|

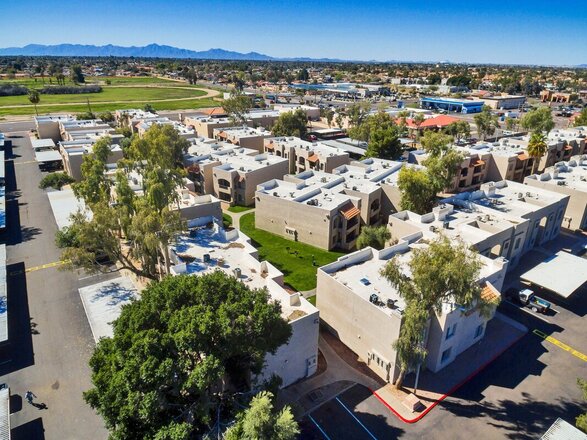

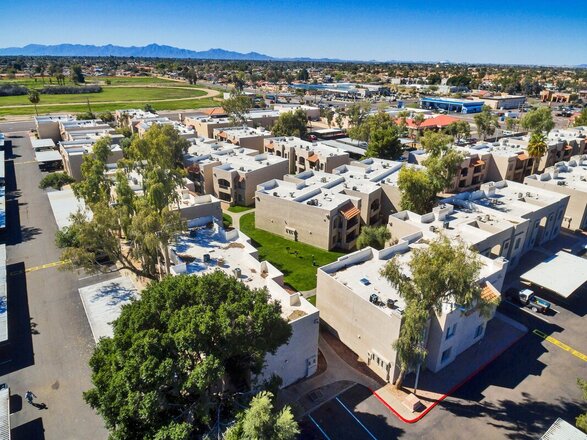

It's been a while my friends...I have to admit I've been slacking on updating this blog routinely. Maybe you've noticed. I really have been prioritizing life outside of work and real estate and that's shown with my lack of updates here. BUT, I just got reinvigorated to keep grinding and writing as much as I can. Soooo, here you have it. My latest portfolio update. I had a number of exits from larger multifamily properties last year, my Indiana portfolio is still providing cash flow, and my partners and I are in the middle of a major rehab project (12 vacant units) in Sacramento where we are close to starting the lease-up process. Let's dive into it! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO AUGUST INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart your education on the processes, procedures, and strategies, check out my ebook below My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana for $86,000. It's a 2 Bed/1 Bath in a "B" Class neighborhood. I took care of a cash-out refinance last year when it was appraised for $154,000 and pulled most of my initial capital out. Even though cash flow isn't that great, my ROI is amazing! This property really is the definition of "stability" as there rarely are any issues. My tenant is amazing, she cares for the property, and always pays on time. I raised rents slightly by 3% to $1,025 per month. BUT, my property taxes also increased significantly, dropping my cash flow...which isn't fun. I can't complain though because this property was appraised for $154,000 and I purchased it for $86,000. I did a cash-out refinance last year and pulled most of my initial capital out, so my ROI is very high. Income Gross Rents: $1,025 TOTAL: $1,025 Expenses Mortgage: $400.18 Property Taxes: $323.32 Insurance: $52.50 Property Management: $92.25 Repairs and Maintenance: $0 TOTAL: $868.25 Income ($1,025) - Expenses ($868.25) = $156.75 Cash Flow from My Second Property: $156.75 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana for $158,000. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. I also took care of a cash-out refinance on this property and pulled some of my initial capital out of the deal. I was so happy last year when this property appraised for $174,000 (bought for $158,000) and I took care of a cash-out refinance. Similar to my single family home, however, property taxes went up! Also not fun! But, due to market conditions I raised rent in Unit 1 by 5.4% to $925 from $875. Unit 2 has a lease expiring later this year and I anticipate raising rent to $925 as well...maybe a little higher as it's the upper unit and has a nice balcony in the back. Income Gross rent from Unit 1: $925 Gross rent from Unit 2: $875 TOTAL: $1,800 Expenses Mortgage: $690.24 Property Taxes: $246.86 Insurance: $65.22 Property Management fee: $180 Repairs: $0 TOTAL: $1,182.32 Income ($1,800) - Expenses ($1,182.32) = $617.68 Cash Flow from My Third Property: $617.68 My Fourth Property This was an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio back in 2018. Unfortunately, things didn't go as smooth as expected and Holdfolio did not hit their underwritten timelines or budgets, but it was a great learning experience. It was acquired for $2.25 million and we sold it for $3.88M in August of 2021. This was a completely passive investment for me as a Limited Partner and it officially sold in August of 2021. If you've been following me for awhile, you'll know this property had a lot of challenges. Unexpected expenses, low rent collections, and poor management plagued this passive investment run by Holdfolio. The best option was to sell and at least lock in a small return. I got about 5% return on my money in 2.5 years. Not the greatest...but again a very valuable learning experience! Total ROI on this investment (exited in 2021): 5.22% My Fifth Property This was a 164-unit apartment complex in Phoenix that I invested in passively with trusted partners. It was acquired for $19.75 million and had a $2.5 million renovation budget. It was sold in 2021. This property was officially sold and we exited this investment. I got a total of 50% return on my money in less than 2 years (22 months to be exact) and I couldn't be happier with the outcome. This was a deal I got into back in 2019 when I found amazing and experienced partners to work with. Finding the right people to work with isn't easy; it takes time, commitment, and TRUST. Develop those relationships NOW and align yourself with people that are more experienced than yourself! That's the biggest business and money hack :) Total ROI on this investment (exited in 2021): 50% My Sixth Property This was a 94-unit apartment complex in Phoenix that a group of partners and I purchased in November 2019. It was acquired for $10.3 million and our renovation budget was $3 million. We officially exited and sold this deal in August of 2021. As a member of the General Partner team, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. As far as the value-add went, all roofs were replaced, exterior painted, interiors completely renovated, and the pool was transformed. This was my first property as a General Partners and it was one of the biggest learning experiences I've ever been part of. We sold this property in August of 2021 and it was frankly a "home run" deal after everything was said and done. Our location choice, execution of the value-add strategy, and great market conditions allowed us to provide our investors with a 100% return on their money in less than 2 years. In addition to investing my own capital on this deal I also had additional equity as part of the General Partner team. Total Investor ROI on this deal (exited in 2021): 100% If you want to learn more about how you can invest in deals like this with me, check out my investing company Jump Investments by clicking the link below My Seventh Property This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on in October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents at acquisition were at ~$1,200 per unit (all 1 bed/1 baths) and after renovations we anticipate pushing them up significantly. This property is still in the middle of being repositioned, it was acquired fully occupied, and tenant turnover has been slower than expected. We're close to having 50% of the units renovated and rented at market rate. Our latest rehabbed unit was leased for $1,850 which is a $590 increase from it's original rate. If you are interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. My Eighth Property This is an 12-unit apartment complex in Sacramento, CA that a group of partners and I purchased and closed on in September 2021. It was acquired for $2,630,000 million and we're investing another $350,000 into it. It was purchased 100% vacant and in the great Midtown neighborhood of Sacramento where all the hip restaurants, bars, and coffee shops are. Super exited about this deal! Working through supply chain issues and labor issues, the renovation on all 12 units is nearing completion! We anticipate the 1 bedroom units renting for $1,925-$2,000 and the multi-level townhomes renting for $2,395. Once all 12 units have been completed we'll begin the lease-up phase immediately and get to work on the exterior! If you're interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. With a VERY BUSY 2021...2022 has been a lot more relaxed for me on the real estate front. As I mentioned at the beginning of this update, I've been prioritizing travel and quality time with family and friends while my real estate portfolio keeps chugging along. BUT, I definitely feel that it's time to get into another deal soon so my partners are on the lookout :)

