|

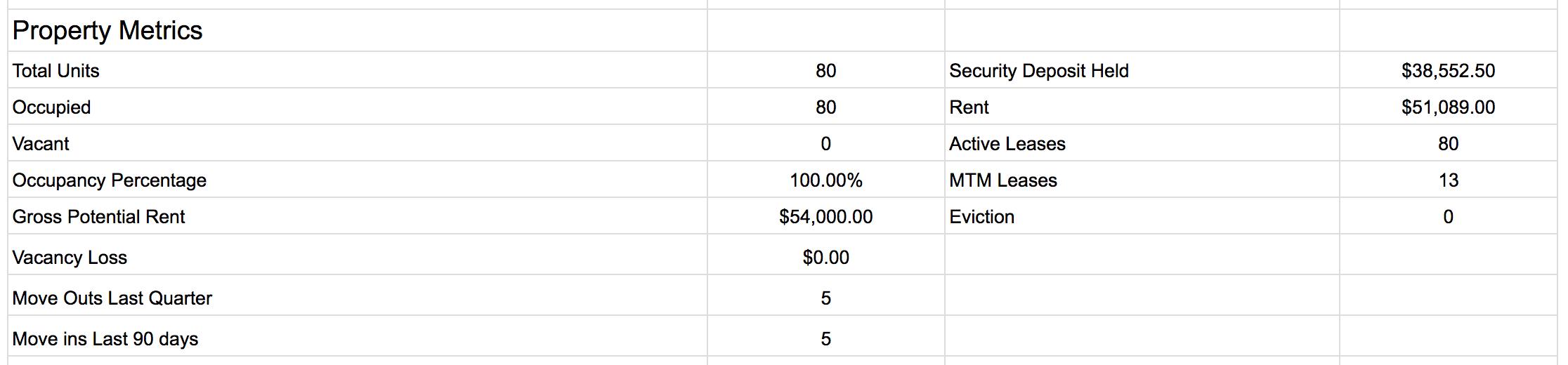

All in all, it was a great month for me. Why? Because I finally filled a vacancy in my duplex. Phew. That was a journey, a cash flow suck, and a long time coming. The downside is I had to pay my property manager a FULL month's rent to fill that vacancy and lock up a tenant. That's just part of their fee structure that I was fully aware of, so I'll have to wait another month to finally get back to cash flow positive on my duplex. Another added expense this month: my property taxes went up on all of my personal units. I saw a solid $9 increase on my single family home and a $68 increase on my duplex. The positive is that my properties are increasing in value, but that also means cash flow is decreasing as my rents are staying constant. The lesson here is: your rents need to increase as your property taxes and property value increases. Unfortunately, it might be tough to raise rents this year with the effects of COVID and the rental market. With that...let's get to the full update! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO APRIL INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. Another smooth month for My Second Property. Still no crazy repairs or expenses of recent note, and I REALLY hope my tenant is NOT ignoring any maintenance needs that should be taken care of. One thing that's on the back of my mind? My tenant has an expiring lease at the end of June, so it's not an immediate concern, but something I need to look out for and start talking to my property manager about. My initial thought on tackling that, especially in these times, is to NOT raise rent and hopefully get an easy 12-24 month renewal. Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $378.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs: $0 TOTAL: $728.79 Income ($995) - Expenses ($728.79) = $275.21 Cash Flow from My Second Property: $266.21 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently vacant and the upper unit is rented to a young professional. Like I mentioned in the intro, I had a vacancy in unit #1 (lower unit) and it was finally filled this month! YES! That vacancy was hindering cash flow, it definitely created stress, and required me to pay out of pocket each month to cover my mortgage, insurance, and taxes. Something we're all trying to avoid in the real estate investing world! The one big expense this month, however, was now with a new tenant in place, my property manager takes a FULL month's rent for placing that tenant. Yup, that's $875 taken out of my income for the first month...can't wait for next month to come around so I can get back to cash flow positive on this property. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $791.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $87.50 + $875 new lease fee Repairs: $0 TOTAL: $2,035.24 Income ($1,750) - Expenses ($2,035.24) = -$285.24 Cash Flow from My Third Property: -$285.24 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and we're investing another $1 million into it as a group. This is a completely passive investment for me as I'm a Limited Partner and amazingly, we were paid out a distribution (albeit small) in December for Q4 of 2019 for the first time! Occupancy is staying steady at 100% for now! 59 of the 80 units have been completely renovated with 21 to go. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an eye-opening learning experience. Total ROI since investing start date 10/11/18: 1.5% My Fifth Property This is a 164-unit apartment complex in Phoenix that I invested in passively. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Investor distributions are expected June of 2020. It's been great to watch this investment move forward the past few months and I'm working with some amazingly experienced partners on this deal and I couldn't be happier. The big question with the impact of COVID for us was: how would rent collections go? In April, rent collections were down 13% on this property compared to March. Of note, is that the 13% is not necessarily "apples to apples" because March was our highest collections month ever. So, that's comparing our best month to our worst. Units are constantly being renovated as we're still in the beginning stages of the reposition phase. Here are a few photos I snapped of our leasing office where we're expanding and adding a gym. My Sixth Property This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. This property is still in the very beginning stages of it's transformation having only closed on it less than 6 months ago. All roofs are being replaced, work on the exterior is taking place, and the pool is being renovated. Rent collections were down 9% on this property in April compared to March. But, this also was a case of comparing our highest collection month to our lowest. Overall, it was a great month in that my personal portfolio is back up to 100% occupancy, but I'll have to wait another month to get back into the cash flow positive side of things. As far as the multifamily part of my portfolio, rent collections were down due to the impacts of COVID, but in no way is there cause for panic as we have plenty of reserves to cover our 6+ months of mortgage payments.

***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler

3 Comments

Serena Cheung

6/12/2020 05:07:13 pm

Hi Tyler, thanks for sharing your story! I have been looking into out-of-state real estate investment. What area(s) in Indianapolis will you recommend? I am looking for A or B class neighborhood that can still fit the 1% rule. Thanks a lot!

Reply

6/18/2020 10:25:49 am

Hey Susan! You probably can't find 1% rentals in A class, but you can probably still find some in B Class.

Reply

Leave a Reply. |

Updates

All

|

Investing |

Jump In |