|

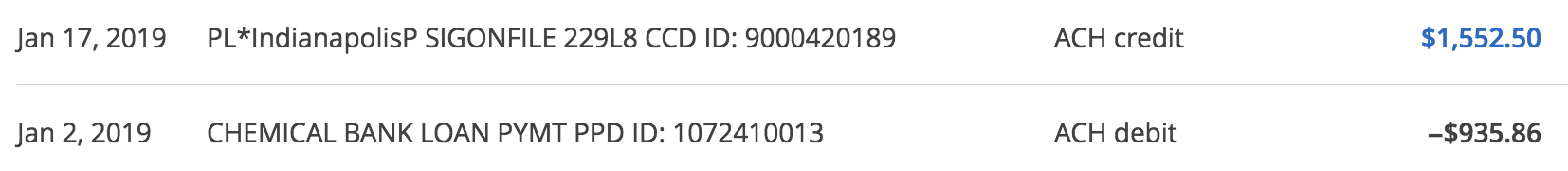

My new upper-unit tenant moved in on October 1st, 2018. Remember, the bottom unit was already occupied when I bought it and their lease runs through January of 2020 (they just renewed). Welpppp.....it took a few months to get a full month of cash flow on this property (I'll explain why it took so long, shortly). But first, let's admire the beauty of bringing in more money than you spend. In January 2019, I brought in $1,552.50 (after property management fees) and spent $935.86. I'll take that!!

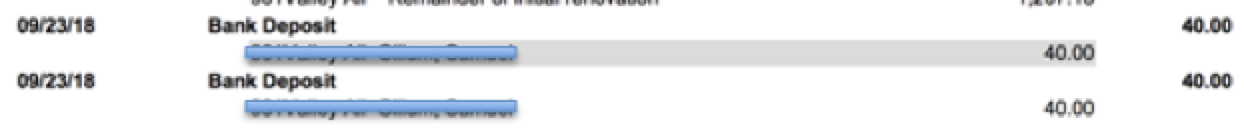

Here's the breakdown Rent: $1,725 MINUS Property Management: $172.50 Principal, Interest, Taxes, Insurance: $935.86 NET: $616.64 Now, why did it take 3 months to get a fully performing property? In October 2018, I had to pay my property manager a full month's rent ($875). This is part of our management agreement for any new lease. In November 2018, I had a couple last repairs to take care of after the new tenant moved in, which prevented a clean cash-flowing month. In December 2018, my LOWER unit tenant renewed their lease for another 12 months. I had to pay my property manager $299 for a renewed lease as part of the management agreement. FINALLY, this month in January, I had a clean and fully performing asset! Well, I'm not quite sure what else to say now. My Third Property has been quite the journey. I learned a lot through this process of acquiring, renovating, and renting a new asset type (duplex), and I'm ALREADY excited to share news about my next investment, MY FOURTH PROPERTY. To keep up to date on this property (and my full portfolio) check out my Month Rental Income Reports HERE! Takeaways