Even with an uncertain economic outlook and market, I always say, JUST START and take action. Give real estate time, have a positive attitude, never stop networking, and you stand to do very well in this world. Best of luck everyone and reach out if you ever have any questions! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Take a look at the Youtube channel I started with my friend: REAL ESTATE INVESTING REAL TALK

0 Comments

Soooo...it's been 4 months since my last portfolio update and A LOT has happened since... After exiting one of my larger multifamily investments (Property #5) earlier this year, I exited two more multifamily investments (Properties #4 and #6). Then my partners and I closed on a new acquisition (Property #8) in Sacramento, CA. I also took care of two cash-out refinances on my personal portfolio (Properties #2 and #3). It's been a busy few months! More details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO SEPTEMBER INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart your education on the processes, procedures, and strategies, check out my ebook below My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana for $86,000. It's a 2 Bed/1 Bath in a "B" Class neighborhood. I recently took care of a cash-out refinance and pulled most of my initial capital out, so even though cash flow isn't life changing, my ROI is amazing! To me, this property is the definition of jumping in, taking action, and being patient! When I acquired this property in 2018, it wasn't a "home run" by any means. But, fast forward 3 years where it appraised for $156,000 and I just took care of a cash-out refinance. You'll notice my cash flow decreased about $40 a month, but I took out a majority of my initial cash, TAX FREE, from the deal which I'll use to reinvest. On the rental side, I had a very clean and smooth month with this property. No repairs or maintenance issues. Full cash flow received! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $400.18 Property Taxes: $212.32 Insurance: $44.50 Property Management: $89.55 Repairs and Maintenance: $0 TOTAL: $746.55 Income ($995) - Expenses ($746.55) = $290.21 Cash Flow from My Second Property: $248.45 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana for $158,000. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. I also took care of a cash-out refinance on this property and pulled some of my initial capital out of the deal. This property just appraised for $174,000 and I took care of a cash-out refinance. You'll notice my cash flow actually increased with my new lower interest rate and I got some of my cash out of the deal, TAX FREE, which I'll use to reinvest. I basically got paid to lower my monthly payments...BOOM! That's the power of real estate. This property has been running smooth for a few months and I'm super glad after it had a rough 2020. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $690.24 Property Taxes: $221 Insurance: $50.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,136.74 Income ($1,750) - Expenses ($1,136.74) = $613.26 Cash Flow from My Third Property: $613.26 My Fourth Property This was an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio back in 2018. Unfortunately, things didn't go as smooth as expected and Holdfolio did not hit their underwritten timelines or budgets, but it was a great learning experience. It was acquired for $2.25 million and we sold it for $3.88M in August of 2021. This was a completely passive investment for me as a Limited Partner and it officially sold in August of 2021. If you've been following me for awhile, you'll know this property had a lot of challenges. Unexpected expenses, low rent collections, and poor management plagued this passive investment run by Holdfolio. The best option was to sell and at least lock in a small return. I got about 5% return on my money in 2.5 years. Not the greatest...but again a very valuable learning experience! Total ROI on this investment (exited in 2021): 5.22% My Fifth Property This was a 164-unit apartment complex in Phoenix that I invested in passively with trusted partners. It was acquired for $19.75 million and had a $2.5 million renovation budget. It was sold in 2021. This property was officially sold and we exited this investment. I got a total of 50% return on my money in less than 2 years (22 months to be exact) and I couldn't be happier with the outcome. This was a deal I got into back in 2019 when I found amazing and experienced partners to work with. Finding the right people to work with isn't easy; it takes time, commitment, and TRUST. Develop those relationships NOW and align yourself with people that are more experienced than yourself! That's the biggest business and money hack :) Total ROI on this investment (exited in 2021): 50% My Sixth Property This was a 94-unit apartment complex in Phoenix that a group of partners and I purchased in November 2019. It was acquired for $10.3 million and our renovation budget was $3 million. We officially exited and sold this deal in August of 2021. As a member of the General Partner team, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. As far as the value-add went, all roofs were replaced, exterior painted, interiors completely renovated, and the pool was transformed. This was my first property as a General Partners and it was one of the biggest learning experiences I've ever been part of. We sold this property in August of 2021 and it was frankly a "home run" deal after everything was said and done. Our location choice, execution of the value-add strategy, and great market conditions allowed us to provide our investors with a 100% return on their money in less than 2 years. In addition to investing my own capital on this deal I also had additional equity as part of the General Partner team. Total Investor ROI on this deal (exited in 2021): 100% If you want to learn more about how you can invest in deals like this with me, check out my investing company Jump Investments by clicking the link below My Seventh Property Here it is! My first in-state (California) investment ever. What's cool is that I can literally drive from my home to visit this property in under an hour. This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on in October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents at acquisition were at ~$1,200 per unit (all 1 bed/1 baths) and after renovations we anticipate pushing them up to ~$2,100 per month. Value add baby! With this being my first in-state investment, I took the jump and decided to give this whole California investing thing a try. I'm working with some amazing local partners on this deal. No way I could pass it up! I also stopped by the property recently and if you take a look at the photos above, you'll see 3 blue doors representing the units that have been vacated and are being renovated. Value add! If you are interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. My Eighth Property BIG NEWS! This is my newest acquisition and it's my second California investment. This is an 12-unit apartment complex in Sacramento, CA that a group of partners and I purchased and closed on in September 2021. It was acquired for $2,630,000 million and we're investing another $350,000 into it. It's 100% vacant and in the great Midtown neighborhood of Sacramento where all the hip restaurants, bars, and coffee shops are. Super exited about this deal! This is a heavy value-add deal with the property being 100% vacant. Our plan calls for a complete renovation of all 12-units, then we get them rented, then we sell this asset off in about 18 months. We're projecting a 30%-45% return for our investors in less than 2 years. If you're interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. It's been a BUSY couple of months with 2 property exits, 2 cash-out-refinances, and a new acquisition in Sacramento! I couldn't be happier with how everything in my real estate portfolio is performing at the time being, and it's always fun to look back at how far this journey has taken me.

