|

I learned A TON going through my first purchase of a small multi-family property (duplex). No matter how much education, reading, and learning you do, you'll never be completely prepared for the journey. Experience is the most valuable tool out there. Here are the biggest lessons I learned from My Third Property that will hopefully help you along the way! 1. There are a lot of investing strategies out there. Before purchasing My Third Property, I considered: index funds, note investing, lending on rehab projects, buying another single family home, or just keeping my cash safe in a savings account. Ultimately, I didn't go for any of those strategies! I went for a small multi-family! Which shows...investing strategies CAN change and WILL change. 2. Finding and getting a property under contract that meets your investing criteria takes hard work, determination, and the right attitude to push through challenges. I found and offered on multiple properties before finally getting an accepted offer. It's really frustrating to lose a property, but that's the game investors play. Stay firm on your numbers, don't compromise, and MOVE ON to the next one if you lose out. 3. There's immense value in partnerships. I used to think doing it alone was the best strategy. I'm now understanding that two heads are better than one :) if you can BOTH bring value to the partnership. 4. Dial in your focus and don't spread yourself thin. 5. First impressions aren't everything. My Third Property was not appealing to me initially, but after running the numbers and better understanding the neighborhood, I liked it. I liked it A LOT. 6. MASTER the art of analyzing properties on paper quickly. Running a quick analysis is key to securing a good investment. 7. Having STRONG and trusting relationships "on the ground" in your market is crucial. Take the time and effort and invest in your relationships. They'll pay off in the long-run. The fact that I could email my agent on a random weekend afternoon and submit an offer within a couple hours may have been the reason I got this property. My agent could have waited a day or two to respond...and by that time...the property may have already been under contract. Who knows? 8. Just because you have a property under contract doesn't mean your work is done. It's just begun! Due diligence is it's own animal! 9. The second you get a property under contract, get to work RIGHT AWAY on proper due diligence. In fact, if you think you're even close to getting a property under contract, I'd recommend you give your inspector a heads up immediately. 10. If there are tenants in the property, check their leases right away. Have the owner confirm their payment habits (do they pay on time or late??). 11. Extend your Inspection Period if needed. Make sure that clause is built into the initial contract if you think you'll need it. 12. After assessing repairs, decide on if you want credit at closing or a reduced purchase price. But, I'll note: if you already have your financing locked up, it might cause a delay if you were to change the purchase price. Credit at closing can be an easier process, and saves you cash up front. 13. Regarding a renovation: realize that you're asking a team thousands of miles away to repair and oversee a renovation project. If you're paying an extra $3 for an item, I believe there's no need to call them out for that. Trust them, create a strong relationship, and they'll treat you right. 14. Get specific renovation timelines. Know exactly when work is to be started and when it's to be completed. Always get pictures of all work done. 15. Protect yourself and don't pay for full renovations up-front. Make an arrangement with your Property Manager and contractor that full payment won't occur until work is 100% complete and up to your standards. 16. It's generally a tough time to find tenants in the Winter. I strongly recommend trying to avoid a vacant property in the Winter at all costs! Lay out your property acquisition plan, renovation plan, and assess when you'll have to market the property. That could be a major factor in your investing plan. 17. If your unit is sitting on the market for an extended period of time, it's most likely due to demand and price. Evaluate the price and gauge if it's worth it to lower the rent. 18. An occupied unit is better than a vacant unit, even if it's demanding less rent. You want your tenant paying your mortgage, NOT YOU. 19. Make sure you understand all the fees your property manager charges. It's pretty typical that a property manager charges for any new or renewed leases. So, even when you get a new tenant in your property, you're probably not seeing any of the rental income for at least another month after they've moved in. Happy Investing! -Tyler

0 Comments

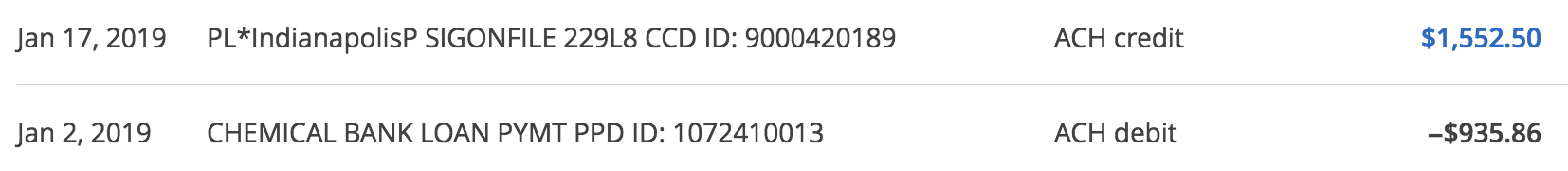

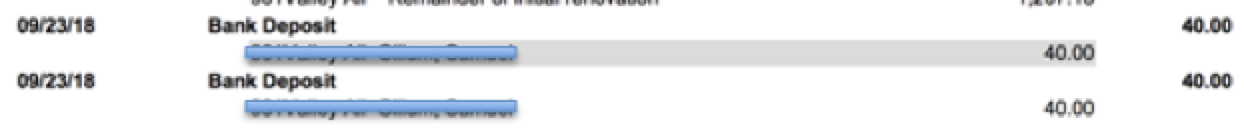

My new upper-unit tenant moved in on October 1st, 2018. Remember, the bottom unit was already occupied when I bought it and their lease runs through January of 2020 (they just renewed). Welpppp.....it took a few months to get a full month of cash flow on this property (I'll explain why it took so long, shortly). But first, let's admire the beauty of bringing in more money than you spend. In January 2019, I brought in $1,552.50 (after property management fees) and spent $935.86. I'll take that!!

