|

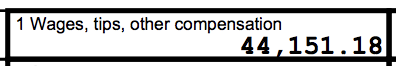

I spent $142,987 last year. I just did a 2018 personal financial recap (you should do one too!) and I spent well over 6 figures last year. That dollar amount includes living expenses, investment acquisitions, mortgages, business startup costs, EVERYTHING. And really....that number doesn't shock me at all. Why not??? Because I TRACK every penny that comes in and out of my accounts. I know EXACTLY where my money is going. And by TRACK, I mean.... I use Personal Capital (affiliate link) to automatically track my financial life. I don't have time to labor over spreadsheets, bank account statements, and credit card bills. And you probably don't either. The good thing is, Personal Capital links my accounts and does everything for me :) By logging on, I was able to determine within 20 seconds that: I spent $3,164 on Restaurants in 2018 I spent $940.23 on my cell phone in 2018 I spent $1,182 on groceries in 2018 Understanding these types of trends, and making adjustments is key to a healthy and successful future. Having these types of insights can exponentially increase your wealth. *Bonus Tip* After identifying my spending trends, I leveraged that knowledge and picked up a new credit card that rewards me for my highest expense categories. If you spend a lot on restaurants and groceries like I do, check out the new American Express Gold Card. You'll get 4x points on those categories and 40,000 points by using my referral link. I started tracking my finances in detail a couple years ago, and it's literally been a LIFE CHANGER. Just a couple years ago I was making $44,000 a year living in the San Francisco Bay Area. I knew that if I wanted to improve my financial situation, I had to understand my finances first. There's no coincidence that my income has more than doubled since I started educating myself and tracking everything. Before you Jump In to real estate, build that financial foundation! Educate yourself on your income, spending habits, and investments. Now, the cool thing is, not only does Personal Capital track your income and expenses, it also tracks Net Worth. Every couple weeks I check my Net Worth and it's been a game changer in building wealth. What exactly is Net Worth? Simplistically, it's your Assets minus Liabilities. It provides a snapshot of your financial situation in real time. Why is it important to track Net Worth? When you see your financial trends right in front of you, you're forced to confront the realities of where you stand financially. Knowing that, will cause you to be more mindful of your financial activities. Coincidentally, I just got this email from CNBC the other day... Glad to see that CNBC and I are on the same page :) If you don't keep track and understand your finances, you're ignoring them. You can't expect to improve your financial situation and grow your wealth if you don't have knowledge over your own finances. So, if you're the type of person that HATES talking about money... Or, you refuse to confront your bank account... Or, you need to step up your finance game... Or, you want to grow your wealth... The first step is to make a change and educate yourself in your own finances. Take charge. And face it now! Check out Personal Capital (affiliate link) because I HIGHLY RECOMMEND IT! And if you sign up using my affiliate link, you'll get a $20 Amazon Gift Card. #KnowYourMoney And Happy Investing! -Tyler

2 Comments

I'll get straight to it. This post has nothing to do with real estate. But, it's #FinanceFriday and I want to spread the knowledge I wish I had in 2014. Over the last four years of my life, I spent over $31,000 and learned a ton when it comes to understanding the HUGEEEEE difference between a performing asset and a depreciating one. In March of 2014, I was sitting on top of the world. I remember driving across the Richmond Bridge on a clear afternoon, stereo blasting, sunroof open, and a 300 horsepower engine purring beneath me. I just bought a BMW 335i 2-door coupe. It was glorious. It was fast. It was sexy. And wow, it was A HUGE step up from my 1995 Toyota Camry (in hindsight, damn I miss that car). Little did I know, I just made the worst financial decision of my life. Let's break it down.