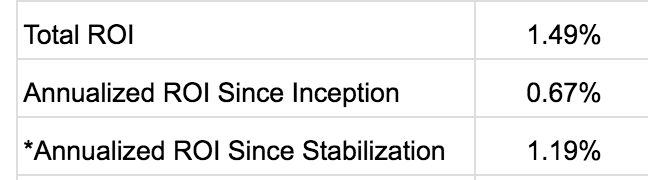

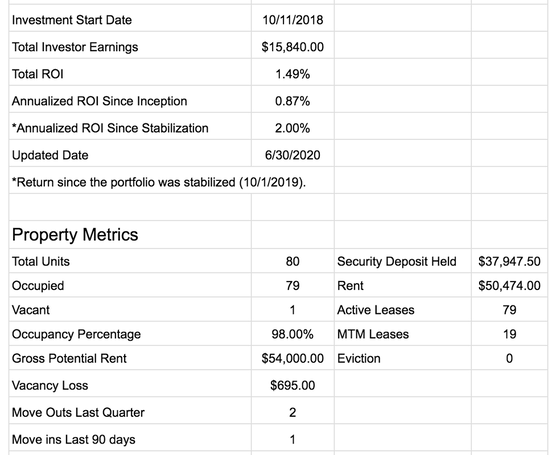

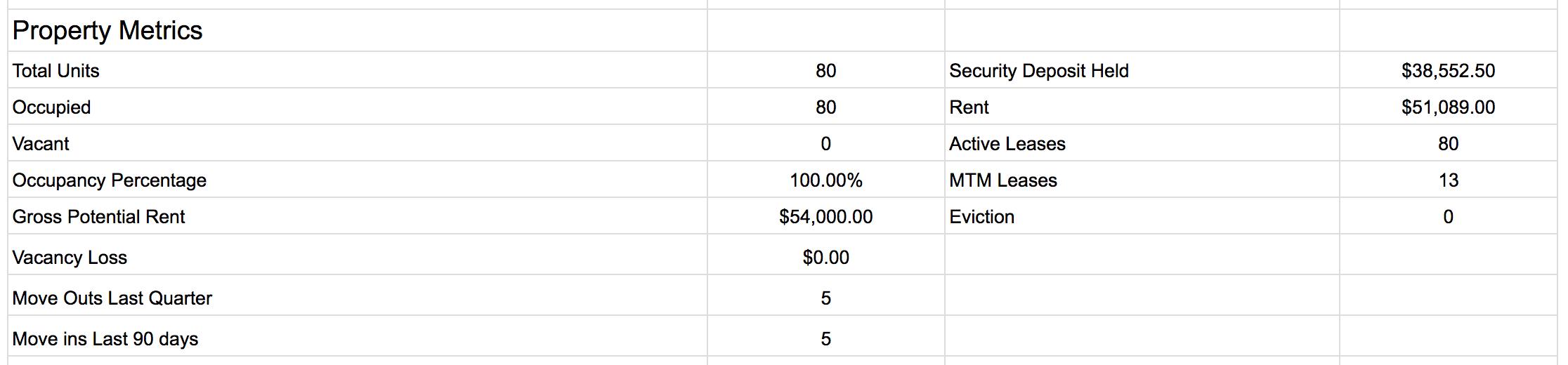

As I always say, JUST START, give real estate time, have a positive attitude, never stop networking, and you stand to do very well in this world. Best of luck everyone and reach out if you ever have any questions! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Take a look at the Youtube channel I started with my friend: REAL ESTATE INVESTING REAL TALK. May was an unexpectedly busy month of transactions...we officially exited one of my larger multifamily properties (Property #5) which locked in a nice 50% return on my money in less than 2 years. Another multifamily property (Property #4) is under contract to be sold and should close in July...fingers crossed! On the personal portfolio side of things (properties 1-3), all of my units are rented and occupied. I have an expiring lease in June, BUT it just got renewed! More details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO MAY INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart your education on the processes, procedures, and strategies, check out the new ebook I just launched. My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a newly renewed 12-month lease. I had a very clean and smooth month with this property. No repairs or maintenance issues. Full cash flow received! I had an expiring lease in June of 2021, but my tenant just renewed for another 12 months. Boom! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $358.42 Property Taxes: $212.32 Insurance: $44.50 Property Management: $89.55 Repairs and Maintenance: $0 TOTAL: $704.79 Income ($995) - Expenses ($704.79) = $290.21 Cash Flow from My Second Property: $290.21 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. Both units are on 24-month leases. This property has been running smooth for a couple of months and I'm super glad after it had a rough 2020. Honestly, I was a little shocked when BOTH of my tenants paid rent on the 1st of the month...they're usually a little late. Let's just say, it was a pleasant surprise. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $722.24 Property Taxes: $221 Insurance: $50.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,168.74 Income ($1,750) - Expenses ($1,168.74) = $581.26 Cash Flow from My Third Property: $581.26 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines or budgets. It was acquired for $2.25 million back in 2018 and we invested another $1 million into it as a group for renovations. This is a completely passive investment for me as a Limited Partner and I have some BIG NEWS. This property is under contract to be sold. If you've been following me for awhile, you'll know this has been a headache of a property. Unexpected expenses, low rent collections, and poor management have plagued this passive investment run by Holdfolio. The best option is to sell and at least lock in a small return...fortunately this property is under contract to be sold with closing scheduled for July. If all goes according to plan and we sell this property I should receive a 15% return on my money in 2.5 years. Not the greatest...but could be a lot worse! Below is the total ROI since my investment start date of October 2018: Total ROI since investing start date 10/11/18: 1.49% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively with trusted partners. It was acquired for $19.75 million and we're investing an additional $2.5 million into it. I got some more BIG NEWS...I've been keeping it a little "hush hush" the past couple of months, but this property was officially sold and we exited this investment. I got a total of 50% return on my money in less than 2 years (22 months to be exact) and I couldn't be happier with the outcome. This was a deal I was confident getting in back in 2019 because I found amazing and experienced partners to work with. Finding the right people to work with where you can trust them with your money isn't easy; it takes time and commitment. Develop those relationships and align yourself with people that are more experienced than yourself! That's the biggest business and money hack :) Total ROI on this investment (exited in 2021): 50% My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November 2019. It was acquired for $10.3 million and we're investing another $3 million into renovations. As a member of the General Partner team, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property has now been under my partners' and my control for about a year now and we're really starting to see the fruits of our labor. All roofs were replaced, exterior is done, and the pool is completely renovated. This was my first property as a General Partners and it's been one of the biggest learning experiences I've ever been part of. My Seventh Property This is my newest acquisition and it's my first in-state investment. What's cool is that I can literally drive from my home to visit this property in under an hour. This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on at the end of October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents are about $1,200 per unit right now and after renovation we anticipate pushing them up to $2,100 per month. Value add baby! With this being my first in-state investment, I decided to take a chance and give this whole California investing thing a try. I'm working with some amazing local partners on this deal. No way I could pass it up! I also stopped by the property a couple of weeks ago and if you take a look at the photos above, you'll see 3 blue doors representing the units that have been vacated and are being renovated. Value add! If you are interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. It was a busy month with a property sale and another property under contract to sell. As far as my personal portfolio goes, everything was simple, smooth, and full of cash flow!