Here's the breakdown Rent: $1,725 MINUS Property Management: $172.50 Principal, Interest, Taxes, Insurance: $935.86 NET: $616.64 Now, why did it take 3 months to get a fully performing property? In October 2018, I had to pay my property manager a full month's rent ($875). This is part of our management agreement for any new lease. In November 2018, I had a couple last repairs to take care of after the new tenant moved in, which prevented a clean cash-flowing month. In December 2018, my LOWER unit tenant renewed their lease for another 12 months. I had to pay my property manager $299 for a renewed lease as part of the management agreement. FINALLY, this month in January, I had a clean and fully performing asset! Well, I'm not quite sure what else to say now. My Third Property has been quite the journey. I learned a lot through this process of acquiring, renovating, and renting a new asset type (duplex), and I'm ALREADY excited to share news about my next investment, MY FOURTH PROPERTY. To keep up to date on this property (and my full portfolio) check out my Month Rental Income Reports HERE! Takeaways

-Tyler Tick. Tock. TiCk. tOcK. With my upper unit on the market, all I can do is WAIT for tenant leads to filter in and hopefully get someone properly qualified to sign a lease. Literally, there's nothing else you can do at this point except be patient, track leads coming in, and evaluate pricing if it takes too long to get a renter. Also, I took a trip out to Indy earlier this month to check out the property, meet with my team, scout neighborhoods, and experience the market first-hand. I've said this multiple times, but I HIGHLY recommend taking a trip out to your market. Understanding your market, the neighborhoods, and meeting your connections face-to-face is invaluable. Plus, you can write it off :) By buddy Nick (who is very interested in Indianapolis) flew out to Indy to hang with me and check out the city too. It was quite the adventure, man. We took separate flights on a Friday night (I came from the San Francisco, he came from LA), and landed in Indianapolis around 5:00am (Eastern time). Which means...it felt like 2:00am my time. FUN. TIMES. Here's a few pictures from our trip: But, back to the investment...the unit sat on the market for WEEKS, so we decided it was time to lower rent. When you're not getting any traction on your unit, it's a clear sign that rent is too high. So, I dropped the price from $900 to $875. And.....leads started picking up again. And guess what? We got a couple applications too! On September 28th.... FINALLY. I got some great news. Email from my property manager: "Tenant is approved and moving in next week. Have a great weekend." YES! Music to my ears! I've got an approved and signed 12-month lease at $875. Which is actually $25 more than I was expecting when running my initial numbers at $850. SCORE! OK, now it's time to call my utility companies, take my name off the account for now, and have my property manager instruct the new tenant to place utilities in their name. WOW. I made it through. Acquisition, renovation, marketing, tenant placement. It's not always a quick process, but you've got to push through and commit. Now, I have another cash-flowing property up and running. Let's get that passive income flowing! Takeaways

