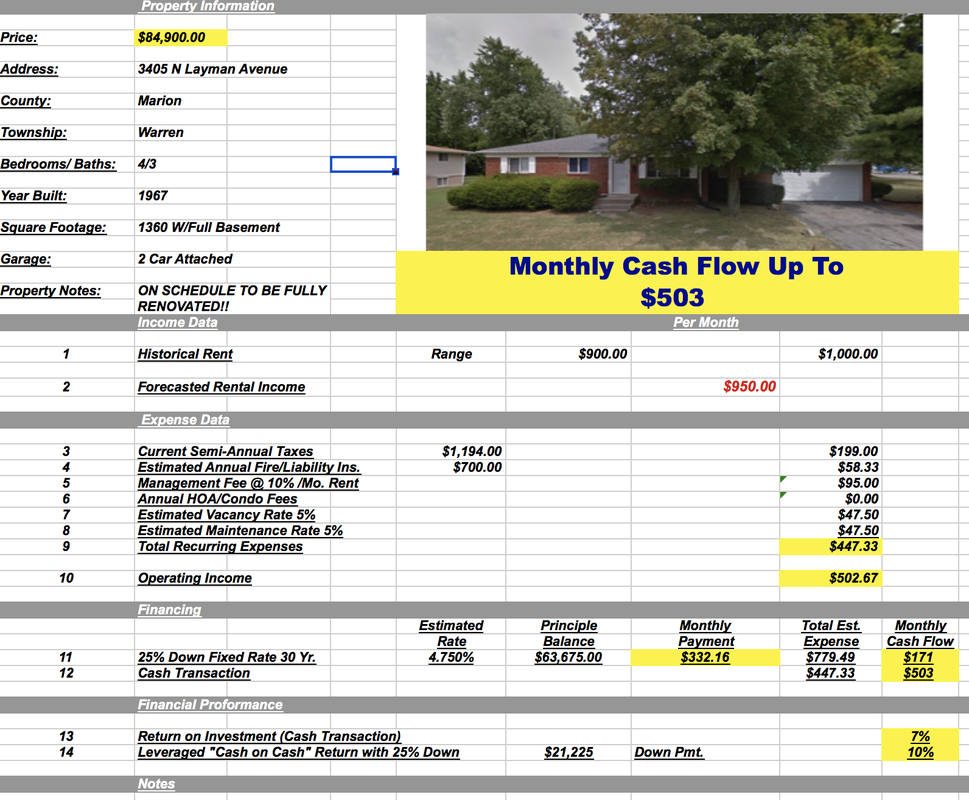

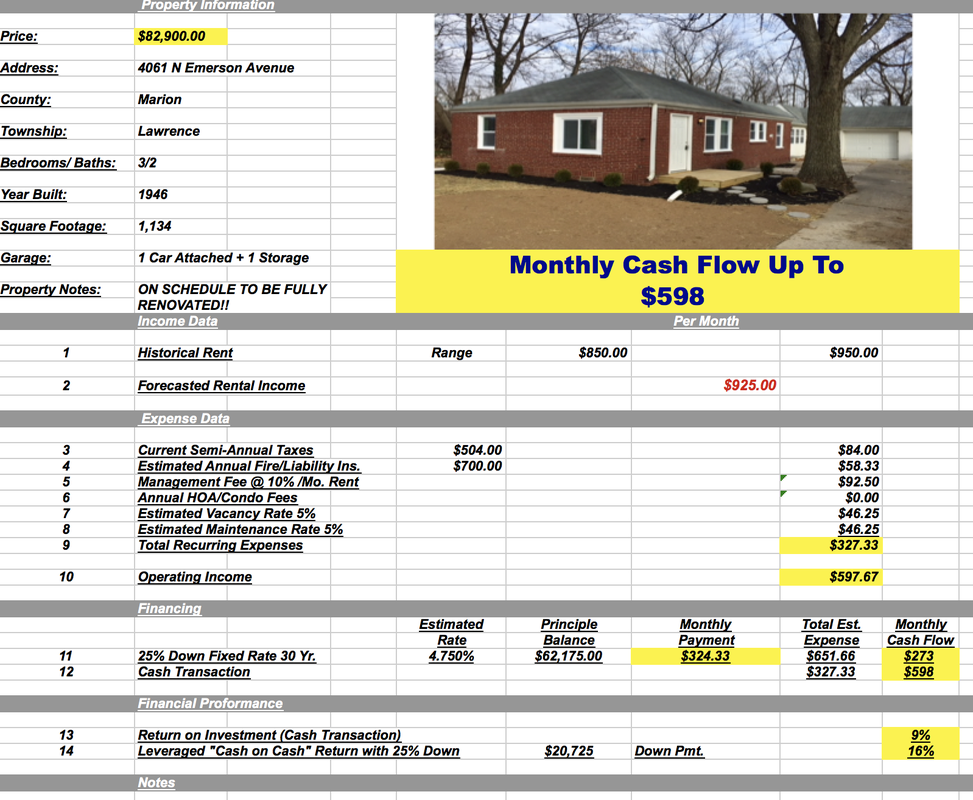

Going into the search for My Second Property, my knowledge base, experience, and connections have all immensely improved over the past year. With that, my investment criteria and strategy also shifted. Key strategy differences in my current search: 1. I'm financing this next property as opposed to paying all cash. This requires getting a mortgage, which I've already been approved for, and allows me to purchase a higher priced property with less money out of pocket. 2. I'm now targeting a property in the $75,000 - $100,000 price range that rents for $1,000/month. If you remember, My First Property was purchased for $37,000. A higher priced property will get me in a better neighborhood, should have better tenants, have less repairs, and a higher rate of appreciation. I also now understand, when it comes to real estate investing, "the more risk, the more reward" is a valid expression. With me targeting a higher class neighborhood, I'm expecting my ROI to fall, but it should be a safer play with a stronger tenant and long-term returns. For example: I was getting a 14% ROI on My First Property with little stability, but now I'm estimating between 7%-10% on My Second Property with more stability. So, my first phone call to find property #2 was to an individual I connected with online. We had a couple great phone conversations and then eventually met in person in Indianapolis (he met me on a Saturday morning at 8:30am...LOVE the dude!). His company follows the Turnkey model: they purchase properties, renovate them, sell them to investors, and manage them. The biggest difference between his company and the one I worked with previously: their properties are in the $75,000 - $100,000 range. They DON'T TOUCH C-Class low-end inventory...something I'm very happy about. After a few weeks of back and forth conversation, and patiently (not really...) waiting to see their inventory, I was sent a package of 5 houses. Below are two that stood out to me. LEAD #1 This property is vacant and scheduled to be fully renovated. FIRST IMPRESSION OF LEAD #1: I like the curb appeal, brick exterior (great in the Indy weather), and 2 car garage. It's a large home with 4 bedrooms and 3 bathrooms, but having 3 bathrooms actually scares me a little...that means three times the toilets and plumbing to deal with. The acquisition