Best of luck everyone and reach out if you ever have any questions! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Take a look at the new Youtube channel I just started with my friend: REAL ESTATE INVESTING REAL TALK. Three months into 2021 and Q1 has already come and gone! CRAZY. On the personal portfolio side of things (properties 1-3), all of my units are rented and occupied, but I do have a lease expiring on my single family in June. My property manager has already reached out to the tenant to see if they want to renew. On the larger deals that I'm a partner/investor in (properties 4-7), rent collections have still been down through COVID, but my properties in Arizona and California (properties 5, 6, and 7) are well positioned with plenty of reserves. Unfortunately, the 80-unit in Louisville (property 4) is still running into issues with low rent collections and I did not receive a distribution for Q1 2021 from this property. More details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO MARCH INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart your education on the processes, procedures, and strategies, check out the new ebook I just launched. My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 24-month lease. I had a very clean and smooth month with this property. No repairs or maintenance issues. Full cash flow received! BUT, as mentioned earlier I have an impending lease expiring in June so my property manager is trying to get the lease renewed and we're already starting that conversation. Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs and Maintenance: $0 TOTAL: $728.79 Income ($995) - Expenses ($728.79) = $266.21 Cash Flow from My Second Property: $266.21 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. Both units are on 24-month leases. After a little bit of a rough start to 2021 for this property, we're back on track and we're at 100% occupancy! Although, one tenant has seemingly gotten in the habit with late payments every month, we've been working with them to get back on track and they've always eventually made their full payment. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,247.74 Income ($1,750) - Expenses ($1,247.74) = $502.26 Cash Flow from My Third Property: $502.26 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines and budgets. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as a Limited Partner and amazingly, we were paid out a distribution (albeit small) for Q4 of 2019 and Q4 of 2020 (also, very minuscule). Occupancy is staying steady at 100%, but collections have been struggling as the resident base is largely service workers who have been hit the hardest by COVID. Collections were down to 72% which obviously hurts cash flow. On top of that, we're now starting to pay principal on our loan after 2 years of interest only payments. This is an extra $2,200 a month that's cutting into cash flow. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and continue to cash-flow. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.49% Oh, and one more surprise...there was a Honey Bee colony found in one of the units... My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it. This continues to be a great investment and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. Gross income was up, expenses were down, and Net Operating Income was up! I also got a distribution from this property for Q4 of 2020. 80 units have been renovated with additional units being worked on now. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November 2019. It was acquired for $10.3 million and we're investing another $3 million into it. As a member of the General Partner team, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property has now been under my partners' and my control for about a year now and we're really starting to see the fruits of our labor. All roofs were replaced, exterior is done, and the pool is pretty much finished. This was my first property as a General Partners and it's been a fun ride and transformation to be part of. Check out the renderings for the new office and gym we are constructing! My Seventh Property This is my newest acquisition and it's my first in-state investment. What's cool is that I can literally drive from my home to visit this property in under an hour. This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on at the end of October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents are about $1,200 per unit right now and after renovation we anticipate pushing them up to $2,100 per month. Value add baby! With this being my first in-state investment, I decided to take a chance and give this whole California investing thing a try. I'm working with some amazing local partners on this deal. No way I could pass it up! If you are interested in learning more about getting involved in deals like this and investing, you can reach out to me directly HERE. After 3 months of 2021 I'm extremely excited for what the rest of the year has in store for all of us. My portfolio overall had a very smooth month. Other than the continuing struggles of my investment property in Louisville (property #4) everything else performed well.

