|

I have a property under contract for an acquisition price that spits out good returns. I've performed my due diligence and had my inspector, real estate agent, and insurance agent out there as soon as possible. A few red flags definitely popped up. So, I need to evaluate the cost for all repairs and determine what my inspection response will be. Do I let this property go? Do I ask for a credit at closing? Do I ask them to reduce the sale price? I send my agent this email after evaluating everything: I've run my numbers and I'm asking for either a credit at closing or reduction of sale price by $5,410. This is due to: -Crawlspace mold and standing water. Needs remediation and new vapor barrier. Source of standing water still unknown. Needs further evaluation and could be grading or foundation issues. -8' x 8' puddle at crawlspace access point. Access point may be source of crawlspace moisture, but not positive. Needs to be repaired and secured. -Both breaker boxes: excessive rust and needs to be evaluated by electrician. Will need to replace both boxes. -Unit 2 Disposal un-operational -Both bathroom fans un-operational -There's a hole in the wood siding that needs repair -Garage door motors: non-operational or non-existent -Smoke detectors non-operational -Missing outlet covers on multiple outlets -Driveway needs maintenance Thanks, Tyler At the end of the day, I want this property. A credit at closing or a reduction in purchase price are both options I'd accept. I personally ran my numbers, got one quote for the crawlspace moisture issue, and came up with wanting $5,410. This isn't an exact number by any means, I honestly could use more/will need more, but I didn't want to rock the boat too hard. Even with those repairs and costs, this should still be a great long-term investment. The response back from the seller? He offered $4,500 credit at closing and agreed to repair the garbage disposal. I accept. And schedule closing for July 31st. My birthday! It's not time to relax now. I've got a deal locked up, performed due diligence, solidified the repair details, and I check in with my property manager. I shoot my PM a note (ALWAYS over communicate and don't make assumptions): -With closing on the last day of July, rent for the occupied lower unit is due the next day (August 1st). Confirming you'll be able to collect? -I have a list of repairs needed with varying degrees of priority. What's the best way to coordinate work and get a quote from you? -Please market the upper unit as soon as possible to fill the vacancy He confirms, we map out a transition plan, and proceed to closing! BOOM! My Third Property. Takeaways

