|

Congrats! You have a nice chunk of cash that you want to invest.

Yeah, you could throw it into a savings account for safekeeping, but with interest rates usually earning you less than 2% annually, you’re barely keeping up with inflation. Luckily, if you’re reading this article, you likely already understand the concept of having money “work for you” and you want to accelerate the process of reaching your financial goals. The fact that you’re thinking about real estate being a potential strategy already puts you a few steps ahead. Now, it’s time to learn more about systems that allow your money to grow on its own. I’m excited for you! So let’s talk about $30k. What can you realistically do with that in real estate? What are your options? Can that cash set you up for a stronger financial future? Let’s jump in! Understanding Your Realistic Opportunities and Boundaries I just posed this question, but the first thing to ask is, “What can you do with $30,000 in real estate?” Well, you’re probably not buying a palace on a private island. You’re probably not buying a mansion on the beach. But let’s be real, those options probably won’t manifest in a good return on investment anyway. As far as real estate investing options go, the ones that stand out to me are:

We’ll touch on these options in detail later, but the point I’m trying to initially make is this: the first step is to grasp the realistic opportunities and boundaries you have with $30k. And before you get too giddy about investing your cash, my personal financial advice to you is: just because you have $30k, doesn’t mean you have to invest it all at once. There’s no need to drop it all on a down payment, leaving you without any cash reserves for unexpected expenses that may come up. Having to replace an AC unit, fixing appliances, repairing a water leak, and patching a roof are all expenses that may surprise you out of nowhere. As a property owner, you’ll have to address them and ensure a safe and livable property.

0 Comments

Buying your first rental property may seem overwhelming. I get it - I’ve been there. I remember it just like yesterday. In 2016 I jumped in, bought my first property, and my life changed for the better. A lot of moving pieces, skills, and relationships are needed in order to be successful in this business. Buying real estate can be scary! You’re investing your hard-earned cash and there are a lot of unknowns. You may not know where to start, how to start, or when to start. But my response to that is... “If it were easy, everyone would be doing it.” To be successful, you need to embrace the challenge! I firmly believe that the most growth occurs when we take on challenges and push ourselves instead of searching for the “easy button.” Buying your first property isn’t easy, but I will say it’s simpler than you may think. Aside from a few things that I’ll touch on below, if you’re prepared mentally and put in the time and effort, you’ll be buying your first property in no time. So Tyler, “How do you buy your first rental property?” 1. Start with the End in Mind Like I mentioned earlier, a lot of what goes into buying your first property is mental, so I think that’s where we should start. Let’s get your mind prepared for the jump into real estate investing. First, I challenge you to think about what your ideal life looks like.

Once you have a better grasp and understanding of your ultimate life goals, visions, and aspirations, then ask yourself, “does real estate play a part in achieving my ideal life?” If the answer is yes and you understand the role that real estate can play in achieving those things, any mental roadblocks you have should start to disappear. Once you tackle the mental side of investing, the next few steps I’ll touch on should arguably be easier and you’ll soon be ready to buy an investment property. 2. Educate Yourself Knowledge is power. So it’s time to study up. Read books, read blogs, listen to podcasts, attend real estate conferences and networking events. Hop on calls with experienced investors, meet them for coffee, and immerse yourself in this world because it’s very important to understand what you’re getting into. Now, I don’t expect you to become an expert in this field just yet. In fact, I urge you NOT to strive to become an expert just yet because I’ve seen people get stuck in this “education phase” for years. There’s a balance needed between education and action. Educate yourself, but don’t get stuck consuming and make sure you eventually start “doing.” 3. Button Up Your Personal Finances I do not advise jumping into the real estate investing world unless you have a firm grasp of your personal finances first. If you can’t tackle your own personal finances, it’ll be very difficult to succeed in the real estate world. One of my favorite sayings is, “what gets measured gets managed.” When it comes to your personal finances I’d start with:

Once you’ve gone through the analysis, try to find ways to decrease expenses and increase income. Fully grasp your personal financial situation, treat your personal finances like a business, and then you’ll be ready to start investing in real estate. 4. Pick Your Initial Investing Strategy Focus is important when initially starting your real estate investing journey. Are you interested in a turnkey, cash-flowing single family home? Are you looking to start with a small multifamily? Are you looking to take a gamble on finding a high appreciation property? Whatever your answer is, pick ONE initial strategy and stick with it until you get that first deal under your belt. I’d argue that the most important deal you ever do in your career is the first one. It gets you started. It gets you in the game. Get that first deal under your belt and then you’ll have plenty of time to experiment, pivot, and try new strategies as your journey progresses. Heck, I started buying sub-$40,000 single family homes in the Midwest and things have changed quite a bit over the years. But again, the key is to focus on one strategy initially to start your journey. 5. Pick a Market Now that you’ve educated yourself on the basics of real estate, tightened up your finances, and picked an initial strategy, you’ll need to pick a market to invest in. Your market choice will probably be heavily dictated by the strategy you choose (cash flow vs. appreciation). Looking for consistent, monthly cash flow? You’ll probably need to invest in a smaller market in the Midwest or The South. Looking for higher appreciation? Your eyes will probably be on the coasts and on bigger cities. I started my journey by investing for cash flow in Indianapolis. Being able to cover a mortgage and take home extra passive income every month is helping me achieve my ideal life. Here are metrics I look at when evaluating a cash flow market:

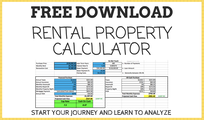

My last piece of advice when it comes to choosing a market, is to not get stuck on trying to find the “perfect market” because there’s no such thing. I’ve seen many people spend too much time trying to find the holy grail of markets, so find a market that matches your initial strategy, passes many of the above metric tests, and get to work. 6. Master Analysis Understanding how to run numbers on a property is paramount. It may seem like common sense, but many investors don’t fully grasp all of the income and expense details that go into owning rental property which ultimately can lead to a failed investment. Become very comfortable estimating rental rates, as well as mortgage payments, property taxes, insurance, property management fees, vacancy reserves, and repair/maintenance reserves. If you need more help in this area, check out this post. It includes all the necessary information you need PLUS a free analysis spreadsheet. 7. Build a Team I always go back to the analogy that you’re the CEO in your investing career and you need to find your various staff who are experts in their respective fields. Key individuals that you should look to build relationships with are:

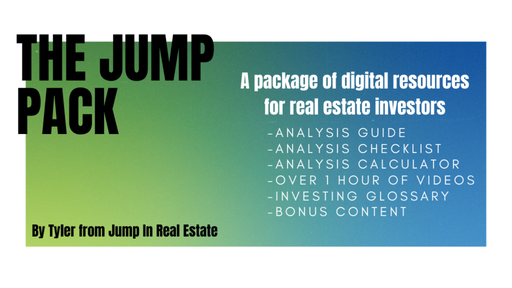

Once you’ve picked your market, it’s time to hop on the phone and connect with these types of individuals locally. Interview dozens of them and get referrals from successful investors who also invest in your market. This can be a daunting task, but I urge you to put as much time and effort into building your team as possible. These individuals will ultimately help you succeed in this business. 8. Line up Financing You’re going to need money to invest in real estate. Yes, I said it. Once you have control over your personal finances and saved enough for a downpayment, you will need help funding the rest of your first deal (unless you’re buying all cash). Contact multiple lenders (local and institutional) and get familiar with their terms, interest rates, working styles, and values. The key is to eventually choose a lender and get a pre-approval letter. You must fully understand how much they’d be willing to lend you as well as estimate monthly payments, as that’s very important when evaluating an investment. 9. Network, Network, NETWORK! If you’ve read some of my other articles, you may be annoyed at me because I often bring up the power of networking. I always talk about it and I’ll never stop being adamant about its amazing value. Bottom line: networking and meeting other real estate investors and professionals has been the biggest factor in my investing career. Networking helps with each and every one of the steps I laid out in buying your first property. It helps with education, grasping personal finances, picking a plan, picking a market, mastering analysis, building a team, and lining up financing. It literally plays a part in everything. So, get out there, shake some hands, meet some people, treat them to lunch, and build real connections. 10. Jump In and Take the Leap! If you follow the previous steps I laid out, you have all the tools necessary to buy your first rental property. I tell people all the time and I’ll tell you again, the last step is purely mental. I know taking action, taking the leap, and closing on that first property is easier said than done, but go back to what your ideal life looks like. If real estate can help you achieve the ideal life of yours, then it’s 100% worth taking the risk! Remember: every challenge is a learning moment “There’s no such thing as losing. You either win or you learn.” I take that quote to heart every day and it’s absolutely needed in the real estate investing world. I won’t sugarcoat it. Investing in real estate isn’t always easy. But these simple steps will get you prepared for making that first investment. Just know, that every challenge you run into is a learning moment that will help you when it’s time to buy that 2nd, 3rd, and 8th property. 11. BONUS: Invest In Yourself Investing in yourself and your education can have extremely profound affects on your life. So, if you're looking to buy your next cash flowing property and sharpen your analysis skills, then The Jump Pack is for you. I created this package of digital resources to improve your property analysis skills. It includes: a property analysis guide, analysis checklist, analysis calculator, over 1 hour of videos, an investing glossary, plus more. I wish you the best of luck on this rewarding journey!

