|

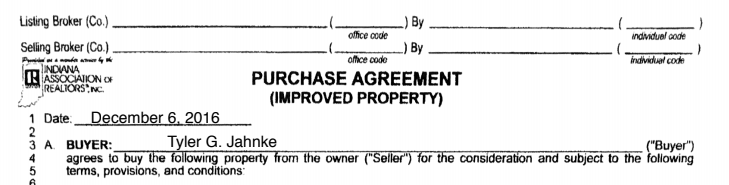

I have to show you something real quick... That's a Purchase Agreement from December of 2016, when I purchased My First Property. WOW...I can't believe it's officially been 2 YEARS since I started investing in Real Estate. And it's been a crazy roller-coaster ride so far, to say the least. Here's a quick recap: I bought My First Property from a turnkey company in December of 2016. Everything went "smooth" for 11 straight months, until an unexpected vacancy and unacceptable management derailed the investment. With $16,000 in repairs needed, I decided to sell it. I bought My Second Property in March of 2018. I bought My Third Property in July of 2018. Then I invested in an 80-unit multi family property just this past October. I've had my fair share of bumps and bruises along the way. Tons of challenges, frustrations, and second guessing. And I know there's plenty more of that to come. But, I'll continue to learn every step of the way. And now it's my job, to share my knowledge with YOU. Here are my TOP 8 TIPS after my first 2 years in Long-Distance Real Estate Investing: 1. Network, network, network "Your Network is Your Net Worth" I live by this and truly believe it. The people you keep closest to you, create such a profound influence. You've got to be conscious of that and surround yourself with the best and brightest. I've met some of my best friends through real estate and I couldn't imagine my life without them. So, use the best real estate networking tool out there, Biggerpockets, and connect with locals that are just as ambitious and driven as you. Set up local events and meetups to chat with novice and experienced investors, agents, contractors. Business and LIFE are all about relationships. 2. Master How to Analyze Property The basics of investing start with understanding How To Analyze Rental Property. You MUST know how to quickly filter through potential investment leads, determine all expenses, and projected rents. You need an understanding of flood planes, school districts, neighborhoods, taxes, and much more. If you're looking to acquire a property, I challenge you to start analyzing 1 property a week. Then 1 property a day. Repetition will get you to a point where analysis becomes clockwork, so when that great deal pops up, you can JUMP ON IT! 3. Location, location, location When I first started investing in real estate, I didn't realize the importance of location. I just saw the numbers on paper, and assumed if the numbers on paper worked out, the investment would work out. Well, I WAS WRONG. Having a great real estate investment requires so many factors...and location is a huge one. You must understand neighborhood crime levels (I use Trulia crime maps), school districts, neighborhood classes, and neighborhood amenities (is there a Starbucks nearby?). Understand what type of tenant lives in the neighborhood (check out Neighborhood Scout). After all, your tenant is the primary source of income. 4. Interview and Vet Multiple Property Managers I've experienced working with the wrong people. And it SUCKS. Don't be like me. My first property manager decided to just NOT tell me that one of my tenants left. I only found out when my friend drove by the property and spotted a lock box on the front door. Then, I ran into $16,000 in needed repairs as the property manager never checked up on the property throughout the year. But, I take full responsibility for hiring the wrong people. And I learned real quick how to never make that mistake again! The key is to interview multiple property managers and really truly vet them. Check out my post on How to Hire a Property Manager. And if you want to work with my property manager, contact him HERE. 5. Always get an inspection Ahhhh...I was so naive a couple years ago. When I bought My First Property I admittedly was a little too trusting. In buying the property all cash, I didn't need to get a property inspection from a 3rd party company. Unless you really understand construction, rehab, and can see the property in-person, I'd say: ALWAYS GET AN INSPECTION! An inspection can and WILL save you from unexpected issues that'll cost you $. Lots and lots of $$$. 6. Don't ignore issues on the inspection report Well, I learned early on about the consequences of not getting an inspection report. But, I guess you could say I didn't learn the whole lesson. I had a relatively major issue pop up on an inspection report once...standing water in the crawlspace. I had a mold guy go out there and check it out, but I never decided to get a foundation expert to assess it. I ended up brushing it off the whole thing and tried to push it out of my brain because emotionally I really wanted the property and the numbers looked AMAZING! I eventually bought the property. Now, it's biting me in the A$$. Bottom line: don't ignore big issues on the inspection report. Take care of them or walk away. 7. Visit your market and meet your team in person Some long-distance real estate investors might disagree with me here, because technically everything can be handled remotely. BUT, having flown to my market multiple times, I can say it's an invaluable experience. You'll have a HUGE advantage if you take the time to get your boots on the ground, meet connections face-to-face, drive through neighborhoods, and really understand the culture and direction of the city. Real Estate Investing is a relationship business and meeting your team IN PERSON strengthens those relationships. Sitting down with your agent and property manager for a nice lunch goes a long way. Trust needs to be built if you're going to invest from afar, so get out there and understand your team on more of a personal level! 8. Keep a Positive Attitude and Move Forward You're going to fall down. And you might even get kicked while you're down. But, that's not only real estate or business...it's life. Being able to get back up from every challenge, move on, and LEARN is crucial to your development. This is much easier said then done, but get it in your brain, so when your next pitfall comes up, you're ready to move forward and grow. Well, as a final conclusion here, I've got some last things to touch on: A LOT has happened in the last couple years. Literally, my life has changed. My mindset has changed. My understanding of investing has changed. By the way: -I'm nowhere near "Financially Independent." This is a LONG game. I'm 2 years in. Let's chat in 20. -I'm continuing to learn each and every day. Books, Podcasts, and Meetups. Never stop. I'm excited for the future. Reach out if you have any questions, I'm always happy to help in any way possible. -Tyler