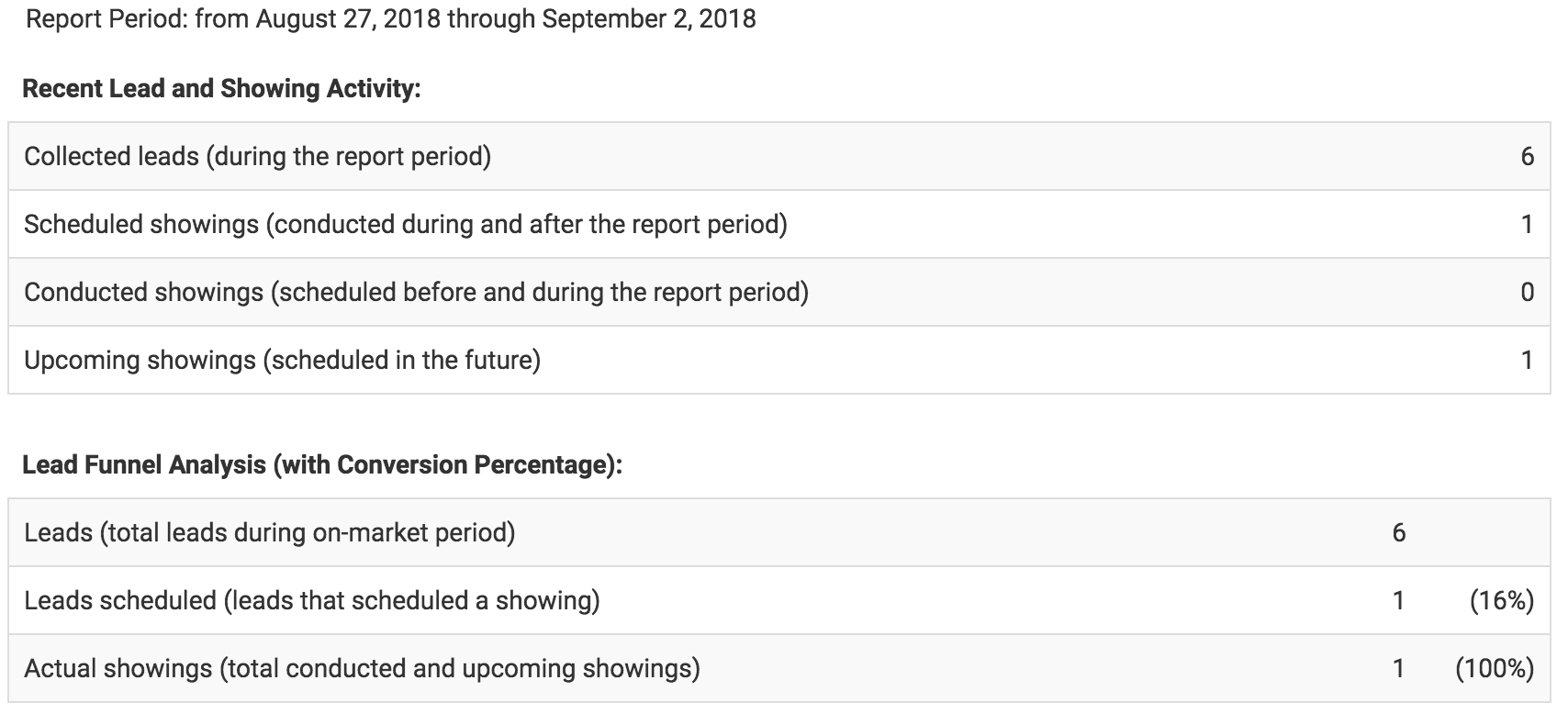

-Tyler Note from my property manager: "I spoke with the Vendor this morning and the work in the upstairs unit is complete. The cleaning crew was scheduled to clean the unit today..." SWEET! Awesome! Let's get this bad boy on the market and get it rented! Not so fast... "Unfortunately, we received a communication from the Tenant in unit 1 last night that they had a small amount of water coming through the ceiling in their unit. We sent a contractor to the home and it was found that the shut off valve for the hot water heater had developed a small leak. The issue was corrected and a dehumidifier was placed in the downstairs unit. At this point, we have determined this to be a result of draining and removing the hot water heater while installing the drip pan. The vendor performing the work in the upstairs unit will make the small drywall repair in the ceiling of unit 1 and paint as a part of their responsibility for the issue." I swear...I was literally JUST thinking about the downsides of having a multi-level duplex. I was thinking about how a kitchen, bathroom, or water heater leak could cause horrible damage to the downstairs unit. So, consider these risks if investing in a duplex (or any property) that has multiple levels. Don't let it scare you, just understand some of the risks. After this little hiccup, we get to work on determining the listing price for the unit. Given that the lower unit is currently renting for $850 per month, my initial thought is to try and get more for the upper unit. Why? -Upper units are generally more desirable, because the bottom unit hears more noise (ie: footsteps from the upper unit). -The upper unit also has a nice deck that faces out to a tree lined backyard -A comparable unit in a 4-plex down the street just got leased for $925 My property manager and I decide to put the unit on the market at $900. You've got to realize...it's about to be WINTER. The longer it takes to get this unit rented, the closer we'll get to the cold, snowy days of Indianapolis. Which makes it harder to find tenants. I need to avoid having a vacant unit in the Winter. You don't want that. NOPE! So, something really cool my property management company does, is they send weekly reports detailing leads that come in through online channels or over the phone, and the number of scheduled showings. This is awesome information to see as an owner. Well....my property is officially on the market! If you recall, I slightly over-priced My Second Property, and it sat on the market for a solid 6 weeks. I'm hoping I can avoid that with this property and get a renter into this unit ASAP before the harsh winter hits! Takeaways