-Tyler

0 Comments

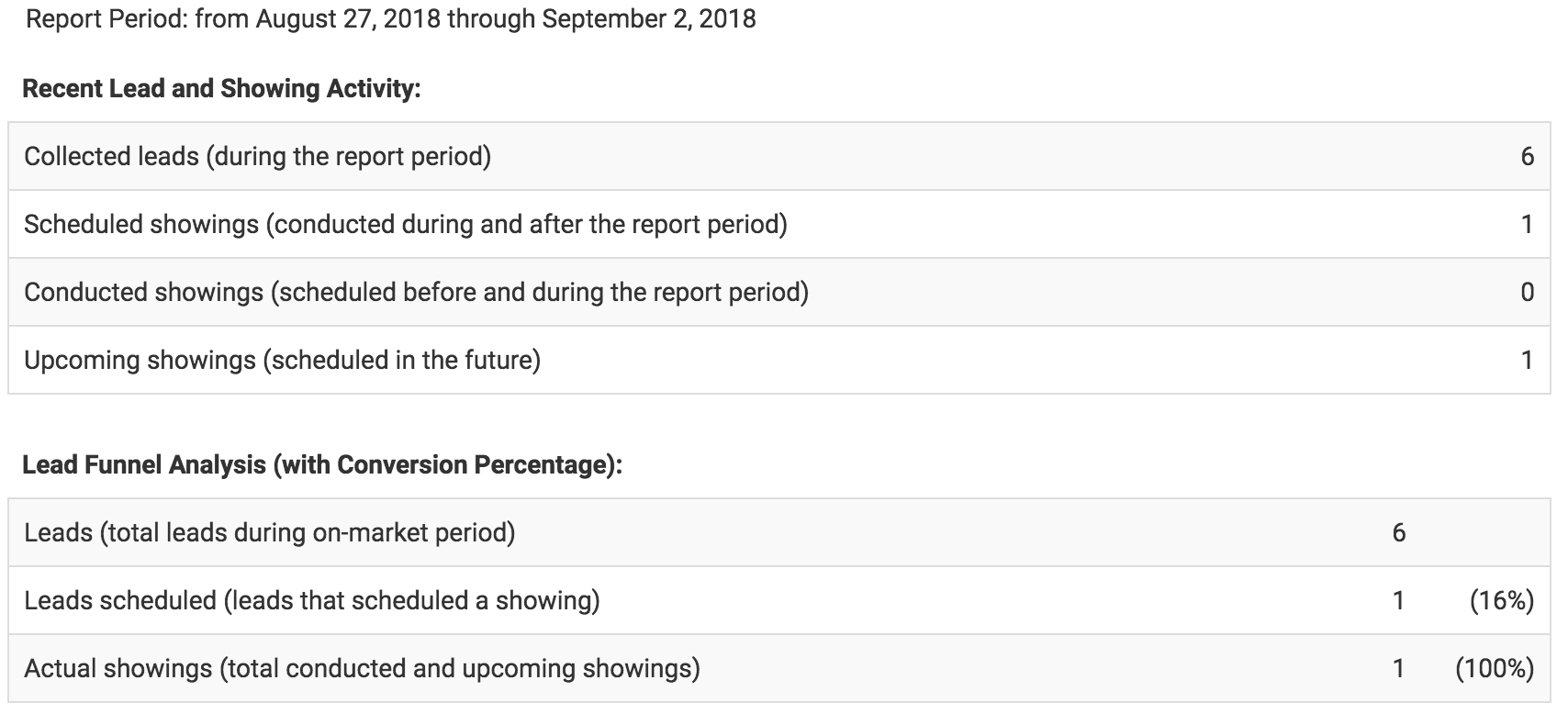

Tick. Tock. TiCk. tOcK. With my upper unit on the market, all I can do is WAIT for tenant leads to filter in and hopefully get someone properly qualified to sign a lease. Literally, there's nothing else you can do at this point except be patient, track leads coming in, and evaluate pricing if it takes too long to get a renter. Also, I took a trip out to Indy earlier this month to check out the property, meet with my team, scout neighborhoods, and experience the market first-hand. I've said this multiple times, but I HIGHLY recommend taking a trip out to your market. Understanding your market, the neighborhoods, and meeting your connections face-to-face is invaluable. Plus, you can write it off :) By buddy Nick (who is very interested in Indianapolis) flew out to Indy to hang with me and check out the city too. It was quite the adventure, man. We took separate flights on a Friday night (I came from the San Francisco, he came from LA), and landed in Indianapolis around 5:00am (Eastern time). Which means...it felt like 2:00am my time. FUN. TIMES. Here's a few pictures from our trip: But, back to the investment...the unit sat on the market for WEEKS, so we decided it was time to lower rent. When you're not getting any traction on your unit, it's a clear sign that rent is too high. So, I dropped the price from $900 to $875. And.....leads started picking up again. And guess what? We got a couple applications too! On September 28th.... FINALLY. I got some great news. Email from my property manager: "Tenant is approved and moving in next week. Have a great weekend." YES! Music to my ears! I've got an approved and signed 12-month lease at $875. Which is actually $25 more than I was expecting when running my initial numbers at $850. SCORE! OK, now it's time to call my utility companies, take my name off the account for now, and have my property manager instruct the new tenant to place utilities in their name. WOW. I made it through. Acquisition, renovation, marketing, tenant placement. It's not always a quick process, but you've got to push through and commit. Now, I have another cash-flowing property up and running. Let's get that passive income flowing! Takeaways