Keep pushing forward, work hard, and reach out if you ever have any questions! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Keep an eye out for a BRAND NEW YouTube channel my good friend and I are launching soon :) January 2021 = the start of a new year! New motivations, new plans, and new goals! I don't know about you, maybe it's just a mental thing, but the new year brings new energy for me and I can't wait to see what 2021 has in store. So, onto the actual portfolio update! On the personal portfolio side of things (properties 1-3), all of my units are rented and occupied after I went through a little rough patch at the end of 2020. Surprisingly, all of my units are now rented on 24-month terms (2 year leases) which indicate that COVID might have prompted people to lock in long-term housing. On the larger deals that I'm a partner/investor in, rent collections have still been down through COVID, but my properties in Arizona (properties 5 and 6) are well positioned with plenty of reserves. Unfortunately, the 80-unit in Louisville (property 4) is still running into issues, but I actually got a distribution (albeit small) this month. Finally, I invested in another multifamily property at the end of 2020. This is my 7th property and it's located in San Jose, CA which is less than an hour drive from my home. This is my first in-state investment! More details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO JANUARY INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart up your education on the processes, procedures, and strategies, I'm writing an ebook that'll cover many of your questions. Check it out here: https://www.jumpinrealestate.com/jumpstart.html My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 24-month lease. I had a very clean and smooth month with this property to start 2021. No repairs or maintenance issues. Full cash flow received! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs and Maintenance: $0 TOTAL: $728.79 Income ($995) - Expenses ($728.79) = $266.21 Cash Flow from My Second Property: $266.21 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. Both units are on 24-month leases. I was struggling with a vacancy in unit 2 for awhile on this property, but it finally got rented and the tenant moved in mid-January. I was able to get about half of the month in rent, which obviously hurt my cash flow numbers. But, bottom line: I'm glad to have this property back to 100% occupancy and I hope to take advantage of full cash from from here on out! Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $508.06 (pro-rated rent for new tenant that moved in) TOTAL: $1,383.06 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $138.30 Repairs: $0 TOTAL: $1,211.04 Income ($1,383.06) - Expenses ($1,211.04) = $172.02 Cash Flow from My Third Property: $172.02 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines and budgets. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as a Limited Partner and amazingly, we were paid out a distribution (albeit small) last December for Q4 of 2019 and I finally just got my second ever distribution from this property for Q4 of 2020 (also, very minuscule) Occupancy is staying steady at 100% for now. There's excellent occupancy, but collections have been struggling as the resident base is largely service workers who have been hit the hardest by COVID. Luckily, the property cash-flowed last quarter but we're now officially paying principal on our loan (the first 2 years were interest-only), which hurts cash flow. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and continue to cash-flow. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.49% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it. This continues to be a great investment and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. Gross income was up, expenses were down, and Net Operating Income was up! I also got a distribution from this property for Q4 of 2020. 73 units have been renovated with another 3 being worked on right now. Here are a few photos of our new leasing office and completed gym. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November 2019. It was acquired for $10.3 million and we're investing another $3 million into it. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. As a General Partner, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. Distributions were sent out to our investors for Q4 of 2020. Cha Ching! This property has now been under my partners' and my control for about a year now and we're really starting to see the fruits of our labor. All roofs were replaced, exterior is done, and the pool is pretty much finished. This was my first property as a General Partners and it's been a fun ride and transformation to be part of. Check out how our pool looks now below! And compare it to the above photo when we took over the property in 2019. My Seventh Property Here it is! The newest acquisition! And surprise, surprise, it's actually my first in-state investment. As you know by now, I've only ever invested in out-of-state markets being a California resident in one of the highest cost of living areas in the US. Well, the day is finally here...I invested in my market for the first time. I can literally drive from my home to visit this property in under an hour. CRAZY haha! This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on at the end of October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents are about $1,200 per unit right now and after renovation we anticipate pushing them up to $2,100 per month. Value add baby! With this being my first in-state investment, I decided to take a chance and give this whole California investing thing a try. With a lot of fear that residents are leaving California, sure, that could be a little risk. But, ultimately, I decided to take the chance, trust my gut, and I'm working with some amazing local partners on this deal. No way I could pass it up! If you are interested in learning more about getting involved in deals like this and investing, you can reach out to me directly HERE. After a crazy 2020, I'm am extremely excited for what 2021 has in store for all of us. Take this chance to write down specific goals for the year (personal, financial, anything) and then break them down into smaller goals that are more achievable. I've found this extremely valuable and it's helped me build my business and portfolio throughout the years. It's also important to re-visit your goals daily or weekly to make sure they're top of mind and you don't let them slip. Making progress in this business is simple, but not easy. Keep working hard and reach out if you ever have any questions!