TOTAL: $31,604.58 Clearly, I poured a ton of money into this car. All while only driving 12,000 over those 4 years (avg 3,000 per year). So basically, I traded a downpayment on a house (remember, I invest in the Midwest) for a car I barely used. Fast forward to March of 2018. I officially paid off my car (YAY for no car payments!!!). And then I sold it IMMEDIATELY. For $7,000.... Breaking down the simple math: Car acquisition and expenses: $31,604.58 Sold For: $7,000 Net Loss: $24,604.58 THAT. IS. PAINFUL. TO. LOOK. AT. Especially when I already had a paid off 1995 Toyota Camry I bought for $3,500. Now, I get it. Some people actually need a car whether it's for their work commute, to load up on groceries, or to drive the kids down to soccer practice, etc. but, I'm still going to beg you to listen to me: If you require a car, buy something affordable that's within your needs. Most importantly, pay for it in cash and don't pay that damn interest. Toss ego aside. Don't think about how people will perceive you with a "less sexy," but more affordable/economical/functional car. If you want to improve your financial outlook and future, these are the types of decisions you'll have to make. It's all for the long-term. So, if you're looking for a car, or you're reading this post with a nice Mercedes in the driveway, it's time to evaluate your situation. Here are some amazing tips (from the help of Mr. Money Mustache) that'll help you find and be efficient with your next car: 1. Don't borrow money to buy a car According to Mr. Money Mustache, around 73% of new cars in the US are financed. YIKES. Here's the problem with that: after years of owning the car, it's very likely it'll be worth less than you owe due to depreciation. That's clearly the definition of a terrible financial situation to be in. Also, who likes paying interest? No one. Who likes paying a monthly bill that cuts into your cash flow? No one. Be smart and pick up a car in cash for $3k-$6k that'll last you years and allow you to have a higher savings rate. 2. Buy a car that suits your needs the MOST Your car should be optimized to fit YOUR NEEDS, while burning the minimal amount of gas. If 90% of your drives include you and one passenger...there's NO NEED for a 7-seater SUV. If you live in the middle of an urban city, don't even think about getting that full-sized pickup truck. 3. Cars aren't for that quick 1/2 mile trip to the store Every time you start up your car, put it in drive, and head to the store 2 minutes down the road, you're really helping out depreciation. Depreciation REALLY loves every time you press that gas pedal. Next time, consider walking, or hopping on your bike for those quick trips. Everything counts! 4. You don't look ridiculous driving that small car, but you do look ridiculous paying for that oversized car every month. Screw your insecurities, say "bye bye" to your concerns about style. Here's a great quote from MMM, "Your job is to pick the (car) that enhances your life the most, and unless you are already financially independent, you'll get a lot more enhancement from getting some cash in your 'stash than you will from having 20" wheels and three rows of leather seating." 5. Cars cost you money PER MILE Because a lot of people aren't thinking long-term, folks assume that since their car is just sitting in the driveway, they should be used with reckless abandon. WRONG! Bottom line: the more you drive, the more you're burning gas, oil, tires, the engine, and YOUR CASH! Become aware of your car use, and minimize it! Best used cars under $10,000 according to US News and World Report 1. 2010 Toyota Prius 2. 2009 Honda Fit 3. 2011 Honda Civic 4. 2013 Honda Fit 5. 2012 Honda Civic 6. 2012 Honda Fit 7. 2011 Toyota Prius 8. 2012 Scion xB 9. 2009 Scion tC 10. 2009 Scion xB 11. 2009 Toyota Prius I'm beginning to see a theme... With that, I'll leave you a few articles from Mr. Money Mustache about cars that are sure to leave you with some value and entertainment. Leave a comment below! What's been your WORST financial decision EVER? How to Come Out Way Ahead When Buying a Used Car Curing Your Clown Like Car Habit New Cars and Auto Financing: Stupid or Sensible? Peace and happy investing! -Tyler Whether you're looking for your first property, your next property, or just trying to accelerate your voyage to financial freedom, you're going to need some cash. Here's where a good Side Hustle comes into play. We're in the age of the Side Hustle. Or the Gig Economy. Our generation is finding more and more ways to bring in revenue. We're diversifying our revenue streams. I love it! So, what exactly is "side hustle?" It's a way to make some extra money, outside of a full-time job, that either allows you flexibility to pursue a passion, or it could even BE your