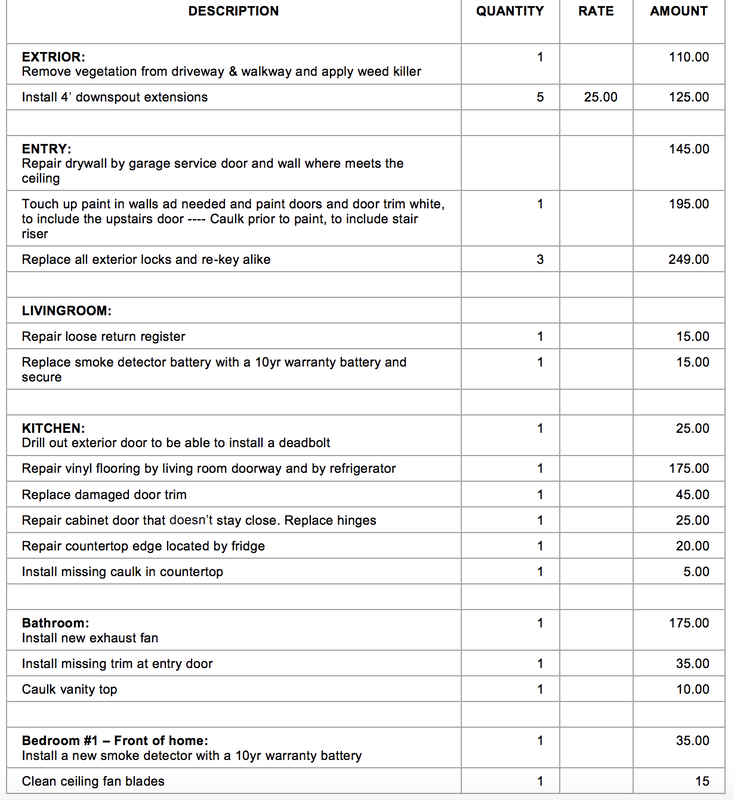

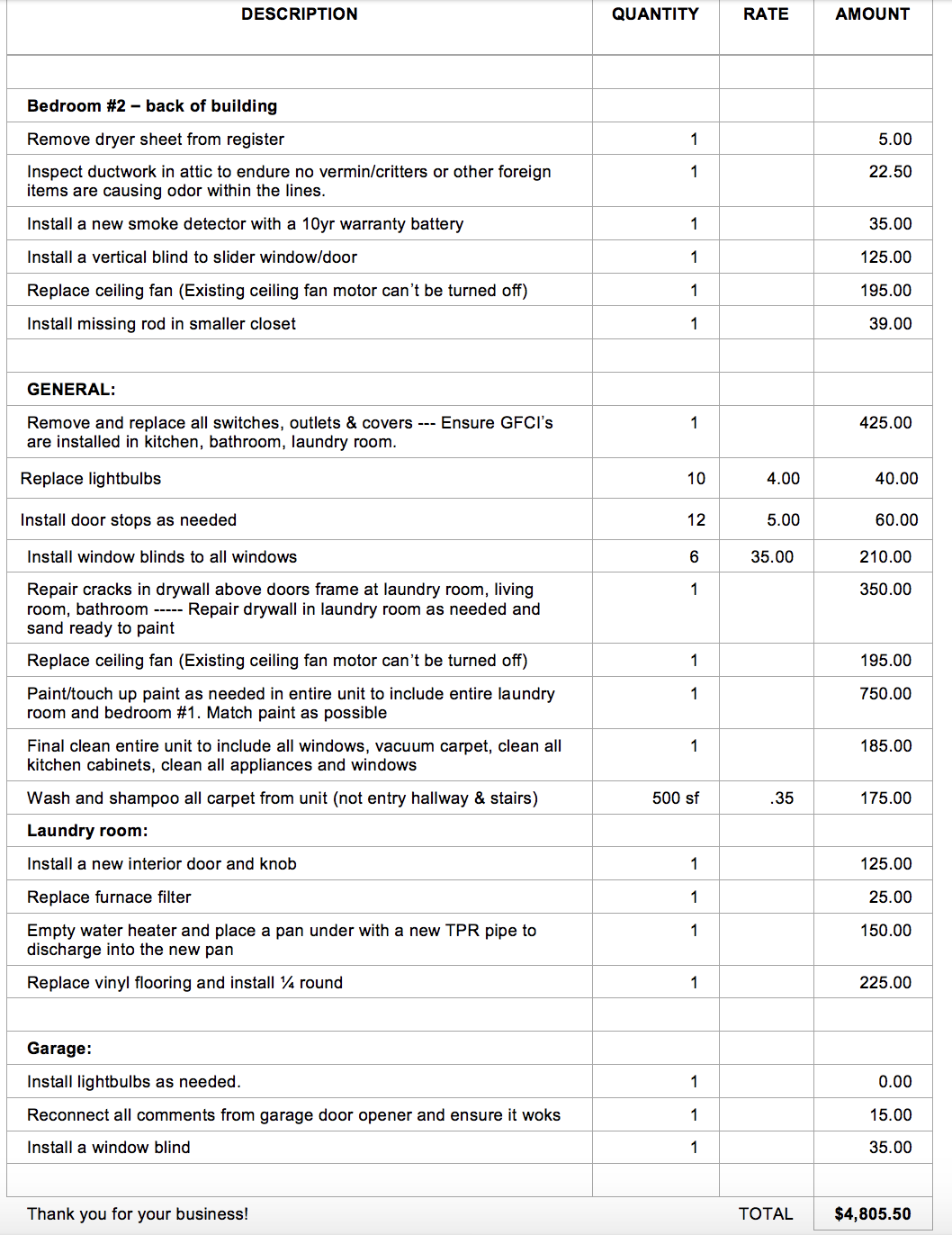

-Tyler CONTRACTORS....START YOUR RENOVATIONS! I closed on My Third Property on July 31, 2018. It was quite the birthday present. Literally. It always feels amazing to pick up a new property. There's always a sigh of relief, because the process of finding a suitable property, running the numbers, offering, negotiating, and locking it up is time consuming (at least being a 1-man show). It takes dedication, motivation, drive, and effort. But, in the grand scheme of things: the journey has just begun if you're dealing with a property needing repairs or renovations. I had a third-party property inspector take an in-depth look at the duplex prior to closing, so I was pretty aware of most of the needed repairs. I trusted the assessment, but now it's time to get my property manager in there to do a proper walk-through and prepare a scope of work. Because the lower unit is already occupied with a tenant, a majority of the work needed is for the vacant upper unit. Here's the repair estimate I received: THE TOTAL COMES TO: $4,805.50 A littleeeeeeee high in my opinion... The good news? Remember, I got $4,500 in credit back at closing for repairs...so that basically covers this. The bad news? This scope of work doesn't include any crawlspace repairs or electrical box repairs. So, that's a little scary. I'll have to spend more than expected to get this property into shape. Also, I noticed they double counted an item (replace ceiling fan - $195), which I'll call them out on. There are also a few items on there that seemed WAY too overpriced, but at the end of the day, I realize I have a naturally frugal mind which is what's causing the pain. I personally don't like to spend money and will always look for cheaper options. BUT, when it comes to investing out-of-state thousands of miles away, you have to realize you're outsourcing and paying for jobs to be taken care of for you. These are jobs that don't require any of your time or effort and there's amazing value in that. It's not the end of the world to pay for repairs that are needed and have someone else take care of everything from start to finish. I approve the Scope of Work and my property manager (PM) gets things started with my contractor. Work is scheduled to start on 8/21 and be completed by 8/27. We're hoping to get the upper unit on the market starting 8/29. IMPORTANT NOTE REGARDING PAYMENT: my PM initially requested full payment for the contractor, but I was adamant about not paying it all up front. We've all heard the horror stories of people getting burned by contractors and running away with money. We agree that I'll pay 50% now (which is still a little high) and 50% upon completion. Don't be afraid to ask for what you're comfortable with. So, protect yourself (especially if you're investing from a distance) and DON'T pay for everything up front. Give them incentive to finish the job properly and on time! Oh yeah coincidentally, I also book a flight out to Indy (it happened to be the optimal time for me to get out there). I hope to see the finished unit if it's still not rented by the time I arrive in September. Takeaways