***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Keep an eye out for a BRAND NEW YouTube channel my good friend and I are launching soon :) September 2020 represented the 6-month mark since our country and world really started to see the massive economic effects of COVID-19. It's definitely been a wild rollercoaster ride for myself, my career, my portfolio, my opportunties, and my future. Luckily for myself, I've trained my brain and instilled the mentality that "every challenge brings a learning moment" and that's really proven beneficial during these times. So, onto the actual portfolio update! On the personal property side of things, I had a lease end at the end of September so I'm in the middle of sprucing up the unit for rent and trying to fill a vacancy as soon as possible. On the larger deals that I'm a partner/investor in, rent collections have definitely been down through COVID, but for my properties in Arizona, we're very well positioned to push through this unknown COVID environment. Unfortunately, there still aren't a ton of positives on the property that I'm a Limited Partner in on My Fourth Property (the 80-Unit in Louisville). Let's get into the details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO SEPTEMBER INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart up your education on the processes, procedures, and strategies, I'm writing an ebook that'll cover many of your questions. Check it out here: https://www.jumpinrealestate.com/jumpstart.html My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. After a very smooth year for the first 8 months, I ran into a vacancy on this property and due to some turnover costs and repairs, this property was negative cash flow for the month of September. I had to cover utilities while it was vacant and take care of: -repairing light fixtures -unclogging bathroom sink -lock changes -general cleaning Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Turnover Repairs and Utilities: $558.24 TOTAL: $1,287.03 Income ($995) - Expenses ($1,287.03) = $292.03 Cash Flow from My Second Property: -$292.03 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is occupied and the upper unit will be vacant starting October 1st. Like I mentioned in the intro, I had a lease end at the end of September that was not renewed. So, with that I'm going through a "turn" and I need to get this unit occupied as soon as possible. But, as far as the month of September, it was a pretty smooth 30 days with no random repairs or expenses. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,247.74 Income ($1,750) - Expenses ($1,247.74) = -$502.26 Cash Flow from My Third Property: $502.26 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as I'm a Limited Partner and amazingly, we were paid out a distribution (albeit small) last December for Q4 of 2019 for the first time! Occupancy is staying steady at close to 100% for now. There's excellent occupancy, but collections have been struggling as the resident base is largely service workers who have been hit the hardest. Unfortunately, income was below the budgeted amount which is largely due to a decrease in collections. The expenses were above the budgeted amount and the biggest variance is related to a big flooring repair that had to be taken care of. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.49% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Our first distribution came Q2 of 2020. It's been great to watch this investment move forward the past few months and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. Gross income was up, expenses were down, and Net Operating Income was up! 58 units have been renovated with another 5 being worked on right now. Here are a few photos of our new leasing office where we're expanding and adding a gym. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property is still in the beginning stages of it's transformation. All roofs were replaced, work on the exterior is taking place, and the pool is being renovated. Here's a comparison photos of our old vs. new exterior paint! We went with a more modern and sleek look by getting away from the sandy color of Phoenix. Overall, it was an up and down month with My Second Property getting a vacancy filled, but some repairs came with that. My Third property had a smooth September, but has an impending vacancy.

My larger properties were also somewhat of a mixed bag, with issues on the Louisville property, but great progress on the Arizona properties. But, this is real estate. This is what I signed up for. The ups and downs are what come with taking investment risks. It's all about moving forward and thinking long term! Happy Investing all! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler All in all, it was a great month for me. Why? Because I finally filled a vacancy in my duplex. Phew. That was a journey, a cash flow suck, and a long time coming. The downside is I had to pay my property manager a FULL month's rent to fill that vacancy and lock up a tenant. That's just part of their fee structure that I was fully aware of, so I'll have to wait another month to finally get back to cash flow positive on my duplex. Another added expense this month: my property taxes went up on all of my personal units. I saw a solid $9 increase on my single family home and a $68 increase on my duplex. The positive is that my properties are increasing in value, but that also means cash flow is decreasing as my rents are staying constant. The lesson here is: your rents need to increase as your property taxes and property value increases. Unfortunately, it might be tough to raise rents this year with the effects of COVID and the rental market. With that...let's get to the full update! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO APRIL INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. Another smooth month for My Second Property. Still no crazy repairs or expenses of recent note, and I REALLY hope my tenant is NOT ignoring any maintenance needs that should be taken care of. One thing that's on the back of my mind? My tenant has an expiring lease at the end of June, so it's not an immediate concern, but something I need to look out for and start talking to my property manager about. My initial thought on tackling that, especially in these times, is to NOT raise rent and hopefully get an easy 12-24 month renewal. Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs: $0 TOTAL: $728.79 Income ($995) - Expenses ($728.79) = $275.21 Cash Flow from My Second Property: $266.21 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently vacant and the upper unit is rented to a young professional. Like I mentioned in the intro, I had a vacancy in unit #1 (lower unit) and it was finally filled this month! YES! That vacancy was hindering cash flow, it definitely created stress, and required me to pay out of pocket each month to cover my mortgage, insurance, and taxes. Something we're all trying to avoid in the real estate investing world! The one big expense this month, however, was now with a new tenant in place, my property manager takes a FULL month's rent for placing that tenant. Yup, that's $875 taken out of my income for the first month...can't wait for next month to come around so I can get back to cash flow positive on this property. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $87.50 + $875 new lease fee Repairs: $0 TOTAL: $2,035.24 Income ($1,750) - Expenses ($2,035.24) = -$285.24 Cash Flow from My Third Property: -$285.24 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as I'm a Limited Partner and amazingly, we were paid out a distribution (albeit small) in December for Q4 of 2019 for the first time! Occupancy is staying steady at 100% for now! 59 of the 80 units have been completely renovated with 21 to go. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.5% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Investor distributions are expected June of 2020. It's been great to watch this investment move forward the past few months and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. The big question with the impact of COVID for us was: how would rent collections go? In April, rent collections were down 13% on this property compared to March. Of note, is that the 13% is not necessarily "apples to apples" because March was our highest collections month ever. So, that's comparing our best month to our worst. Units are constantly being renovated as we're still in the beginning stages of the reposition phase. Here are a few photos I snapped of our leasing office where we're expanding and adding a gym. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property is still in the very beginning stages of it's transformation having only closed on it less than 6 months ago. All roofs are being replaced, work on the exterior is taking place, and the pool is being renovated. Rent collections were down 9% on this property in April compared to March. But, this also was a case of comparing our highest collection month to our lowest. Overall, it was a great month in that my personal portfolio is back up to 100% occupancy, but I'll have to wait another month to get back into the cash flow positive side of things. As far as the multifamily part of my portfolio, rent collections were down due to the impacts of COVID, but in no way is there cause for panic as we have plenty of reserves to cover our 6+ months of mortgage payments.

