|

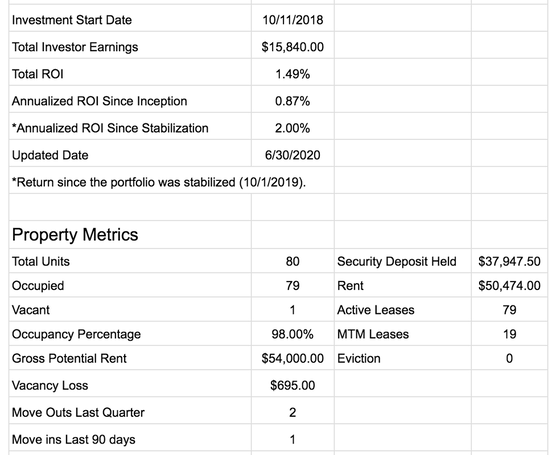

September 2020 represented the 6-month mark since our country and world really started to see the massive economic effects of COVID-19. It's definitely been a wild rollercoaster ride for myself, my career, my portfolio, my opportunties, and my future. Luckily for myself, I've trained my brain and instilled the mentality that "every challenge brings a learning moment" and that's really proven beneficial during these times. So, onto the actual portfolio update! On the personal property side of things, I had a lease end at the end of September so I'm in the middle of sprucing up the unit for rent and trying to fill a vacancy as soon as possible. On the larger deals that I'm a partner/investor in, rent collections have definitely been down through COVID, but for my properties in Arizona, we're very well positioned to push through this unknown COVID environment. Unfortunately, there still aren't a ton of positives on the property that I'm a Limited Partner in on My Fourth Property (the 80-Unit in Louisville). Let's get into the details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO SEPTEMBER INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart up your education on the processes, procedures, and strategies, I'm writing an ebook that'll cover many of your questions. Check it out here: https://www.jumpinrealestate.com/jumpstart.html My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. After a very smooth year for the first 8 months, I ran into a vacancy on this property and due to some turnover costs and repairs, this property was negative cash flow for the month of September. I had to cover utilities while it was vacant and take care of: -repairing light fixtures -unclogging bathroom sink -lock changes -general cleaning Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Turnover Repairs and Utilities: $558.24 TOTAL: $1,287.03 Income ($995) - Expenses ($1,287.03) = $292.03 Cash Flow from My Second Property: -$292.03 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is occupied and the upper unit will be vacant starting October 1st. Like I mentioned in the intro, I had a lease end at the end of September that was not renewed. So, with that I'm going through a "turn" and I need to get this unit occupied as soon as possible. But, as far as the month of September, it was a pretty smooth 30 days with no random repairs or expenses. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,247.74 Income ($1,750) - Expenses ($1,247.74) = -$502.26 Cash Flow from My Third Property: $502.26 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as I'm a Limited Partner and amazingly, we were paid out a distribution (albeit small) last December for Q4 of 2019 for the first time! Occupancy is staying steady at close to 100% for now. There's excellent occupancy, but collections have been struggling as the resident base is largely service workers who have been hit the hardest. Unfortunately, income was below the budgeted amount which is largely due to a decrease in collections. The expenses were above the budgeted amount and the biggest variance is related to a big flooring repair that had to be taken care of. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.49% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Our first distribution came Q2 of 2020. It's been great to watch this investment move forward the past few months and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. Gross income was up, expenses were down, and Net Operating Income was up! 58 units have been renovated with another 5 being worked on right now. Here are a few photos of our new leasing office where we're expanding and adding a gym. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property is still in the beginning stages of it's transformation. All roofs were replaced, work on the exterior is taking place, and the pool is being renovated. Here's a comparison photos of our old vs. new exterior paint! We went with a more modern and sleek look by getting away from the sandy color of Phoenix. Overall, it was an up and down month with My Second Property getting a vacancy filled, but some repairs came with that. My Third property had a smooth September, but has an impending vacancy.

My larger properties were also somewhat of a mixed bag, with issues on the Louisville property, but great progress on the Arizona properties. But, this is real estate. This is what I signed up for. The ups and downs are what come with taking investment risks. It's all about moving forward and thinking long term! Happy Investing all! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler

0 Comments

|

Updates

All

|

Investing |

Jump In |