2 Comments

So, it's time to buy a rental property. You're probably feeling good, you're juiced up, and you're excited because with every property acquired you see yourself getting closer to your financial dreams. But, great deals aren't always easy to come by.

You have to be quick, concise, and really KNOW YOUR NUMBERS!

This post will teach you how to quickly analyze buy-and-hold investment property, so you can ultimately determine if you've got a good buy or a bad one.

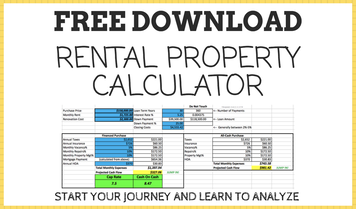

THE FIRST STEP? Download my free Rental Property Calculator HERE.

Now that you have my FREE rental property calculator, take a SUPER quick look at these three indicators of a good investment:

1. Does it meet the 1% rule? There's a good chance that if you can get at least 1% of the purchase price in monthly rent, you've got a cash-flowing property. For example: if you purchase a property for $100,000 it should rent for at least $1,000 per month to cash flow. 2. Can you get it for UNDER market value? Take a look at what properties are selling for in the area and what properties have sold for in the past 6 months. You can gather this info on Zillow, Trulia, or through your agent. That should give you a rough estimate of what the property is worth. Now, can you negotiate the purchase price down and acquire it for under market value? If yes, you've got yourself some built in equity and value! 3. Is it in a good neighborhood? Stay away from war zones! Don't buy in crime stricken neighborhoods. The financial numbers on paper might look great for that crack house on the corner, but believe me, you'll run into more issues than you can handle. I love the crime map overlay on Trulia. That's where I usually go first to scout out neighborhood safety. If the answer is YES to all three questions, you're well on your way to finding a great investment property. Time to dig a little deeper! Understanding Expenses We need to understand all the expenses that go in to owning the property. Typically, they'll look like this:

Take these amounts and subtract them from your expected rental income. Whatever is left over is "cash flow" baby! If you have NOTHING left over, or even worse, the expenses are more than expected rent, that's a pretty clear sign this property will not work out from a cash flow standpoint. Here's a breakdown of each expense and how to calculate them: Mortgage This first expense might look intimidating to calculate, but it's really not. I use www.Bankrate.com for a quick mortgage check. Enter the amount you wish to borrow (which is purchase price minus your down payment), enter the interest rate, and enter how many years the loan will be. Bingo! There's your estimated monthly mortgage payment. Property Taxes Sites like Zillow, Trulia, and others show historical data on property tax history, however, the most reliable source I count on is the local county website. For example: I invest in Indianapolis and use the Marion County property taxes site. Always verify using the county website! Insurance Finding the cost of insurance will require you to call a few agents. I recommend getting three quotes from different insurance providers and analyze how the rates compare. Once you start getting familiar with your market you'll better understand the general costs depending on square footage and specific neighborhoods. Property Management Fees Property managers typically charge 6% - 10% of monthly gross rent and a one-time fee when a new tenant moves in. I would also recommend interviewing multiple companies and reading this complete guide on how to hire a property manager. Vacancy This is the amount in rent you expect to lose during a vacancy. As a little cash flow "buffer," it's comforting to save some of your monthly rental income for an unexpected vacancy, or if there's a vacancy during the turn-over of a unit once a renter leaves. I usually build in 5% of gross monthly rent for this category. Future Repairs This is one of the toughest expense categories to determine. Random repairs can come up in bunches, or you could go months, even years, without major maintenance needed. Be conservative when you're new to investing and save anywhere from 10% - 20% every month for repair expenses. Home Owner's Association Dues These expenses are not applicable for all properties. They're typically a monthly fee charged by an association for providing value to a condo or town home community. Some HOA's come with pools, community rooms, gyms, or other amenities. A quick call is all that's needed to find details on this expense category and how much it'll put you back per month. Understanding Income Now, we'll cover the income side of the things, which for a single-family homes, is usually just one category. RENT. Rent In order to determine what your property will rent for it's best to gather data from several different sources and average them out. I recommend taking a look at these four resources: 1. www.Rentometer.com - great website for comparing your rent with other local properties. Simply enter the property address, number of bedrooms, and see what the low, median, and high rents are in your area. 2. Reach out to property managers - email or call local property managers and have them assess your property. Their job is to understand the rental market and they should be able to give you accurate data. 3. Craigslist - scour Craigslist and see what similar properties are renting for in the area of your targeted investment. If you want to take it a step further, you can even post a fake ad on Craigslist for your potential rental property and see what kind of feedback you receive. For example: if you list a property for $1,000 and get crickets, you probably won't be able to receive that amount in monthly rent. You'll have to update your projections to a lower rent amount. 4. Zillow or Trulia - I tend to NOT rely on these for monthly rental estimates, but it's always a good tactic to at least take a look.

So there you have it...it really isn't quantum physics. These are the typical expenses and income categories you can expect from single-family rental property. Subtract your expenses from your income and you've got your cash-flow number. I personally will never buy a property that doesn't "cash flow," but everyone has their own investment criteria. So, have a strategy and stay firm with it.

Need help analyzing a deal? I'd love to help! Shoot me a message and let's chat!

Want to sharpen and take your property analysis skills to the next level? Then, The Jump Pack is for you. I created this package of digital resources to improve your property analysis skills. It includes: a property analysis guide, analysis checklist, analysis calculator, over 1 hour of videos, an investing glossary, plus more.

Now, before I conclude this post, I have a challenge for you: start analyzing 5 properties per day. Just do it! Get in the hang of looking up expenses and estimating rents.

ALSO - read this post on the nuts and bolts of calculating Return on Investment (ROI). I'll literally show you the exact formulas and equations needed to calculate ROI. Best of luck! -Tyler |

Investing |

Jump In |