|

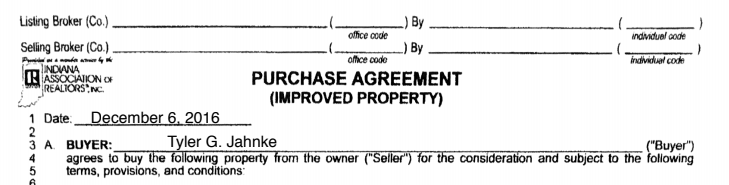

I have to show you something real quick... That's a Purchase Agreement from December of 2016, when I purchased My First Property. WOW...I can't believe it's officially been 2 YEARS since I started investing in Real Estate. And it's been a crazy roller-coaster ride so far, to say the least. Here's a quick recap: I bought My First Property from a turnkey company in December of 2016. Everything went "smooth" for 11 straight months, until an unexpected vacancy and unacceptable management derailed the investment. With $16,000 in repairs needed, I decided to sell it. I bought My Second Property in March of 2018. I bought My Third Property in July of 2018. Then I invested in an 80-unit multi family property just this past October. I've had my fair share of bumps and bruises along the way. Tons of challenges, frustrations, and second guessing. And I know there's plenty more of that to come. But, I'll continue to learn every step of the way. And now it's my job, to share my knowledge with YOU. Here are my TOP 8 TIPS after my first 2 years in Long-Distance Real Estate Investing: 1. Network, network, network "Your Network is Your Net Worth" I live by this and truly believe it. The people you keep closest to you, create such a profound influence. You've got to be conscious of that and surround yourself with the best and brightest. I've met some of my best friends through real estate and I couldn't imagine my life without them. So, use the best real estate networking tool out there, Biggerpockets, and connect with locals that are just as ambitious and driven as you. Set up local events and meetups to chat with novice and experienced investors, agents, contractors. Business and LIFE are all about relationships. 2. Master How to Analyze Property The basics of investing start with understanding How To Analyze Rental Property. You MUST know how to quickly filter through potential investment leads, determine all expenses, and projected rents. You need an understanding of flood planes, school districts, neighborhoods, taxes, and much more. If you're looking to acquire a property, I challenge you to start analyzing 1 property a week. Then 1 property a day. Repetition will get you to a point where analysis becomes clockwork, so when that great deal pops up, you can JUMP ON IT! 3. Location, location, location When I first started investing in real estate, I didn't realize the importance of location. I just saw the numbers on paper, and assumed if the numbers on paper worked out, the investment would work out. Well, I WAS WRONG. Having a great real estate investment requires so many factors...and location is a huge one. You must understand neighborhood crime levels (I use Trulia crime maps), school districts, neighborhood classes, and neighborhood amenities (is there a Starbucks nearby?). Understand what type of tenant lives in the neighborhood (check out Neighborhood Scout). After all, your tenant is the primary source of income. 4. Interview and Vet Multiple Property Managers I've experienced working with the wrong people. And it SUCKS. Don't be like me. My first property manager decided to just NOT tell me that one of my tenants left. I only found out when my friend drove by the property and spotted a lock box on the front door. Then, I ran into $16,000 in needed repairs as the property manager never checked up on the property throughout the year. But, I take full responsibility for hiring the wrong people. And I learned real quick how to never make that mistake again! The key is to interview multiple property managers and really truly vet them. Check out my post on How to Hire a Property Manager. And if you want to work with my property manager, contact him HERE. 5. Always get an inspection Ahhhh...I was so naive a couple years ago. When I bought My First Property I admittedly was a little too trusting. In buying the property all cash, I didn't need to get a property inspection from a 3rd party company. Unless you really understand construction, rehab, and can see the property in-person, I'd say: ALWAYS GET AN INSPECTION! An inspection can and WILL save you from unexpected issues that'll cost you $. Lots and lots of $$$. 6. Don't ignore issues on the inspection report Well, I learned early on about the consequences of not getting an inspection report. But, I guess you could say I didn't learn the whole lesson. I had a relatively major issue pop up on an inspection report once...standing water in the crawlspace. I had a mold guy go out there and check it out, but I never decided to get a foundation expert to assess it. I ended up brushing it off the whole thing and tried to push it out of my brain because emotionally I really wanted the property and the numbers looked AMAZING! I eventually bought the property. Now, it's biting me in the A$$. Bottom line: don't ignore big issues on the inspection report. Take care of them or walk away. 7. Visit your market and meet your team in person Some long-distance real estate investors might disagree with me here, because technically everything can be handled remotely. BUT, having flown to my market multiple times, I can say it's an invaluable experience. You'll have a HUGE advantage if you take the time to get your boots on the ground, meet connections face-to-face, drive through neighborhoods, and really understand the culture and direction of the city. Real Estate Investing is a relationship business and meeting your team IN PERSON strengthens those relationships. Sitting down with your agent and property manager for a nice lunch goes a long way. Trust needs to be built if you're going to invest from afar, so get out there and understand your team on more of a personal level! 8. Keep a Positive Attitude and Move Forward You're going to fall down. And you might even get kicked while you're down. But, that's not only real estate or business...it's life. Being able to get back up from every challenge, move on, and LEARN is crucial to your development. This is much easier said then done, but get it in your brain, so when your next pitfall comes up, you're ready to move forward and grow. Well, as a final conclusion here, I've got some last things to touch on: A LOT has happened in the last couple years. Literally, my life has changed. My mindset has changed. My understanding of investing has changed. By the way: -I'm nowhere near "Financially Independent." This is a LONG game. I'm 2 years in. Let's chat in 20. -I'm continuing to learn each and every day. Books, Podcasts, and Meetups. Never stop. I'm excited for the future. Reach out if you have any questions, I'm always happy to help in any way possible. -Tyler

