|

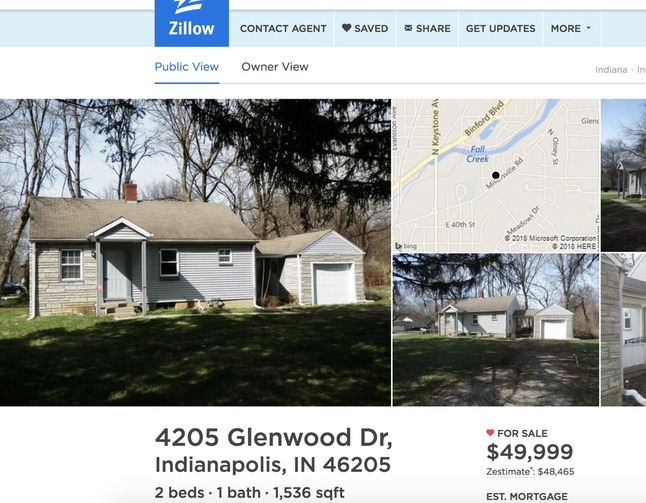

closed on My First Property. It was a day full of excitement, optimism, uncertainty, and progress. It was Chapter 1, Step 1, of my long-term financial plan. It was my first taste of "passive income." And it was the first puzzle piece to building a life full of travelling, family, friends, #vanlife, and personal projects. 512 days later...I've officially turned the page on this chapter in my real estate journey. I closed a deal last week and sold My First Property. The past 512 days were full of crazy ups, downs, surprises, and wins. I was immersed in the greatest real estate educational course I could have ever asked for. It was a million times better than sitting around reading blogs, articles, interviews, and not taking action. And a billion times better than any guru course I could have taken. It wasn't easy, but I'm forever grateful I took a leap and decided to Jump In. So, let's get to the recap now that things have settled: In October of 2016, I decided to work with a turnkey company. Their job was to assist me in all aspects of acquiring, renovating, renting, and managing rental property. After a couple weeks of receiving property leads, I put one under contract and closed on it in December of 2016. I paid for it in cash to protect myself against a monthly mortgage payment, to avoid paying interest, and to drastically improve my monthly cash flow. If the numbers all worked out, I would be getting a 13% annual return. What's not to like about that?? Things were looking good! Renovation started! But, then there were numerous delays. Communication was more than frustrating with my property management company. Red flag, after red flag kept popping up, but I didn't take the indicators serious enough. I was focused on getting the property rented, cash flowing, and bringing in "passive income" for a Financially Independent future. More renovation delays came. Little progress was made, but with my demands I finally was able to kick the contractors into gear. Finally, the rehab phase was over and a huge weight was lifted off my shoulders. Then, I flew out to Indianapolis for a quick weekend trip. Early on, I honestly didn't have plans to fly out to Indy. I really wasn't concerned about seeing the property first-hand, but I am now grateful I pulled the trigger on that move. Why? Because I met my property manager, contractor, and most importantly, I met connections FOR THE FUTURE. I left Indianapolis confident. My property was officially on the market for rent and by the end of March, four weeks later, I GOT A SIGNED LEASE! Even though the renovation and leasing of the property took weeks longer than expected, at the end of the day, I was happy with my vision actually coming to fruition. I purchased a property. I had it renovated. And I got a signed 12-month lease for $750/month. I was well on my way to building a large real estate portfolio. I received my first rental payment while vacationing with friends in Vietnam. I was ecstatic. This was the definition of "passive income," right? Getting income deposited into my bank account while ON VACATION? Wow. Things were smooth. Literally, not much happened for 11 straight months, except the routine rental payments deposited into my account. I did a 1 year recap, where I broke down all income and expenses, and the numbers looked great! Then. Everything. Fell. APART. I got a tip online from someone that my property was vacant. So, I sent a third party property management company out there to investigate. Sure enough, the only person living in my house, was a squatter in the garage. Frustrated? Hell yeah. But, I had to tackle this head on, take control, and move forward. I put together a plan. I secured the property by installing new locks. I evaluated the damage and repairs needed (which came out to $16,000!!!). Ultimately, after a detailed evaluation, I decided to SELL My First Property. I didn't feel it would be worth it to pour more money into this low-priced asset. I pessimistically foresaw years of capital expenses piling up. I saw flaky tenants living paycheck-to-paycheck and unable to keep up with rent. Yes, the numbers on paper looked great for these low-priced investments, but by growing my knowledge in real estate every day, I knew I had to focus on a better class of property. This is where the greatest gift of My First Property came in to play. It gave me the chance to re-evaluate my investing strategy and adjust for the better. I had to let this one go. With my property listed, it sat on the market for over three weeks. In Bay Area terms (which I'm familiar with), that was an eternity. Those 25 days were brutal. Absolutely terrible. I questioned my strategies, my intentions, and MY DREAMS. Offers came in here and there in the beginning, but none of the buyers were willing to negotiate up to an acceptable amount. Then things went quiet for awhile. Crickets. I even began to forget that I was actually selling a property. BOOM. Out of nowhere, I got another offer. It was like sitting on a lake and fishing for hours, then finally feeling a little tug on the line. I had to pull this one in. Back and forth, back and forth, the negotiations teetered from one side to the other. Eventually, we agreed on a price that allowed me to not just break even, but bring in a small return on investment. We closed within a few weeks as it was an all cash purchase, and now I'm focused on the next move: managing My Second Property and purchasing My Third Property. So, what did these past 512 crazy days amount to? I'll tell you - they amounted to the greatest chapter in my life. 1. Over the past 16 months, I got a 3% return on my investment, which is better than any savings account I could have parked my money in. That's a huge win in my book considering the challenges I ran into over the past few months. 2. I re-adjusted my investing strategy in Indianapolis. I now only target houses in the $75k-$100k range that rent for over 1% per month. Higher rents = a better class of tenant. 3. I purchased My Second Property, which is a much stronger investment than My First Property. I bought it for $86,000 and it's currently rented to a quality tenant for $995/month in a B class neighborhood. 4. I now completely understand the importance of having a top notch and trustworthy property management company. Having vetted multiple companies, I can now teach you how to hire one. 5. I met some of my best friends through putting myself out there and networking. We all connected online because of our similar mindsets and passion for real estate. Your net worth is your network. 6. I started this blog and truly believe I can bring amazing value to Jump In Nation. I talk to investors daily and love it. I publicly posted my phone number on this site...so seriously....you can call or text and I'll get back to you My life has transformed because I decided to Jump In to real estate. I wouldn't trade this adventure for anything. If you haven't already, read the complete story of acquiring, renovating, renting, and selling My First Property HERE. If you have any questions, leave them in the comments section below or shoot me a message. Seriously, love you all! -Tyler

5 Comments

Ake

5/18/2018 09:01:21 am

Congrats on your sale! Keep your jump on.

Reply

R.C.

3/27/2019 10:49:32 pm

This was a very inspiring post. I appreciate your insights on an investment that did turn out the way you had anticipated and how you handled the situation. I'm not a REI yet, just learning and soaking as much information as I can. Your story has the ingredients of my worst nightmare and a strong reason why I haven't stepped into REI. I'm glad it worked out for you at the end, happy investing!

Reply

4/7/2019 08:42:37 pm

Hey R.C.!

Reply

James Ketchum

7/4/2020 01:47:02 am

I knew I was going to get into real estate as long as I've had my own business

Reply

Leave a Reply. |

Investing |

Jump In |