***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler WOW. All that I can say is...I'm somewhat speechless. I don't think ANY of us really could have predicted or imagined how the last month has unfolded. Our lives practically changed overnight and we're all trying to adjust to a new normalcy in work, at home, socially, and financially. The industry I have a full-time job in has completely HAULTED, but luckily I'm able to keep my job and work from home right now. This is the time to practice gratitude and really appreciate the little things we take for granted. I hope you are all doing well out there! With that, welcome to Jump In Real Estate's March 2020 portfolio update. Considering the events that have transpired I'm happy with how my portfolio is positioned because:

The biggest thorn in my side right now is dealing with a vacancy in my duplex, which sucks from a cash flow perspective, but really in the grand scheme of things there are so many more important things in life right now to worry about. Alright, so here's the report! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO MARCH INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. The past 6 months have been rather smooth for My Second Property. I'm hoping that either I'm getting lucky with no repair expenses popping up or my tenant is taking care of them himself. I REALLY hope my tenant is NOT ignoring any maintenance that needs to be taken care of, though. Getting into the theme of spending little money on repairs is great, but it always gets me thinking about any differed maintenance that isn't being spotted. Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $369.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs: $0 TOTAL: $719.79 Income ($995) - Expenses ($719.79) = $275.21 Cash Flow from My Second Property: $275.21 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently vacant and the upper unit is rented to a young professional. I'll just say it how it is...these past few months have been ROUGH for My Third Property. I had a tenant in the bottom unit move out in January and following a couple weeks of renovation (and bumping rent up to $895) it's still sitting vacant. A decent number of applications have come in, but you can imagine how things have just completely slowed down. A couple of promising applications are being stalled due to some employment verifications we're waiting on. My property manager and I are going to lower the vacant unit down to $875 from the original rate of $895. Income Gross rent from Unit 1 (VACANT): $0 Gross rent from Unit 2: $875 TOTAL: $875 Expenses Mortgage: $725.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $87.50 Repairs: $0 TOTAL: $1,094 Income ($875) - Expenses ($1,094) = -$219 Cash Flow from My Third Property: -$219 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as I'm a Limited Partner and amazingly, we were paid out a distribution (albeit small) in December for Q4 of 2019 for the first time! The positive news is that occupancy has increased from 50% at acquisition to 100% now! 59 of the 80 units have been completely renovated with 21 to go. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.5% My Fifth Property This is a 164-unit apartment complex in Phoenix that a group of partners and I purchased. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Investor distributions are expected June of 2020. It's been great to watch this investment move forward the past few months and get under control. I'm working with some amazingly experienced partners on this deal and I could not be happier. Units are constantly being renovated as we're still in the beginning stages of the reposition phase. Here are a few photos I snapped of our new BBQ area and dog park: My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property is still in the very beginning stages of it's transformation having only closed on it less than 6 months ago. All roofs are being replaced and work has begun on the pool as you can see here:

Well, as I stated earlier, we are in unprecedented times right now. Most importantly, I hope you all are safe, healthy, and have positive attitude.