-Tyler I have a property under contract for an acquisition price that spits out good returns. I've performed my due diligence and had my inspector, real estate agent, and insurance agent out there as soon as possible. A few red flags definitely popped up. So, I need to evaluate the cost for all repairs and determine what my inspection response will be. Do I let this property go? Do I ask for a credit at closing? Do I ask them to reduce the sale price? I send my agent this email after evaluating everything: I've run my numbers and I'm asking for either a credit at closing or reduction of sale price by $5,410. This is due to: -Crawlspace mold and standing water. Needs remediation and new vapor barrier. Source of standing water still unknown. Needs further evaluation and could be grading or foundation issues. -8' x 8' puddle at crawlspace access point. Access point may be source of crawlspace moisture, but not positive. Needs to be repaired and secured. -Both breaker boxes: excessive rust and needs to be evaluated by electrician. Will need to replace both boxes. -Unit 2 Disposal un-operational -Both bathroom fans un-operational -There's a hole in the wood siding that needs repair -Garage door motors: non-operational or non-existent -Smoke detectors non-operational -Missing outlet covers on multiple outlets -Driveway needs maintenance Thanks, Tyler At the end of the day, I want this property. A credit at closing or a reduction in purchase price are both options I'd accept. I personally ran my numbers, got one quote for the crawlspace moisture issue, and came up with wanting $5,410. This isn't an exact number by any means, I honestly could use more/will need more, but I didn't want to rock the boat too hard. Even with those repairs and costs, this should still be a great long-term investment. The response back from the seller? He offered $4,500 credit at closing and agreed to repair the garbage disposal. I accept. And schedule closing for July 31st. My birthday! It's not time to relax now. I've got a deal locked up, performed due diligence, solidified the repair details, and I check in with my property manager. I shoot my PM a note (ALWAYS over communicate and don't make assumptions): -With closing on the last day of July, rent for the occupied lower unit is due the next day (August 1st). Confirming you'll be able to collect? -I have a list of repairs needed with varying degrees of priority. What's the best way to coordinate work and get a quote from you? -Please market the upper unit as soon as possible to fill the vacancy He confirms, we map out a transition plan, and proceed to closing! BOOM! My Third Property. Takeaways