price ($84,900) to rent ($950) ratio is great and exactly what I'm looking for from an investment standpoint. LEAD #2 This property is vacant and scheduled to be fully renovated. FIRST IMPRESSION OF LEAD #2: I also like the curb appeal, brick exterior, and garage. It has less square footage with 3 bedrooms and 2 bathrooms. But, as I mentioned before, I don't mind the smaller floorpan and one less bathroom. However, this house is about 20 years older than Lead #1. The acquisition price ($82,900) to rent ($925) ratio is great, but I would prefer rent a little closer to $1,000. So, I got right to work and dug into the numbers a little more! By now, analyzing properties has become a lot easier, and I now have processes and a strong system in place. I look back at analyzing My First Property before purchasing it, and I was quite foolish. I really did JUMP IN rather blindly. But, that's beside the point now. Thankfully, I've learned a ton and now initially look at these core questions: -Does it meet the 1% Rule? -Can I get it for under-market value? -Is it in a good neighborhood? -How are the schools? -Is it in a flood zone? -What's the zip code like? I then calculate all expenses and income. How? Well, you're in luck! Check out my post on How to Analyze Property. After a quick analysis, LEAD #2 came out on top! So I asked a few more questions (with answers in red) and got additional photos. 1. How old is the roof? - NOT SURE EXACTLY. OUR ROOFER ESTIMATED 8-10 YEARS OLD. 2. How old is the furnace? - INSTALLED NEW FURNACE. 3. How old is the water heater? - INSTALLED NEW WATER HEATER. 4. What condition are the windows in? - WE INSTALLED NEW VINYL WINDOWS AND SLIDER. The place looks nice!!! The numbers look great!! I'm excited! I'm pumped! Could this be my next investment??? Am I one step closer to Financial Independence?? Ok...now I'm a little nervous...I thought it'd be easier to pull the trigger on My Second Property. I've got more experience under my belt...right? Decisions...decisions.... Takeaways -Investment strategies change. A year ago, the properties I was targeting were completely different from the ones I am now looking at. That's the beauty of experience. You learn and grow. -I thought it would be a lot easier pulling the trigger on My Second Property. Yes, it's no longer "my first rodeo" but there's still challenges, questions, and doubts that creep into your brain. -Tyler

