|

So, it's time to buy a rental property. You're probably feeling good, you're juiced up, and you're excited because with every property acquired you see yourself getting closer to your financial dreams. But, great deals aren't always easy to come by.

You have to be quick, concise, and really KNOW YOUR NUMBERS!

This post will teach you how to quickly analyze buy-and-hold investment property, so you can ultimately determine if you've got a good buy or a bad one.

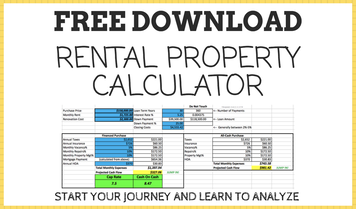

THE FIRST STEP? Download my free Rental Property Calculator HERE.

Now that you have my FREE rental property calculator, take a SUPER quick look at these three indicators of a good investment:

1. Does it meet the 1% rule? There's a good chance that if you can get at least 1% of the purchase price in monthly rent, you've got a cash-flowing property. For example: if you purchase a property for $100,000 it should rent for at least $1,000 per month to cash flow. 2. Can you get it for UNDER market value? Take a look at what properties are selling for in the area and what properties have sold for in the past 6 months. You can gather this info on Zillow, Trulia, or through your agent. That should give you a rough estimate of what the property is worth. Now, can you negotiate the purchase price down and acquire it for under market value? If yes, you've got yourself some built in equity and value! 3. Is it in a good neighborhood? Stay away from war zones! Don't buy in crime stricken neighborhoods. The financial numbers on paper might look great for that crack house on the corner, but believe me, you'll run into more issues than you can handle. I love the crime map overlay on Trulia. That's where I usually go first to scout out neighborhood safety. If the answer is YES to all three questions, you're well on your way to finding a great investment property. Time to dig a little deeper! Understanding Expenses We need to understand all the expenses that go in to owning the property. Typically, they'll look like this:

Take these amounts and subtract them from your expected rental income. Whatever is left over is "cash flow" baby! If you have NOTHING left over, or even worse, the expenses are more than expected rent, that's a pretty clear sign this property will not work out from a cash flow standpoint. Here's a breakdown of each expense and how to calculate them: Mortgage This first expense might look intimidating to calculate, but it's really not. I use www.Bankrate.com for a quick mortgage check. Enter the amount you wish to borrow (which is purchase price minus your down payment), enter the interest rate, and enter how many years the loan will be. Bingo! There's your estimated monthly mortgage payment. Property Taxes Sites like Zillow, Trulia, and others show historical data on property tax history, however, the most reliable source I count on is the local county website. For example: I invest in Indianapolis and use the Marion County property taxes site. Always verify using the county website! Insurance Finding the cost of insurance will require you to call a few agents. I recommend getting three quotes from different insurance providers and analyze how the rates compare. Once you start getting familiar with your market you'll better understand the general costs depending on square footage and specific neighborhoods. Property Management Fees Property managers typically charge 6% - 10% of monthly gross rent and a one-time fee when a new tenant moves in. I would also recommend interviewing multiple companies and reading this complete guide on how to hire a property manager. Vacancy This is the amount in rent you expect to lose during a vacancy. As a little cash flow "buffer," it's comforting to save some of your monthly rental income for an unexpected vacancy, or if there's a vacancy during the turn-over of a unit once a renter leaves. I usually build in 5% of gross monthly rent for this category. Future Repairs This is one of the toughest expense categories to determine. Random repairs can come up in bunches, or you could go months, even years, without major maintenance needed. Be conservative when you're new to investing and save anywhere from 10% - 20% every month for repair expenses. Home Owner's Association Dues These expenses are not applicable for all properties. They're typically a monthly fee charged by an association for providing value to a condo or town home community. Some HOA's come with pools, community rooms, gyms, or other amenities. A quick call is all that's needed to find details on this expense category and how much it'll put you back per month. Understanding Income Now, we'll cover the income side of the things, which for a single-family homes, is usually just one category. RENT. Rent In order to determine what your property will rent for it's best to gather data from several different sources and average them out. I recommend taking a look at these four resources: 1. www.Rentometer.com - great website for comparing your rent with other local properties. Simply enter the property address, number of bedrooms, and see what the low, median, and high rents are in your area. 2. Reach out to property managers - email or call local property managers and have them assess your property. Their job is to understand the rental market and they should be able to give you accurate data. 3. Craigslist - scour Craigslist and see what similar properties are renting for in the area of your targeted investment. If you want to take it a step further, you can even post a fake ad on Craigslist for your potential rental property and see what kind of feedback you receive. For example: if you list a property for $1,000 and get crickets, you probably won't be able to receive that amount in monthly rent. You'll have to update your projections to a lower rent amount. 4. Zillow or Trulia - I tend to NOT rely on these for monthly rental estimates, but it's always a good tactic to at least take a look.

So there you have it...it really isn't quantum physics. These are the typical expenses and income categories you can expect from single-family rental property. Subtract your expenses from your income and you've got your cash-flow number. I personally will never buy a property that doesn't "cash flow," but everyone has their own investment criteria. So, have a strategy and stay firm with it.

Need help analyzing a deal? I'd love to help! Shoot me a message and let's chat!

Want to sharpen and take your property analysis skills to the next level? Then, The Jump Pack is for you. I created this package of digital resources to improve your property analysis skills. It includes: a property analysis guide, analysis checklist, analysis calculator, over 1 hour of videos, an investing glossary, plus more.

Now, before I conclude this post, I have a challenge for you: start analyzing 5 properties per day. Just do it! Get in the hang of looking up expenses and estimating rents.

ALSO - read this post on the nuts and bolts of calculating Return on Investment (ROI). I'll literally show you the exact formulas and equations needed to calculate ROI. Best of luck! -Tyler

8 Comments

10/13/2021 08:54:17 pm

Thanks for providing recent updates regarding the concern, I look forward to read more

Reply

10/19/2021 07:14:36 am

Hello there I am so glad I stumbled upon your website, I really found you by accident, while I was researching on google for something else, Regardless I am here now and would just like to say thanks for a marvelous post and a all round thrilling blog.

Reply

10/28/2021 07:14:43 am

Thank you for the tips on understanding the different expenses. Very good site, thumbs up!

Reply

11/10/2021 05:29:00 am

This is a must read. Very well presented. Thank you for sharing.

Reply

11/17/2021 12:15:57 am

I am truly grateful for this blog and I was in fact looking for something impressive like this.

Reply

11/19/2021 04:35:13 am

This is a very helpful content. Truly a must-visit for individuals in the field of real estate or rental businesses. Thanks for sharing this here.

Reply

Leave a Reply. |

Investing |

Jump In |