|

After unexpectedly discovering My First Property as being vacant without ANY notice from my property manager, I put in motion a plan to turn around this investment ASAP. My immediate priorities were: 1. Formalize agreement to have new property manager take over My First Property - DONE 3/26/18 2. Re-key front door, side door, and secure garage - DONE 3/28/18 3. Assess repairs needed and prepare scope of work - DONE 3/28/18 4. Evaluate repairs, budget, and After Repair Value - DONE 3/28/18 5. Decide to rent (preferred) or sell My First Property - DONE As you can see...#5 is kind of a big deal. And judging by the title of this post, I think you know what I decided. I'm selling My First Property. But, before we dig into all of the details of that last statement, let's rewind a little. I had to be patient. And confident in my decisions. After interviewing multiple property management companies in Indianapolis, I officially terminated my previous company. The key here: I didn't fire my old company until I hired a new one. Like they say, don't quit your job until you have another one lined up. With a new property manager (PM) in place, we focused on securing the asset. Vacant properties can attract squatters, and sure enough, I'm pretty sure I had one in my garage. We re-keyed the front and side doors. Also, placed a new lock on the garage. My PM then assessed the whole property for repair and maintenance needs. I requested a FULL EVALUATION of the property. As in, I wanted to know everything and anything that could use some work, repairs, or renovation. For $299, this Scope of Work was a necessary step in evaluating next steps to get this property turned around. Here are some big ticket items summarized in the Scope of Work I received:

Take a look at the actual Scope of Work BELOW:

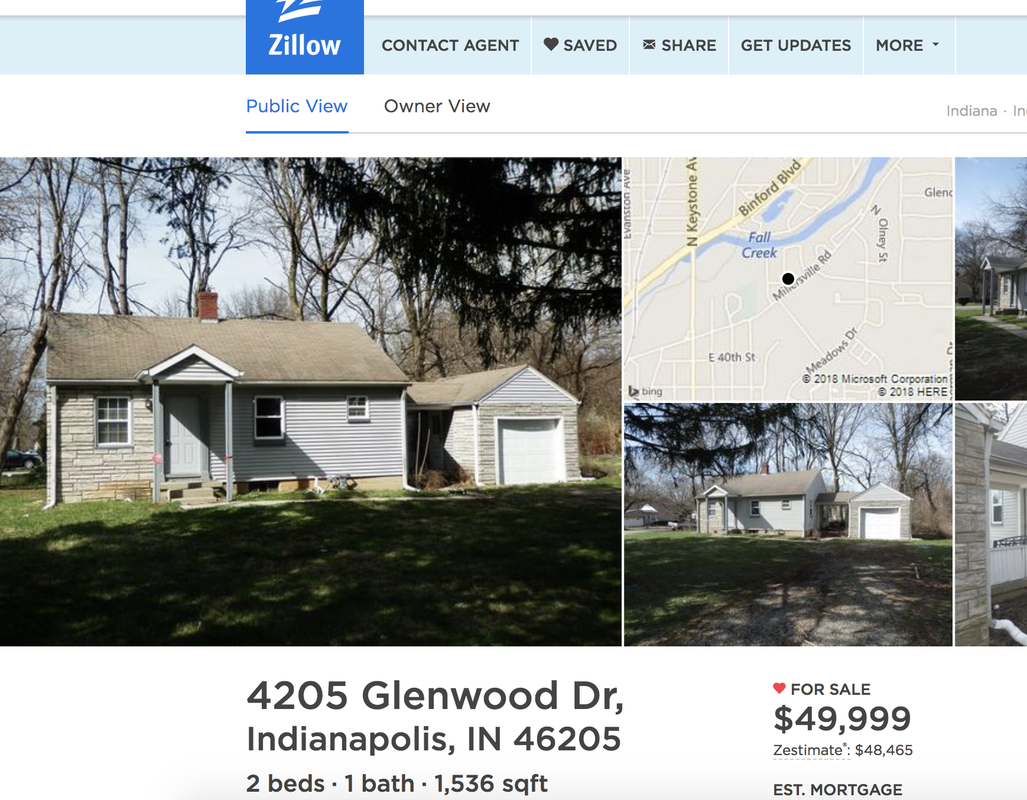

$16,741 for a complete renovation? WOW. Crazy. Insane. Again, this quote was for a COMPLETE renovation, but HOLY CR@P! I was not expecting this. With the assumption that My First Property could still be rented for $750/month, taking into account the money I'd invested, and the 11 months of rental income I saved, I determined my maximum renovation budget would be $7,000. What were my renovation priorities with that type of budget? Roof/Soffitt/Facia Repair: $2,200 Bedrooms: $800 New Bathroom: $2,139 Kitchen: $1,047 Dumpster labor/load: $612 TOTAL: $6,798 At the same time, I had to evaluate all options: 1. Renovate the place, rent it, and hold. 2. Renovate the place and sell it. 3. Sell it "as is" I already had my renovation budget, so working with my realtor, we determined After Repair Value (ARV) and current value. Now the toughest decision... Put more money into this investment, turn it around, and save it? Or take the past year an a half as a learning experience, cash out, and allocate my resources toward my next investment? Well, My First Property is now listed for sale. Why? Because I'm ready to take what I learned and apply it for the future. I made mistakes, but am better prepared now than I ever have been. What was the biggest downfall here? Working with a bad property management company. They were non-communicative. Never checked up on the property. And were not a good partner to work with. I did not vet, interview, or truly know the operation they were running before blindly deciding to work with them. I will never make that mistake again. Can this property still cash flow? Of course! Is it a good investment for someone? Yes, with great property management and a few thousand bucks in repairs. On paper, the numbers are still amazing. It's selling for under $50,000 and was renting for $750/month. Water heater, furnace, electrical panel, and PEX piping all replaced in January of 2017. The property across the street is valued at $90k+ and its neighbors are at $60k+. It's two blocks from a new YMCA, two blocks from three charter schools, and right down the street from a new grocery store. Check out the Zillow Listing HERE. Questions? Comments? Interest? Let me know! And feel free to email me at: [email protected] Happy Investing! -Tyler

0 Comments

Leave a Reply. |

|||||||

Investing |

Jump In |