|

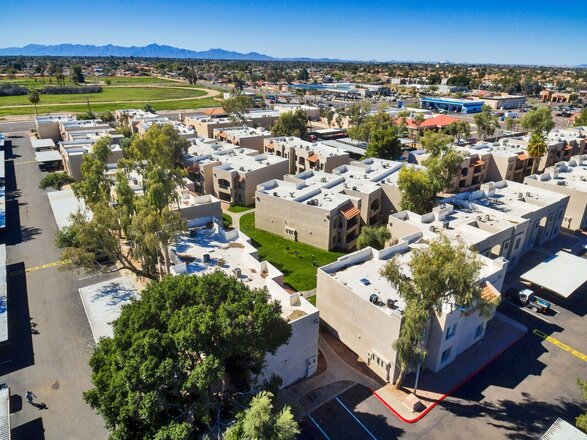

Soooo...it's been 4 months since my last portfolio update and A LOT has happened since... After exiting one of my larger multifamily investments (Property #5) earlier this year, I exited two more multifamily investments (Properties #4 and #6). Then my partners and I closed on a new acquisition (Property #8) in Sacramento, CA. I also took care of two cash-out refinances on my personal portfolio (Properties #2 and #3). It's been a busy few months! More details below! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood in Indianapolis, Indiana. NO SEPTEMBER INCOME. See how it performed HERE. If you're looking to buy your first rental property and want to jumpstart your education on the processes, procedures, and strategies, check out my ebook below My Second Property I bought this single family house in March of 2018 in Indianapolis, Indiana for $86,000. It's a 2 Bed/1 Bath in a "B" Class neighborhood. I recently took care of a cash-out refinance and pulled most of my initial capital out, so even though cash flow isn't life changing, my ROI is amazing! To me, this property is the definition of jumping in, taking action, and being patient! When I acquired this property in 2018, it wasn't a "home run" by any means. But, fast forward 3 years where it appraised for $156,000 and I just took care of a cash-out refinance. You'll notice my cash flow decreased about $40 a month, but I took out a majority of my initial cash, TAX FREE, from the deal which I'll use to reinvest. On the rental side, I had a very clean and smooth month with this property. No repairs or maintenance issues. Full cash flow received! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $400.18 Property Taxes: $212.32 Insurance: $44.50 Property Management: $89.55 Repairs and Maintenance: $0 TOTAL: $746.55 Income ($995) - Expenses ($746.55) = $290.21 Cash Flow from My Second Property: $248.45 My Third Property I bought this duplex in July of 2018 in Indianapolis, Indiana for $158,000. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. I also took care of a cash-out refinance on this property and pulled some of my initial capital out of the deal. This property just appraised for $174,000 and I took care of a cash-out refinance. You'll notice my cash flow actually increased with my new lower interest rate and I got some of my cash out of the deal, TAX FREE, which I'll use to reinvest. I basically got paid to lower my monthly payments...BOOM! That's the power of real estate. This property has been running smooth for a few months and I'm super glad after it had a rough 2020. Income Gross rent from Unit 1: $875 Gross rent from Unit 2: $875 TOTAL: $1,750 Expenses Mortgage: $690.24 Property Taxes: $221 Insurance: $50.50 Property Management fee: $175 Repairs: $0 TOTAL: $1,136.74 Income ($1,750) - Expenses ($1,136.74) = $613.26 Cash Flow from My Third Property: $613.26 My Fourth Property This was an 80-unit apartment complex in Louisville that I invested in passively through a company called Holdfolio back in 2018. Unfortunately, things didn't go as smooth as expected and Holdfolio did not hit their underwritten timelines or budgets, but it was a great learning experience. It was acquired for $2.25 million and we sold it for $3.88M in August of 2021. This was a completely passive investment for me as a Limited Partner and it officially sold in August of 2021. If you've been following me for awhile, you'll know this property had a lot of challenges. Unexpected expenses, low rent collections, and poor management plagued this passive investment run by Holdfolio. The best option was to sell and at least lock in a small return. I got about 5% return on my money in 2.5 years. Not the greatest...but again a very valuable learning experience! Total ROI on this investment (exited in 2021): 5.22% My Fifth Property This was a 164-unit apartment complex in Phoenix that I invested in passively with trusted partners. It was acquired for $19.75 million and had a $2.5 million renovation budget. It was sold in 2021. This property was officially sold and we exited this investment. I got a total of 50% return on my money in less than 2 years (22 months to be exact) and I couldn't be happier with the outcome. This was a deal I got into back in 2019 when I found amazing and experienced partners to work