0 Comments

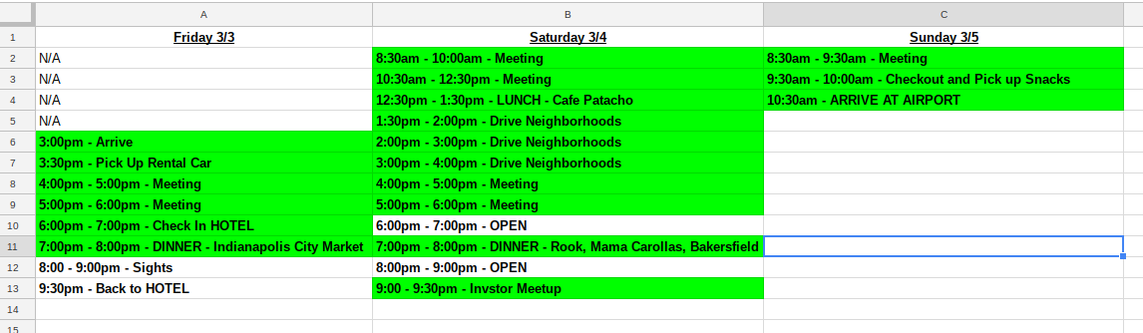

The first major difference between purchasing My First Property and purchasing My Second Property, is the financing strategy I'm using. While I paid ALL CASH for My First Property, I don't have the reserves to purchase this next investment outright. But, I'm fine with that. I really have no desire to buy it cash even if I could. Why? Through my experience purchasing one property all cash, I realized the amazing power of leverage. Yes, cash flow is negatively affected with a mortgage, but your dollars can go much further, you can scale much faster, and your cash-on-cash return can be larger. Check out my post on the various Pros and Cons of having a mortgage vs. paying all cash HERE. So, the adventure to find money began. Luckily, as I mentioned in my previous post, I met some great connections in Indy. Through the jam-packed weekend I connected with a lender who is now a crucial, crucial component of acquiring My Second Property. The process of getting a mortgage was a little intimidating at first...I'd never gotten one before! But, looking back, it was smooth overall. A little laborious, a lot of documents had to be tracked down, but again, very smooth. So what was the process like? Step 1 Fill out an Online Mortgage Application. This required basic contact information as well as: -Loan information (how much are you asking for?) -Detailed personal information -Employment and Income information -Assets and Liability information -Declarations -Consent and Confirmation This all took about 15-20 minutes to compile and complete. Step 2 After submitting the online application, I got in touch with my lender and he required a few additional documents: -Last two paystubs -The past two years W2s -The past two years tax returns -Last two bank statements for all accounts -Copy of my driver's license He also set up a BOX account (cloud storage) so I could upload everything for his team to access instead of emailing everything over. Step 3 This step was a simple waiting game as the lender had to assess my qualifications. Within a day, I was pre-approved! I'm going to assume it helped that I'm targeting a property in the $100,000 range...and not a house in the Bay Area for $700,000. Key Information when applying for a mortgage -Lenders won't give out loans to financially risky individuals. A good credit score, a steady paying W2 job (being self-employed makes you a little more risky to lenders), and having a sizable cash reserve will help your case for a mortgage. Make sure these are in tip-top shape before looking for a loan. -If you plan to purchase a distressed property...one that needs a lot of rehab work...don't assume you can get it financed. Lenders won't provide financing for risky assets. -Keep your files and documents organized! If you plan to build a large real estate portfolio with the help of bank financing, this won't be the only time you'll be asked for a W2 from two years ago or your tax return from last year. -Mortgage rates change daily, so if you're getting 4.5% one day, it could easily jump to 4.75% the next day. Before offering on a property, always ask your lender for the most up-to-date interest rate so you can accurately analyze it. And with that, I'm ready to look for my next investment! I've got a pre-approval letter in hand, a $100,000 budget, specific investment criteria in my head, and a new sense of excitement. I'm jumping in to property #2. LET'S DO THIS! -Tyler Always think one step ahead. Two steps ahead. Five steps ahead. In March of 2017, I flew out to Indianapolis for the first time in my life. I had just completed renovations on My First Property and was looking forward to seeing the investment with my very own eyes. I really had no idea what to expect. "Did I really buy a property 2,300 miles away without ever seeing it in person?" Yes. "Did I really renovate it without keeping a close eye on the contractors?" Yes. "Am I crazy??" Probably. However, my PRIMARY goal of flying to Indy was actually NOT to check up on this property. Yeah, I needed to see it, but really, it wasn’t my sole objective. Always think one step ahead. Two steps ahead. Five steps ahead. My goal was to build relationships in Indy. Relationships for the future. Within 2 hours of landing in Indianapolis I met my property management company and contractor, walked through the property, and obtained keys for the front door. I knocked those tasks off my list as soon as possible so I could focus my time and energy on the future! The next 36 hours were full of meetings with local agents, investors, deal finders, driving neighborhoods, walking through properties, and checking out contractor rehab quality. Oh, and there was a great lunch, refreshing beers, and some sightseeing along the way as well. In a quick day and a half, I put together the foundation for My SECOND Property and now have multiple funnels to find my next investment:

-I can scour the MLS (Zillow and Trulia) and find a deal with an agent -I can work with a couple new turnkey companies (that are MUCH better than the company I worked with before). They focus on properties at a higher price point, with higher rents, and better neighborhoods. -I can pick up a distressed property through a wholesaler and renovate it with a new contractor. Takeaways -Always think toward the future and see how actions now can impact your long-term goals. -NETWORK. NETWORK. NETWORK. Meet people online, in real life, talk to them on the phone, via email, and text. These connections will be the foundation of your future. Happy Investing! -Tyler |

Browse Topics

All

|

Investing |

Jump In |