-Tyler Note from my property manager: "I spoke with the Vendor this morning and the work in the upstairs unit is complete. The cleaning crew was scheduled to clean the unit today..." SWEET! Awesome! Let's get this bad boy on the market and get it rented! Not so fast... "Unfortunately, we received a communication from the Tenant in unit 1 last night that they had a small amount of water coming through the ceiling in their unit. We sent a contractor to the home and it was found that the shut off valve for the hot water heater had developed a small leak. The issue was corrected and a dehumidifier was placed in the downstairs unit. At this point, we have determined this to be a result of draining and removing the hot water heater while installing the drip pan. The vendor performing the work in the upstairs unit will make the small drywall repair in the ceiling of unit 1 and paint as a part of their responsibility for the issue." I swear...I was literally JUST thinking about the downsides of having a multi-level duplex. I was thinking about how a kitchen, bathroom, or water heater leak could cause horrible damage to the downstairs unit. So, consider these risks if investing in a duplex (or any property) that has multiple levels. Don't let it scare you, just understand some of the risks. After this little hiccup, we get to work on determining the listing price for the unit. Given that the lower unit is currently renting for $850 per month, my initial thought is to try and get more for the upper unit. Why? -Upper units are generally more desirable, because the bottom unit hears more noise (ie: footsteps from the upper unit). -The upper unit also has a nice deck that faces out to a tree lined backyard -A comparable unit in a 4-plex down the street just got leased for $925 My property manager and I decide to put the unit on the market at $900. You've got to realize...it's about to be WINTER. The longer it takes to get this unit rented, the closer we'll get to the cold, snowy days of Indianapolis. Which makes it harder to find tenants. I need to avoid having a vacant unit in the Winter. You don't want that. NOPE! So, something really cool my property management company does, is they send weekly reports detailing leads that come in through online channels or over the phone, and the number of scheduled showings. This is awesome information to see as an owner. Well....my property is officially on the market! If you recall, I slightly over-priced My Second Property, and it sat on the market for a solid 6 weeks. I'm hoping I can avoid that with this property and get a renter into this unit ASAP before the harsh winter hits! Takeaways