2 Comments

In 2016 I purchased My First Property with the help of a turnkey company. They assisted in acquisition, renovation, and pushed me to work with their preferred property management company. Boy, was I stupid in blindly working with their property manager without vetting them. And YES, it ended up biting me in the ass! My property became unexpectedly vacant without any notice and there was a squatter in my garage. How do you guarantee no return on your investment? Own a vacant property that’s managed poorly. So, I got right to work in finding a NEW property manager. If you’re looking for a property manager, don’t take this process lightly. Here’s my step-by-step guide: A. Get Property Management Company Leads There are multiple ways to figure out who the best property managers in town are. Here are three resources to target your next property manager:

B. Scour their Websites To better vet your property management company leads, take a look at their website. Is it well maintained? Are they transparent with their fee structure? Is it easy for you AND tenants to contact them? Can tenants pay online? Is it a mom and pop shop? Or a massive national company? C. Interview your Top Leads Now, it’s time to give them a call or meet them in person! DO NOT SKIP THIS STEP! You must truly vet and interview each company. Your property manager essentially runs your real estate business day-to-day, so understand the importance, and make the right hire! Here are a number of questions that helped me select my new property manager: 1. What are the various services that you offer to your clients? Know exactly how this company plans to market, inspect, lease, manage, maintain, and maybe even sell your property. 2. How many rental units do you manage? Too few units and they could be inexperienced or losing clients. Too many, and you might get lost in the shuffle. I think 200-600 units is the sweet spot. 3. How do you determine rent amount? Rent = cash flow. Not sure much needs to be said here, but determining the appropriate rent amount is crucial to your investment. Your PM needs to be an expert in the rental market. 4. Are you currently an active real estate investor in your market? Is the property manager an investor who understands the mentality of a landlord? If so, that’s an added bonus in my book. And honestly, probably should be a requirement. 5. Under what conditions can I cancel my management contract? Understand exactly how you can get out of a contract if needed. 6. What are the management fees and/or pricing options when the property is being rented? Pretty self-explanatory. You MUST understand all costs and expenses when investing in real estate. 7. Are there fees when the property has no tenants? Some property management companies charge a monthly fee even if the place is VACANT. I only work with property managers that get their fee on COLLECTED RENT. 8. What miscellaneous fees could I be charged for the management of my property? Again, pretty self-explanatory. You MUST understand all costs and expenses when investing in real estate. 9. Do I have to sell my property with you if I want to list it? Some property managers will require you to sell your property with them. Be clear on this agreement before hiring them. 10. Do you offer direct deposit for your owners? This should be a 100% yes. 11. How do you collect rent from tenants? Understand how rent is collected. If your property manager isn’t having tenants pay online that will slow down the speed in which you get paid and makes it easier for tenants to miss payment. Also, from a tenant’s perspective, an easy way to make a rent payment is just a major benefit. 12. Do you conduct property inspections? And, if you do, what charge is associated with them? Routine inspections are key in owning rental property. You’ll want to catch issues before they spiral out of control. You should be saving some of your cash flow for repairs every month so it's encouraged you actually use some of it responsibly for long-term sustainability. Don't wait for your gutters to fall off before putting money into them...clean them once every 6 months! 13. Do you offer eviction warranty (also called a “screening guarantee”)? Some companies offer this warranty that will save you in an eviction process. But, needing this is completely up to what you’re comfortable with. 14. What steps do you take to market properties? Your property manager should be advertising through multiple channels. 15. How long are your properties typically vacant? 2-4 weeks should be the average time needed to get your property rented. Any longer and your rent may be too high or your property manager is not effectively marketing it. 16. What are your income and screening requirements for applicants? There should be a standard policy on tenant income requirements. 17. What control do I have over the tenant lease agreement? Your property manager should allow you some input in the lease agreement. A big one for me is regarding pets: I typically have a no pet policy. 18. Do you mark-up maintenance and repairs? Understand if your property management company makes a profit anytime maintenance is performed. This will factor into your overall return on investment. 19. How often will I get updates on my portfolio? You should be able to get updates on your portfolio as often as you want. After all, it is your property. PRINTABLE VERSION OF THESE QUESTIONS

D. Make a Decision and Hire Now that you’ve found property manager leads, vetted them, and interviewed them, it’s time to make a decision. Weigh their fees, experience, number of properties, customer service, and your gut. Who do you want to work with? And most importantly, who do you trust? BONUS TIP If you have multiple properties, hire multiple property managers to oversee portions of your portfolio. For example: I have two properties and two different property managers. This limits risk as you’re not relying on one PM to manage your whole portfolio. But, the greatest benefit is you can go through a little “test run” with each PM and see how they are different. This will help you determine the best PM for your long-term goals. Hopefully this helps you in selecting the best Property Manager out there! If you have any questions, leave a comment below, shoot me an email, or send me a tweet! Happy Investing! -Tyler |

|||||||

Investing |

Jump In |