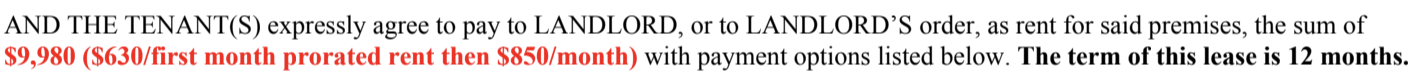

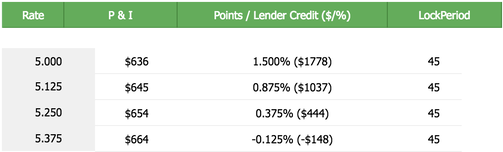

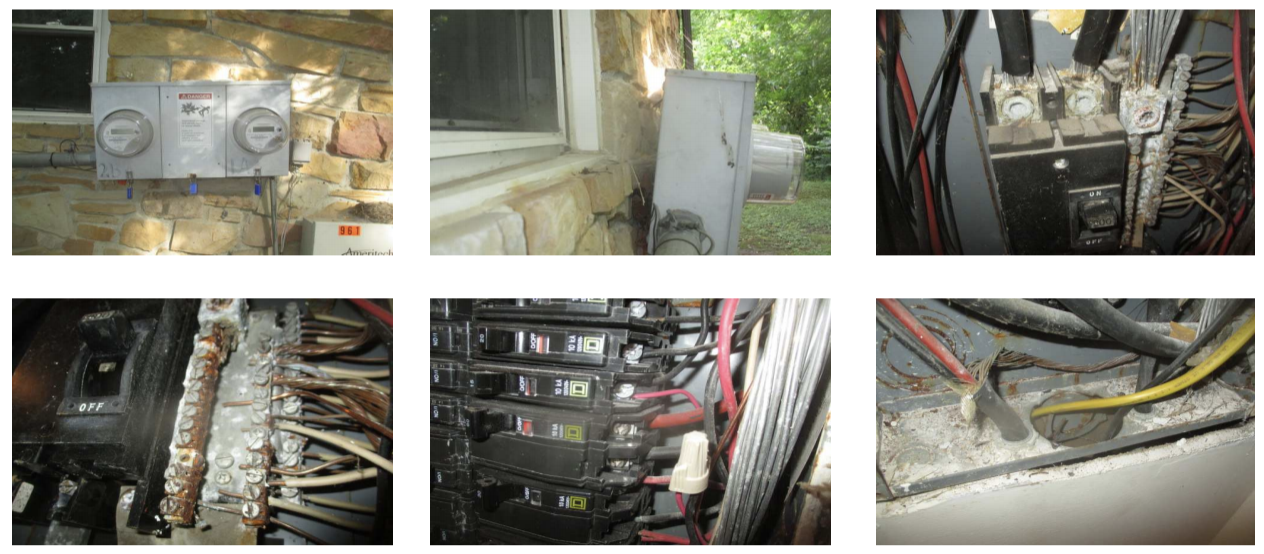

-Tyler It's time to get to work. I've got a duplex under contract and 10 days to perform due diligence. Every Day. Every hour. Counts. I can't waste time now! Step 1: with a tenant in the lower unit, I immediately ask for the formal lease to verify rent and legalities. Good news! The lease is in fact set for $850 per month: The tenant has paid ON TIME over the current terms of their lease. I also get my loan rate locked in. Here are the rates I got from my lender: I lock in an interest rate of 5.25% for an extra $444. Now, the fun stuff...I get an inspection ASAP which cost me $450. Price is generally determined by square footage and type of property. For example: the inspection for My Second Property (Single Family) was $310. The inspection uncovered some issues... -Excessive rust in both main panels. Recommend a licensed electrician evaluate. -Both bathroom fans need to be repaired/replaced -Driveway in poor condition -Both garage doors to repaired or replaced -Recommend a qualified contractor assess source of standing water in crawlspace and make repairs. But, there were some good things too! -Both furnaces are only 2 years old -Both cooling systems are 4 years old -Both water heaters are only 1 year old -Roof structure, roof covering, gutters, and attic are all in good shape *It's always great when your mechanicals are still at the early stages of their lifecycles* *It's also great when the roof is in great shape* Overall, YES, there are some concerns. The biggest one...and you might be able to guess...is the STANDING WATER in the crawlspace. Also, the rusted panels are a red flag as well. I don't want to kill the deal, the numbers are still great. SO, I have to do my best to estimate repair costs, lean on my property manager, contractors, and my own research. Because I require another specialist to get out to the property to evaluate the crawlspace, I immediately ask for an inspection period extension. This is usually built into the initial contract, so make sure when getting a property under contract it's in there, unless you really feel like you won't need it! Meanwhile, I also had my agent go out there and TAKE PHOTOS AND VIDEOS! Make sure in addition to your inspector seeing the property, you arrange to have your agent and/or your property manager check out everything. Getting their impression of the place is SO valuable. NEXT STEPS: I need to determine repair costs and then come up with an inspection response back to the seller. I still plan to move forward with this property! Takeaways