with. Finding the right people to work with isn't easy; it takes time, commitment, and TRUST. Develop those relationships NOW and align yourself with people that are more experienced than yourself! That's the biggest business and money hack :) Total ROI on this investment (exited in 2021): 50% My Sixth Property This was a 94-unit apartment complex in Phoenix that a group of partners and I purchased in November 2019. It was acquired for $10.3 million and our renovation budget was $3 million. We officially exited and sold this deal in August of 2021. As a member of the General Partner team, I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. As far as the value-add went, all roofs were replaced, exterior painted, interiors completely renovated, and the pool was transformed. This was my first property as a General Partners and it was one of the biggest learning experiences I've ever been part of. We sold this property in August of 2021 and it was frankly a "home run" deal after everything was said and done. Our location choice, execution of the value-add strategy, and great market conditions allowed us to provide our investors with a 100% return on their money in less than 2 years. In addition to investing my own capital on this deal I also had additional equity as part of the General Partner team. Total Investor ROI on this deal (exited in 2021): 100% If you want to learn more about how you can invest in deals like this with me, check out my investing company Jump Investments by clicking the link below My Seventh Property Here it is! My first in-state (California) investment ever. What's cool is that I can literally drive from my home to visit this property in under an hour. This is an 12-unit apartment complex in San Jose, CA that a group of partners and I purchased and closed on in October 2020. It was acquired for $3 million and we're investing another $300,000 into it. Current rents at acquisition were at ~$1,200 per unit (all 1 bed/1 baths) and after renovations we anticipate pushing them up to ~$2,100 per month. Value add baby! With this being my first in-state investment, I took the jump and decided to give this whole California investing thing a try. I'm working with some amazing local partners on this deal. No way I could pass it up! I also stopped by the property recently and if you take a look at the photos above, you'll see 3 blue doors representing the units that have been vacated and are being renovated. Value add! If you are interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. My Eighth Property BIG NEWS! This is my newest acquisition and it's my second California investment. This is an 12-unit apartment complex in Sacramento, CA that a group of partners and I purchased and closed on in September 2021. It was acquired for $2,630,000 million and we're investing another $350,000 into it. It's 100% vacant and in the great Midtown neighborhood of Sacramento where all the hip restaurants, bars, and coffee shops are. Super exited about this deal! This is a heavy value-add deal with the property being 100% vacant. Our plan calls for a complete renovation of all 12-units, then we get them rented, then we sell this asset off in about 18 months. We're projecting a 30%-45% return for our investors in less than 2 years. If you're interested in learning more about getting involved in deals like this and investing you can reach out to me directly HERE. It's been a BUSY couple of months with 2 property exits, 2 cash-out-refinances, and a new acquisition in Sacramento! I couldn't be happier with how everything in my real estate portfolio is performing at the time being, and it's always fun to look back at how far this journey has taken me.

As I always say, JUST START, give real estate time, have a positive attitude, never stop networking, and you stand to do very well in this world. Best of luck everyone and reach out if you ever have any questions! ***VERY IMPORTANT NOTE: even if I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler P.S. Take a look at the Youtube channel I started with my friend: REAL ESTATE INVESTING REAL TALK.

2 Comments

Christopher Shue

10/3/2021 11:27:26 pm

Hi Tyler,

Reply

10/22/2021 12:03:28 pm

Hey Chris! That was a typo on my part! It was a 50% total return in less than 2 years!

Reply

Leave a Reply. |

Updates

All

|

Investing |

Jump In |