|

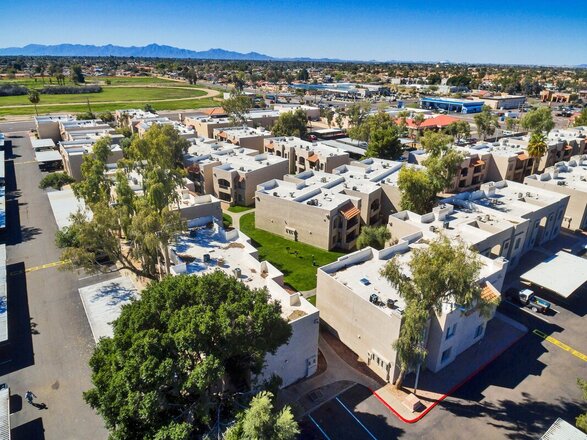

Welcome to Jump In Real Estate's November 2019 portfolio update! SO, it's been a BUSY few months...and I must admit...I've been slacking on adding updated content to the site. Sorry! BUT, the big news...my partners and I officially closed on a 94-unit property in the Phoenix market. Yup! ANOTHER acquisition and as part of the General Partner team, that required me to fly to Phoenix, assist with due diligence, run through comps, vet the business plan, and work with investors. So, let's check out how the portfolio is performing! My First Property I bought this single family house in December of 2016 and SOLD it in May of 2018. 2 Bed/1 Bath in a "C" Class neighborhood. NO NOVEMBER INCOME. See how it performed HERE. My Second Property I bought this single family house in March of 2018. 2 Bed/1 Bath in a "B" Class neighborhood. It's currently rented on a 12-month lease. It's been a pretty smooth few months for My Second Property. If you've been keeping up with my updates, I got a new tenant in this property a few months ago. After just a few minor repairs to get the place rent-ready, I haven't run into any additional expenses out of the ordinary lately. Knock on wood cash flow trend keeps up! Income Gross Rents: $995 TOTAL: $995 Expenses Mortgage: $369.42 Property Taxes: $216.32 Insurance: $44.50 Property Management: $89.55 Repairs: $0 TOTAL: $719.79 Income ($995) - Expenses ($719.79) = $275.21 Cash Flow from My Second Property: $275.21 My Third Property I bought this duplex in July of 2018. Both units are 2 Bed/1 Bath in a "B" Class neighborhood. The lower unit is currently rented to a young married couple and the upper unit is rented to a young professional. I've had some more smooth sailing for this property the past few months! BUT, there is some rough times ahead.... The tenants in my bottom unit have a lease ending on 12/31/19 and they do not intend to renew. So, it looks like I'm going to be facing a winter vacancy...boooo! The winter is pretty rough in Indianapolis and I know the market will be cold (literally). I'm definitely expecting an extended vacancy on this property, but the positive is at least the top unit will cover about 80% of the mortgage, thankfully. I also intend to get into the unit ASAP, clean it up, and I'm hoping to raise rent slightly from $850 to $875 or $900. Income Gross Rents: $1,725 TOTAL: $1,725 Expenses Mortgage: $725.24 Property Taxes: $221 Insurance: $60.50 Property Management fee: $172.50 Repairs: $0 TOTAL: $1,179.24 Income ($1,725) - Expenses ($1,179.24) = $545.76 Cash Flow from My Third Property: $545.76 My Fourth Property This is an 80-unit apartment complex in Louisville that I invested in through a company called Holdfolio. Unfortunately, things haven't gone as smooth as expected in this deal and Holdfolio is not hitting their underwritten timelines. It was acquired for $2.25 million and the plan is to invest another $1 million into it. This is a passive investment for me as I'm a Limited Partner and we haven't seen any distributions yet since closing 15 months ago. The positive news is that occupancy has increased from 50% at acquisition to 96% now! 59 of the 80 units have been renovated so we expect to have a fully renovated property soon. As a Limited Partner in this deal, there isn't much I can do except be patient and trust my partners to get this property turned around and cash-flowing. This was my first tip-toe into the larger multifamily world and although it's been challenging, it's been an amazing learning experience. My Fifth Property This is a 164-unit apartment complex in Phoenix that a group of partners and I purchased. It was acquired for $19.75 million and we're investing an additional $2.5 million into it over the next 24 months. Investor distributions are expected June of 2020. It's been great to watch this investment move forward the past few months and get under control. I'm working with some amazingly experienced partners on this deal and I could not be happier. Units are constantly being renovated as we're still in the beginning stages of the reposition phase. There isn't a ton to update here though as we literally only closed a few months ago. BUT, here are a few photos I snapped of exterior painting in progress: My Sixth Property Here's the big news! Here's why I've been so dang busy the past few months and visiting Phoenix so often. This is an 94-unit apartment complex in Phoenix that a group of partners and I purchased and closed on at the end of November. It was acquired for $10.3 million and we're investing another $3 million into it over the next 24 months. As a member of the General Partner team, I'm working with the same individuals that I worked with on My Fifth Property. I flew out to Phoenix multiple times running due diligence, checking out comps, vetting the business plan/strategy, and connecting with investors. My goal for 2019 was to get into a large multifamily deal on the General Partner side and I'm super pumped and proud that I achieved that goal this year! Hard work, constant networking, and proving my value were all KEY to achieving this goal. Honestly, I wasn't sure if I'd actually be able to achieve this feat, but a reminder to you all: THINK BIG. It was a BUSY few month as much of my time in the real estate world was dedicated to My Sixth Property. I'm so happy I finally found some great partners in the multifamily space that have a proven track record and experience having done My Fifth and My Sixth Property deals in Phoenix with them. I can't wait to get 2020 started!

***VERY IMPORTANT NOTE: even though I'm bringing in positive cash flow after all my expenses are paid, I'M NOT TOUCHING any of it! This income goes toward my next investment and any future expenses. I have a day job and side-hustles to cover my lifestyle :) If I ever get to the point where I actually want to take the cash flow, I would still only take about half of it and save the remainder for future expenses. This is SUPER IMPORTANT! ALWAYS factor in future vacancy/repair/maintenance expenses. Make sure you know how to properly calculate cash flow HERE. Let me know if you have any questions! -Tyler

0 Comments

Leave a Reply. |

Updates

All

|

Investing |

Jump In |