-Tyler

0 Comments

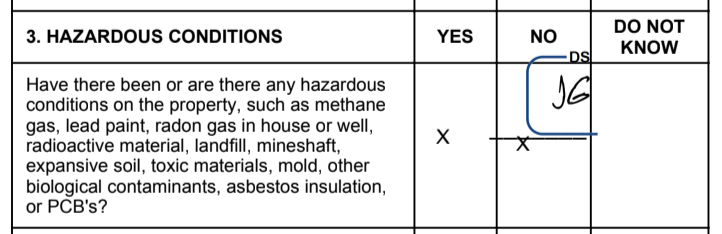

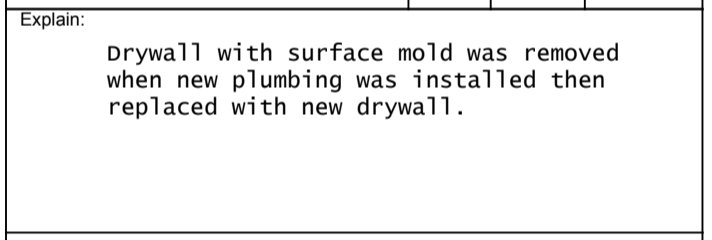

I got LEAD #4 on my mind... AND I WANT IT! Why? It's a duplex listed at $165,000 and should rent for about $850 per unit (so $1,700 total). Each unit is a 2 bedroom/1 bathroom, each unit is right around 1,000 square feet, and each unit has an attached garage space. It's in a good neighborhood with great schools and little crime. Obviously, STEP 1 is to run the numbers and dive deep into the ANALYSIS. And the numbers check out! I test different acquisition prices, see what type of return I want, understand what my MAX price would be, and email my agent immediately: "Please submit an offer for $155,000." Thank you, Tyler Within a couple hours, I got the disclosures. And...a little red flag popped up: I'm not down with HAZARDOUS CONDITIONS, but the explanation was sufficient for me and it's something I can check on during the inspection window if I get the property under contract. So, I officially sign the Docusign documents to submit an offer. WOW! Now....it's the waiting game... Ahhhh, the anticipation can be crippling. What will their response be? Accept, counter, reject? I keep trying to train myself to take emotion out of investing, but it's difficult. I think the only thing that will help is repetition. Side Note: at this point, I send my lender a quick note and let them know that I offered on a property. Over communication is just a good general life tip. Within 24 hours a counter offer comes back: OK. OK. We're getting somewhere. A counter at $161,000 isn't bad. I knocked the list price down by $4,000 within a day. But, running my numbers again, I know $161,000 is still a little too much. I'm not comfortable with the ROI at that acquisition price. *In the meantime* I alerted my insurance agent that I had a property on the hook and that I needed a real quote as soon as possible. He's amazing, and drove out to the property right away to survey it and send me photos. Seriously, if you need an insurance agent, email me and I'll introduce you to him. So, back to the negotiation...I counter back at $158,000. At this point I know we must be VERY CLOSE to getting this deal locked up. I needed to keep the acquisition price under $160,000 and I felt this was a very strong offer. Anddddddd...... The seller accepted! WOop WOOp! WOOP! Another property under contract! OK, no time to really celebrate. It's time to get to work on due diligence. Remember, always have an inspection contingency in your contracts and take full advantage of it. Takeaways

-Tyler Well, remember how I started last post by talking about FOCUS? Follow One Course Until Success My business partner is a smart man and really decided to follow that mantra. And I admire him for that. Because I need to improve my focus. I've got the classic "shiny object" syndrome that plague the entrepreneur type. So, after we lost out on three deals together (Partnership Leads #1, #2, and #3), my business partner decided to bow out of working together (just for the time being)... BECAUSE He just closed on a duplex in Forth Worth, Texas. Like I said, he's a smart man, and he now must shift his focus on getting this new duplex in Texas turned around, renovated, stabilized, and rented. Which, pretty much leaves me back at square one. Sitting here with some cash, but no deal. But guess what? Out of nowhere...sorta... Something caught my eye. What is it??? A duplex. How'd I find it? I didn't. My business partner found it while looking at sold and listed comps for Partnership Lead #3. Introducing... LEAD #4 This duplex is listed at $165,000 and should rent for about $850 per unit (so $1,700 total). Each unit is a 2 bedroom/1 bathroom, each unit is right around 1,000 square feet, and each unit has an attached garage space. It's in a good neighborhood with great schools and little crime. FIRST IMPRESSIONS OF LEAD #4: HECK NO! I don't want this thing. The marketing photos make it look great, but on Google Street View it's on an odd block. There's an old couch just sitting on the sidewalk, it's at the end of cul-de-sac and surrounded by shabby looking multi-family units. BUT, there's still a lot going for it too. Rents are pretty high, it beats the 1% rule, and it's in a safe neighborhood with GREAT schools. It definitely warrants further research. So, I get to work on my analysis. The more and more I uncover, the more and more I like the property: -It was recently renovated -There's a tenant in the bottom unit on a 12-month lease paying $850 a month. This is great to know because now I can really see what market value for the top would be when projecting rental income. -It's part of an HOA (which I'm not a fan of), but it's only $30 a month and it covers lawn care and maintenance on common property -It's surrounded by two amazing parks with running/bike paths -Even at asking price ($165,000) it beats the 1% rule ($1,700 per month in rent is >1% of purchase price) -I love the appeal of getting a small-multi unit property instead of a single family. This will help scale my portfolio faster than expected. I like this place a lot. A LOT. AAAAAA LOOOOOTTTTTT. You know what that means...time to be aggressive and go after it! Takeaways

-Tyler |

Browse Topics

All

|

Investing |

Jump In |