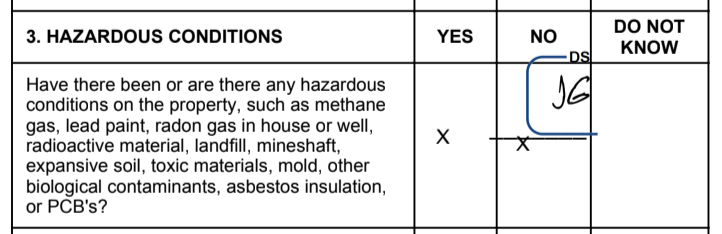

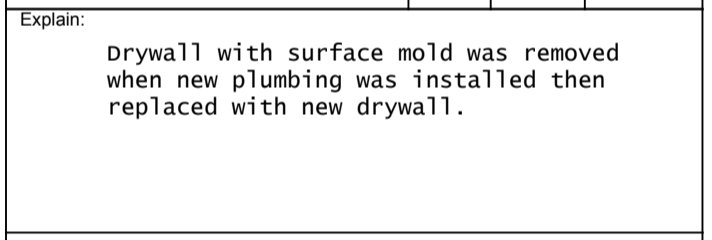

-Tyler I got LEAD #4 on my mind... AND I WANT IT! Why? It's a duplex listed at $165,000 and should rent for about $850 per unit (so $1,700 total). Each unit is a 2 bedroom/1 bathroom, each unit is right around 1,000 square feet, and each unit has an attached garage space. It's in a good neighborhood with great schools and little crime. Obviously, STEP 1 is to run the numbers and dive deep into the ANALYSIS. And the numbers check out! I test different acquisition prices, see what type of return I want, understand what my MAX price would be, and email my agent immediately: "Please submit an offer for $155,000." Thank you, Tyler Within a couple hours, I got the disclosures. And...a little red flag popped up: I'm not down with HAZARDOUS CONDITIONS, but the explanation was sufficient for me and it's something I can check on during the inspection window if I get the property under contract. So, I officially sign the Docusign documents to submit an offer. WOW! Now....it's the waiting game... Ahhhh, the anticipation can be crippling. What will their response be? Accept, counter, reject? I keep trying to train myself to take emotion out of investing, but it's difficult. I think the only thing that will help is repetition. Side Note: at this point, I send my lender a quick note and let them know that I offered on a property. Over communication is just a good general life tip. Within 24 hours a counter offer comes back: OK. OK. We're getting somewhere. A counter at $161,000 isn't bad. I knocked the list price down by $4,000 within a day. But, running my numbers again, I know $161,000 is still a little too much. I'm not comfortable with the ROI at that acquisition price. *In the meantime* I alerted my insurance agent that I had a property on the hook and that I needed a real quote as soon as possible. He's amazing, and drove out to the property right away to survey it and send me photos. Seriously, if you need an insurance agent, email me and I'll introduce you to him. So, back to the negotiation...I counter back at $158,000. At this point I know we must be VERY CLOSE to getting this deal locked up. I needed to keep the acquisition price under $160,000 and I felt this was a very strong offer. Anddddddd...... The seller accepted! WOop WOOp! WOOP! Another property under contract! OK, no time to really celebrate. It's time to get to work on due diligence. Remember, always have an inspection contingency in your contracts and take full advantage of it. Takeaways

-Tyler Well, remember how I started last post by talking about FOCUS? Follow One Course Until Success My business partner is a smart man and really decided to follow that mantra. And I admire him for that. Because I need to improve my focus. I've got the classic "shiny object" syndrome that plague the entrepreneur type. So, after we lost out on three deals together (Partnership Leads #1, #2, and #3), my business partner decided to bow out of working together (just for the time being)... BECAUSE He just closed on a duplex in Forth Worth, Texas. Like I said, he's a smart man, and he now must shift his focus on getting this new duplex in Texas turned around, renovated, stabilized, and rented. Which, pretty much leaves me back at square one. Sitting here with some cash, but no deal. But guess what? Out of nowhere...sorta... Something caught my eye. What is it??? A duplex. How'd I find it? I didn't. My business partner found it while looking at sold and listed comps for Partnership Lead #3. Introducing... LEAD #4 This duplex is listed at $165,000 and should rent for about $850 per unit (so $1,700 total). Each unit is a 2 bedroom/1 bathroom, each unit is right around 1,000 square feet, and each unit has an attached garage space. It's in a good neighborhood with great schools and little crime. FIRST IMPRESSIONS OF LEAD #4: HECK NO! I don't want this thing. The marketing photos make it look great, but on Google Street View it's on an odd block. There's an old couch just sitting on the sidewalk, it's at the end of cul-de-sac and surrounded by shabby looking multi-family units. BUT, there's still a lot going for it too. Rents are pretty high, it beats the 1% rule, and it's in a safe neighborhood with GREAT schools. It definitely warrants further research. So, I get to work on my analysis. The more and more I uncover, the more and more I like the property: -It was recently renovated -There's a tenant in the bottom unit on a 12-month lease paying $850 a month. This is great to know because now I can really see what market value for the top would be when projecting rental income. -It's part of an HOA (which I'm not a fan of), but it's only $30 a month and it covers lawn care and maintenance on common property -It's surrounded by two amazing parks with running/bike paths -Even at asking price ($165,000) it beats the 1% rule ($1,700 per month in rent is >1% of purchase price) -I love the appeal of getting a small-multi unit property instead of a single family. This will help scale my portfolio faster than expected. I like this place a lot. A LOT. AAAAAA LOOOOOTTTTTT. You know what that means...time to be aggressive and go after it! Takeaways