***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler Welcome to Jump In Real Estate's November 2019 portfolio update! SO, it's been a BUSY few months...and I must admit...I've been slacking on adding updated content to the site. Sorry! BUT, the big news...my partners and I officially closed on a 94-unit property in the Phoenix market. Yup! ANOTHER acquisition and as part of the General Partner team, that required me to fly to Phoenix, assist with due diligence, run through comps, vet the business plan, and work with investors. So, let's check out how the portfolio is performing! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO NOVEMBER INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. It's been a pretty smooth few months for My Second Property. If you've been keeping up with my updates, I got a new tenant in this property a few months ago. After just a few minor repairs to get the place rent-ready, I haven't run into any additional expenses out of the ordinary lately. Knock on wood cash flow trend keeps up! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $369.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs: $0 TOTAL: $719.79 Income ($995) - Expenses ($719.79) = $275.21 Cash Flow from My Second Property: $275.21 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently rented to a young married couple and the upper unit is rented to a young professional. I've had some more smooth sailing for this property the past few months! BUT, there is some rough times ahead.... The tenants in my bottom unit have a lease ending on 12/31/19 and they do not intend to renew. So, it looks like I'm going to be facing a winter vacancy...boooo! The winter is pretty rough in Indianapolis and I know the market will be cold (literally). I'm definitely expecting an extended vacancy on this property, but the positive is at least the top unit will cover about 80% of the mortgage, thankfully. I also intend to get into the unit ASAP, clean it up, and I'm hoping to raise rent slightly from $850 to $875 or $900. Income Gross Rents: $1,725 TOTAL: $1,725 Expenses Mortgage: $725.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $172.50 Repairs: $0 TOTAL: $1,179.24 Income ($1,725) - Expenses ($1,179.24) = $545.76 Cash Flow from My Third Property: $545.76 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and the plan is to invest another $1 million into it. This is a passive investment for me as I'm a Limited Partner and we haven't seen any distributions yet since closing 15 months ago. The positive news is that occupancy has increased from 50% at acquisition to 96% now! 59 of the 80 units have been renovated so we expect to have a fully renovated property soon. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an amazing learning experience. My Fifth Property This is a 164-unit apartment complex in Phoenix that a group of partners and I purchased. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Investor distributions are expected June of 2020. It's been great to watch this investment move forward the past few months and get under control. I'm working with some amazingly experienced partners on this deal and I could not be happier. Units are constantly being renovated as we're still in the beginning stages of the reposition phase. There isn't a ton to update here though as we literally only closed a few months ago. BUT, here are a few photos I snapped of exterior painting in progress: My Sixth Property Here's the big news! Here's why I've been so dang busy the past few months and visiting Phoenix so often. This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. My goal for 2019 was to get into a large multifamily deal on the General Partner side and I'm super pumped and proud that I achieved that goal this year! Hard work, constant networking, and proving my value were all KEY to achieving this goal. Honestly, I wasn't sure if I'd actually be able to achieve this feat, but a reminder to you all: THINK BIG. It was a BUSY few month as much of my time in the real estate world was dedicated to My Sixth Property. I'm so happy I finally found some great partners in the multifamily space that have a proven track record and experience having done My Fifth and My Sixth Property deals in Phoenix with them. I can't wait to get 2020 started!

***VERY IMPORTANT NOTE: even though I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler Welcome to Jump In Real Estate's July 2019 portfolio update! First of all, I'm moving away from calling these INCOME REPORTS because, as my portfolio has become more and more complex (ie I've invested in 2 large multifamily assets as a limited partner), it becomes very difficult to report income with so many moving pieces. Also, for confidentiality reasons, I'm choosing not to report everything with so many partners involved in some of these deals. If you want to learn more, always feel free to contact me directly HERE. SO, the big news...I invested in MY FIFTH PROPERTY as a limited partner. This investment is a 164-unit property in Phoenix where I partnered with very experienced and proven operators. I'm SUPER excited about this one, because I completely trust the people I'm working with. This is similar to My Fourth Property in that it's a passive investment where I'm given equity in the asset in exchange for my investment. As I've gotten older I've become more and more conscious of the value of time. Why have my last two investments been passive multifamily investments as a limited parter? One word: TIME. Yes, I could continue to slowly build my portfolio one duplex at a time, but at least for now, I'm valuing the passivity of my last 2 investments and will always be flexible and open to new strategies. My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO JULY INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. As mentioned last month, I had a tenant move out on June 8th (I had them pay a full months rent) and a new tenant moved in on June 28th. That means I had to pay a $895 new lease fee. These fees are pretty standard in the property management world, so you'll learn to expect them. It sucks having to pay $895 for a new tenant, but, it is what it is, and I'm happy to have another 12-month lease in place! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $369.42 Property Taxes: $216.32 Insurance: $44.50 LEASING FEE (one-time fee for new lease): $895 Repairs: $0 TOTAL: $1,525.24 Income ($995) - Expenses ($1,525.24) = -$530.24 Cash Flow from My Second Property: -$530.24 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently rented to a young married couple and the upper unit is rented to a young professional. Some of you already know, but I visited Indianapolis in July! It's part of my plan to visit the market once a year, to check up on the portfolio, connect with my team on the ground, and re-evaluate the market. Welp, when I was out there in July and drove by this investment, I noticed something wrong...there was a HOLE in the siding right by the roof. So, about $1,000 later...it's fixed, after putting a nice dent in my July cash flow. Income Gross Rents: $1,725 TOTAL: $1,725 Expenses Mortgage: $725.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $172.50 Repairs: $1,155 TOTAL: $2,334.24 Income ($1,725) - Expenses ($2,334.24) = -$609.24 Cash Flow from My Third Property: -$609.24 My Fourth Property This is an 80-unit apartment complex in Louisville that a group of partners and I purchased. It was acquired for $2.25 million and we're investing $1.05 million into it over the next 7-9 months. Cash distributions aren't expected until Q4 of 2019. Occupancy has increased from 50% at acquisition to 78% with 10 new residents moving in during the second quarter. The goal is to be over 90% by Q4 of 2019 when we're expected to receive our first distribution. My Fifth Property This is a 164-unit apartment complex in Phoenix that a group of partners and I purchased. It was acquired for $19.75 million and we're investing $2.5 million into it over the next 24 months. Investor distributions aren't expected until June of 2020. It was a BUSY month as every property in my portfolio saw some action. My single family got a new tenant, my duplex needed some repairs, my Louisville property saw occupancy levels rise, and I invested in My Fifth Property!

***VERY IMPORTANT NOTE: even if I brought in positive cash flow after all my expenses, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler |

Updates

All

|

Investing |

Jump In |