true passion. Take a look at these great side hustles that will accelerate your income and help you purchase your next property: Instacart My primary side hustle in 2016. Basically, I was a personal grocery shopper...I'd drive to stores, pick up specific items, check out, and deliver them. A couple times a week, I'd leave my office job for the day around 5:30pm and work from 6pm to 8pm. No, I didn't get rich off of Instacart, but an extra 40 bucks here, and an extra 50 bucks there definitely helped. Check it out and SIGN UP HERE. Lime Scooter Juicer Ever see those electric scooters zooming around town? They are EVERYWHERE in Oakland (where I live). Well, someone has to charge them at night. And that someone is ME. I'm a Lime Scooter Juicer! Yup, after work on my way home, I pick up a couple scooters here, and a couple there...bring them back to my place, plug them in, let them charge overnight, and drop them back off on the sidewalk in the morning. I get paid on a per-scooter basis and am pulling in $8 minimum per scooter. So, the 4 scooters I charged last night brought me $32 this morning...all for about an hour worth of work. I plan to make $500+ a month on this side hustle....and this money is going straight toward my next investment. To become a Lime Scooter Juicer, DOWNLOAD THE APP HERE and get $3 credit from me! I'd recommend trying a scooter at least once before signing up to become a Lime Scooter Juicer to increase your chances of getting the job. Rover My girlfriend's primary side hustle. She loves dogs, so naturally, taking care of them, walking them, and getting paid for it is a natural fit. She's built numerous relationships with local dog owners too, so you could (if you want) skip the middle man (Rover) after you build your network and keep 100% of the revenue. Shopkick This is a shopping rewards app, so I wouldn't technically count it as a side hustle. But, it's a vehicle to bring in extra cash. How does it work? Earn points by walking into specific stores (it uses GPS technology), and scanning certain items. You can then redeem these points for rewards such as Amazon, Walmart, and Target gift cards. Here's how I use the app: if I head out for a little lunch break at work, I'll stop by a store and scan a couple items. That way I'm making some extra cash on my lunch break! DOWNLOAD THE APP HERE. Uber/Lyft (Ridesharing) I can't personally speak on life as a rideshare driver, since I've never been one, but the thought of it has ALWAYS been intriguing. Partially because I feel like I'd get a chance to meet such a wide variety of people. Life's all about connections. And you'd be paid for it! My thought though: make sure you have a fuel efficient car. *UPDATE* I actually signed up and am driving for Uber now! I'm experimenting with the whole "networking" opportunity of being stuck in a car with strangers. I'll let you know how it goes! Airbnb Also can't speak for using Airbnb as a side hustle, but if you have an extra room at your place...why not consider renting it out and making a little extra cash? Sign up to be a new HOST HERE. And if you just want to use Airbnb for your next trip, SIGN UP HERE for $40 OFF! Etsy Are you creative and can create a tangible product? Maybe it's time to start selling it online. Start your mini-business today! Craigslist Go through your closet, look under your bed, take a peek in the garage, and get rid of all the crap you haven't touched in a year. De-clutter your life! And add some digits to you bank account. Also - if you're at a garage sale, try to bargain down items that you can later flip for a higher price on Craigslist. Believe me, some people do this for a living. Taskrabbit Basically, people will post a job (such as...I need help constructing my Ikea table!) and you'll take on that task for a set price. Write Content and Start a Blog What questions do your friends always ask you? What skills or experience do you have that are unique? Answering these questions could be the foundation for a new online business. Take this blog for example: people still find it crazy that I buy real estate 2,000+ miles away from where I live. So, what'd I do about it? I started writing content, providing value, and building community. With consistant writing and an engaging audience, you can monetize your website through advertisements, affiliate links, ebooks, and online courses. This list of Side Hustles could go on forever... Bottom line: if you are struggling to save for a rental property, or want to accelerate your savings as I did, finding a side hustle can be critical in your investment career. So get yourself a side hustle! And check out this solid list of 99 side hustle ideas HERE! Do you have a unique side hustle? What is it? Leave a comment below! -Tyler |

Investing |

Jump In |