-Tyler So you’re preparing to sell a rental property?

Maybe you want the cash, maybe you want a new property, or maybe you want to get out of the landlord business altogether. Whatever your reason for selling, that’s great because you’re taking action and making strategic moves for the better. Heck, I personally recommend evaluating each property in your portfolio every few months regardless to keep an eye out for valuation and cash flow trends (whether good or bad). As an investor you should never be afraid to sell off a property if that’s what is best for you. Here’s the thing about selling a rental property… It’s not always easy and there’s a big difference between selling a vacant property versus selling an occupied property. Selling a vacant property is pretty cut and dry: clean it up, work with an agent or sales platform, list it, go through the dance of having open houses, and hopefully sell it in a timely manner. On the other hand, selling an occupied property is a whole different story. You should first review the lease terms/lease agreement so you have an understanding of what you’re dealing with. Then, it’s time to consider some of the challenges associated with selling an occupied property. To keep reading, check out the full article I wrote that was published on Roofstock below! “It takes money to make money.”

You’ve probably heard that quote if you understand the business world and are familiar with basic investing strategies. Well, it’s very applicable and valid in the real estate world, too. Why? Because to acquire rental property, regardless of whether it’s a single family home, small multifamily, or a 300-unit apartment complex, you’re probably going to have to pay a down payment and fork over some cash. Hence, it takes money to make money. In my personal experience in building a portfolio of properties in Indianapolis, I generally put 25% down on my investment properties, meaning I have a nice chunk of cash “tied up” in my assets. Since I’m constantly saving then re-investing on repeat, you could call me “asset rich, cash poor” -- which many investors can relate to, as well. With money tied up to acquire property, that brings us to the questions, “Is real estate liquid?” and “Can I access my equity quickly, if needed?” As a quick answer, I’d say no. To keep reading, check out the full article I wrote that was published on Roofstock below! Okay, real estate investors ... let’s get one thing straight.

To grow and succeed in this business, you must understand how to analyze assets and potential investment properties. That starts with comprehending one of the most foundational metrics in the real estate world: Cap rate. Cap rate. Cap rate. Let’s talk about cap rate! Don’t worry - I’ll explain exactly what cap rate is and how to use its formula in practical ways to analyze markets and rental properties. Check out the full article I wrote that was published on Roofstock! Stocks.

Bonds. Mortgage Notes. Crypto. Oil. The list of investment options in this world could go on for another 98 pages. But, I’ll stop right there and focus on my favorite investment strategy of them all: Residential Real Estate Investing. I’ve been investing in real estate for a few years and am often reminded that this industry is ever-changing and evolving. But, there are key foundational facts about residential real estate that will always stay constant. Check out the full article I wrote that was published on Roofstock! Here’s a scenario: You just closed on an awesome investment property and you eagerly share the big news with your friends.

“What’s the ROI [return on investment]?” they ask. “It’s amazing!” you say. “It’s …” Then it hits you. You’re not sure how to answer the question, because there are a number of possible answers. Are they talking about capitalization rate? Cash-on-cash return? Internal rate of return? Cash flow? Appreciation? Every investor has their own understanding of what an "amazing" ROI is. In this article, we’ll look at defining your investment goals (namely, cash flow vs. appreciation) and run through the primary formulas for calculating rental property ROI. Check out the full article I wrote that was published on Roofstock! Featured OnWant to know the #1 question I get asked? I'll tell you. It's... "Why in the WORLD do you buy houses in Indianapolis?" Believe me, I understand why that question pops up all the time. Living in the San Francisco Bay Area and buying property over 2,000 miles away from home isn't the typical investing strategy. On the surface, it probably seems crazy. And, maybe it is. BUT, I'm sold on the city of Indianapolis. And aparently, many of you agree with me as well...having lost out on 4 deals this past week! Ahhhh the frustration! Anyways, I wrote an article for Roofstock: 10 Reasons I'll Buy More Rental Properties in Indianapolis. Check it out, give it a read, and let me know what you think about Indianapolis! After you read that article, take a look at the Indianapolis market overview below! Use my referral link below and GET $500 INSTANTLY applied to your Roofstock account!

|

Investing |

Jump In |