-Tyler I find it ironic that I tell myself to FOCUS (Follow One Course Until Success) ALL THE TIME, when in reality, my investing strategies are still all over the place right now. Let's take a minute to recap where I'm at right now: 1. I'm looking for a single family property for myself 2. I'm looking to partner with my friend on a buy-and-hold dupex (Partnership Leads #1 and#3) 3. I'm looking to partner with my friend on a single family value-add property (Partnership Lead #2) We'll, either way, I've got to tackle things one at a time. Seeing as I already lost out on three single family properties just a couple weeks ago, my business partner and I are going to be aggressive: We take a big look at Partnership Lead #1 Remember, it's listed for $105,000, each unit is a 3bed/2bath, total gross rents are $1,525, and it's in Warren (a pretty decent neighborhood we like). Crunching the numbers, and we're talking more than a 15% Cash on Cash return! 15% RETURN?!?!?! Yeah, we've got to hop on this thing quick. So, I ask my agent to get out there as soon as possible to do some recon. Definitely want to get photos, videos, and her take on the property/neighborhood. According to the listing agent and her impression of the place: -1 Tenant has been there for a year -The other Tenant just moved in, but it's a couple making over $60k combined and they haven't had issues paying. -Property is being sold AS IS. -Roof is about 12 years old -HVAC systems are 17 years old (YIKES! That's an upcoming expense) -There were a few cracked tiles inside, but overall, things looked "real good" according to my agent My partner and I go real deep into the analysis of the property and finally around midnight, I send my agent a few last questions....everything from yard maintenance responsibilities, to replacement roof cost estimates. We're literally 12 hours away from putting in an offer... I knock out for the night, exhausted. And the next morning at 6am, get the following email from my agent: Just talked with the list agent - unfortunately they accepted an offer last night. They had an offer come in with a midnight response time (!!) and went ahead and accepted it. I let the list agent know to keep me in the loop. Sorry!! Knew this one would go quick, but midnight offers is crazy! WOW. Seriously. WOW. I know, investing shouldn't be emotional. But, I was upset. And it lingered for days. Dang it. We wanted that one! BAD! But, I'll repeat this lesson: you've got to get OVER IT! And move on! We take a look at Partnership Lead #2 Remember, I literally found this lead on my phone while walking through Target on my lunch break. This would be a HUGE departure from what my partner and I have experience in. This single family property is a For Sale By Owner listed at $60,000 and it's a value-add investment. All fixed up, it should be worth around $95,000. Basically, my partner and I would buy it all cash, renovate it so it'll appraise for $95k, rent it out at $950 per month, then refinance it and pull most of our money back out. At the end of the day, we'd have VERY little money in property, it would cash flow, PLUS we'd have most of our money back and ready for the next investment! Breaking down the numbers to determine our offer price: After Repair Value: $95,000 Renovations: about $15,000 Agent Commission: $1,800 (because it's a For Sale By Owner, we offered to pay commission) General rule of thumb on flips or value add investments, you want to be "ALL IN" for 75% of ARV. So, if our ARV is $95,000 we have to be ALL IN for.... $71,250 Which doesn't give us a ton of wiggle room. Especially since the list price is $60,000. We go for it anyway, and offer: $52,000 Andddddd, we get a quick response: There's already another offer in at $63K cash - buyer is paying all closing costs and commissions, So total out of pocket to the buyer is higher than $63K, I would assume somewhere in the $67-$68K range. I told him I'd talk with you and see what you want to, but it sounds like we're quite a bit apart. My partner and I definitely can't go that high. ANOTHER ONE BITES THE DUST! Damnnnnn. We take a look at Partnership Lead #3 Here's another attempt to go in on a duplex with my partner. A couple interesting things about this property: -it's outside of the neighborhoods we generally look at and not very close to downtown. -the owner is late on their taxes and owes over $4,000. We've never dealt with anything like this... -Rents are currently at $750 per side, but there's a strong case for being able to raise them to $850. Things check out after running the numbers and even though we don't know this neighborhood AT ALL, it looks very safe and clean so we're very comfortable Jumping IN. We go for it and offer $143,000 with a little wiggle room to negotiate up if needed. BOOM! We're hit with a "multiple offer notification" meaning, the sellers are asking for every buyer to submit their "highest and best" offer by tomorrow 10:00am. This is always a tricky situation. You never know where you stand in terms of your offer amount compared to others. You could VERY WELL already be the highest offer and getting emotional now can hurt you in the end. Ultimately, as an investor, it comes down to what number are you still comfortable buying the asset for and what returns do you want. In our case... We offered our HIGHEST AND BEST at $146,000. That's the absolute HIGHEST! And we're not moving up from there. SAD FACE :( The next morning we're hit with an email: "I heard back from the agent on the duplex - they went with another offer." This is where frustration REALLY hits you. All the hours of work put into researching properties, looking up expenses, running spreadsheets, reading disclosures, putting in offers.... It's TOUGH. It HURTS when you fail and lose out on a deal, or two, or three, or six. But, to really make it in this business, it's going to take hundreds of hours to master. It'll take WAY more offers than you'd ever want to submit. All you can say is: ON TO THE NEXT ONE. Key Takeaways

-Tyler |

Browse Topics

All

|

Investing |

Jump In |