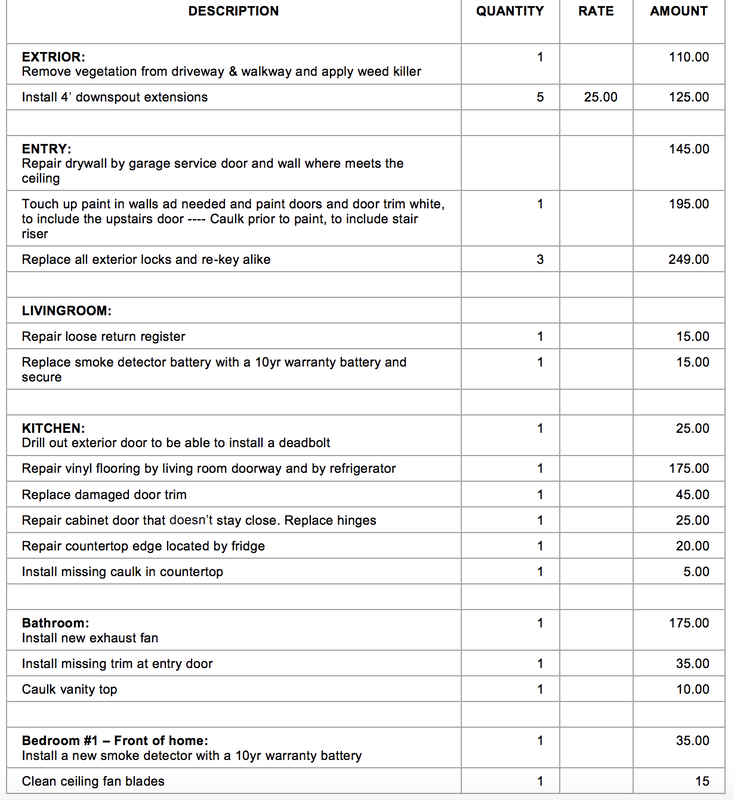

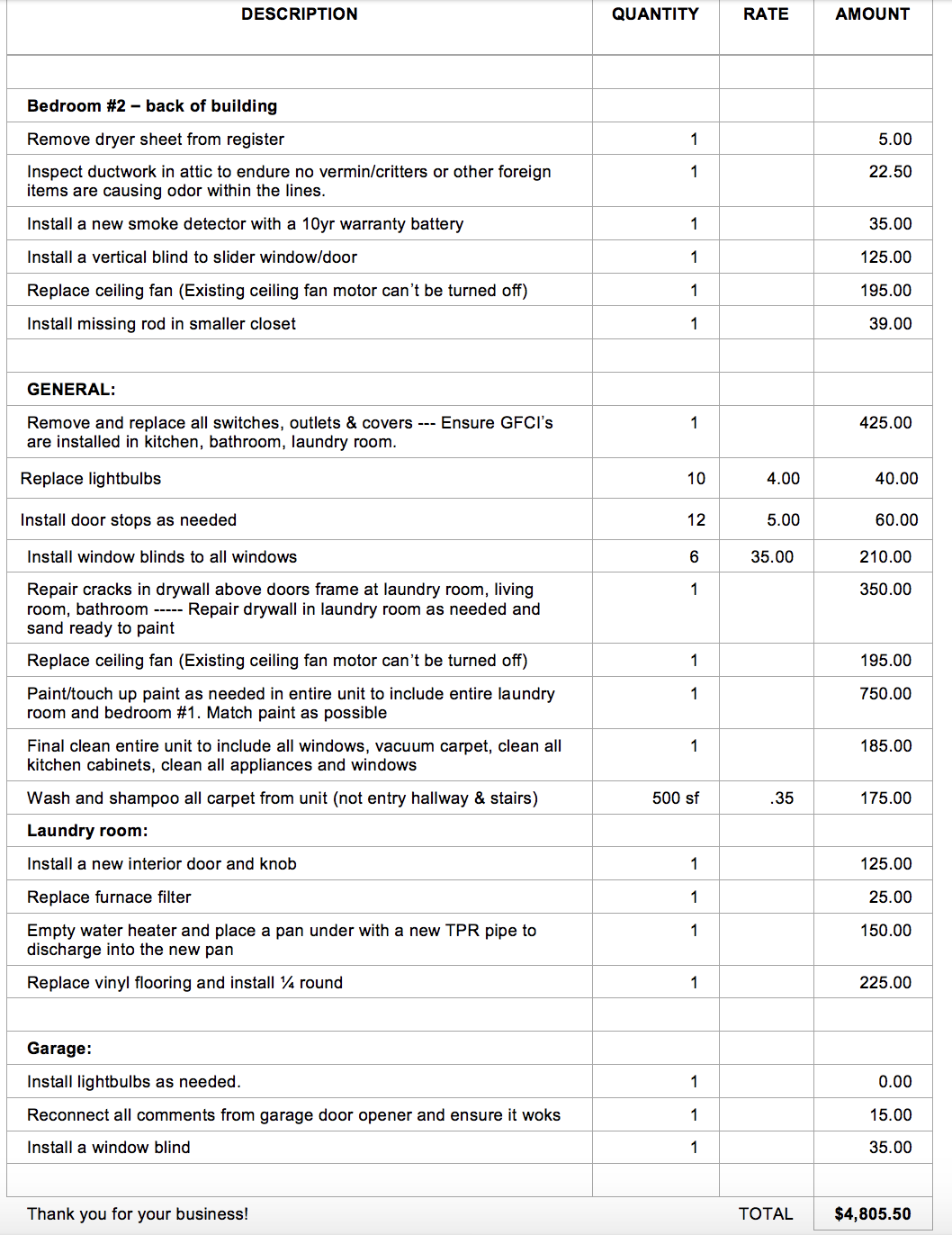

-Tyler CONTRACTORS....START YOUR RENOVATIONS! I closed on My Third Property on July 31, 2018. It was quite the birthday present. Literally. It always feels amazing to pick up a new property. There's always a sigh of relief, because the process of finding a suitable property, running the numbers, offering, negotiating, and locking it up is time consuming (at least being a 1-man show). It takes dedication, motivation, drive, and effort. But, in the grand scheme of things: the journey has just begun if you're dealing with a property needing repairs or renovations. I had a third-party property inspector take an in-depth look at the duplex prior to closing, so I was pretty aware of most of the needed repairs. I trusted the assessment, but now it's time to get my property manager in there to do a proper walk-through and prepare a scope of work. Because the lower unit is already occupied with a tenant, a majority of the work needed is for the vacant upper unit. Here's the repair estimate I received: THE TOTAL COMES TO: $4,805.50 A littleeeeeeee high in my opinion... The good news? Remember, I got $4,500 in credit back at closing for repairs...so that basically covers this. The bad news? This scope of work doesn't include any crawlspace repairs or electrical box repairs. So, that's a little scary. I'll have to spend more than expected to get this property into shape. Also, I noticed they double counted an item (replace ceiling fan - $195), which I'll call them out on. There are also a few items on there that seemed WAY too overpriced, but at the end of the day, I realize I have a naturally frugal mind which is what's causing the pain. I personally don't like to spend money and will always look for cheaper options. BUT, when it comes to investing out-of-state thousands of miles away, you have to realize you're outsourcing and paying for jobs to be taken care of for you. These are jobs that don't require any of your time or effort and there's amazing value in that. It's not the end of the world to pay for repairs that are needed and have someone else take care of everything from start to finish. I approve the Scope of Work and my property manager (PM) gets things started with my contractor. Work is scheduled to start on 8/21 and be completed by 8/27. We're hoping to get the upper unit on the market starting 8/29. IMPORTANT NOTE REGARDING PAYMENT: my PM initially requested full payment for the contractor, but I was adamant about not paying it all up front. We've all heard the horror stories of people getting burned by contractors and running away with money. We agree that I'll pay 50% now (which is still a little high) and 50% upon completion. Don't be afraid to ask for what you're comfortable with. So, protect yourself (especially if you're investing from a distance) and DON'T pay for everything up front. Give them incentive to finish the job properly and on time! Oh yeah coincidentally, I also book a flight out to Indy (it happened to be the optimal time for me to get out there). I hope to see the finished unit if it's still not rented by the time I arrive in September. Takeaways

-Tyler |

Browse Topics

All

|

Investing |

Jump In |