|

Here’s a scenario: You just closed on an awesome investment property and you eagerly share the big news with your friends.

“What’s the ROI [return on investment]?” they ask. “It’s amazing!” you say. “It’s …” Then it hits you. You’re not sure how to answer the question, because there are a number of possible answers. Are they talking about capitalization rate? Cash-on-cash return? Internal rate of return? Cash flow? Appreciation? Every investor has their own understanding of what an "amazing" ROI is. In this article, we’ll look at defining your investment goals (namely, cash flow vs. appreciation) and run through the primary formulas for calculating rental property ROI. Check out the full article I wrote that was published on Roofstock!

0 Comments

*A GUEST POST BY AIDEN WHITE*It’s a dream for every investor to find the "perfect" investment option. But practically, finding such an investment doesn’t actually exist.

Every investor has their specific choices and criteria by which they may consider an investment option suitable. Each investor has their separate risk-taking abilities and mindset about investing. So, there is no such guaranteed investment option that can be proved to be the best. Is it still a good time to invest in real estate in 2019? At Equity Trust’s recent Wealth Building Summit, Rebecca, the Executive Director of the National Real Estate Investors Association (National REIA), elaborated on her research about the situation of the real estate industry. She explained that individual investors are concentrating on increasing investment in the real estate market, and the number is growing continuously. Rebecca also added some forecasts about the real estate investment possibilities in 2019, she explained the following five points: 1. Ignore building more starter homes The number of homeowners is increasing day by day and they also want to stay in their homes for longer. This information is confirmed by the U.S. Census Bureau, which means the demand for building new starter homes will be much less than expected. 2. Focus on millennials Millennials account for a total of 68% of first-time home buyers, per the Federal Housing Administration (FHA). Rebecca said that millennials also use a different approach for house shopping and provide value to different amenities. Millennials usually follow these trends during their housing hunt, as per the FHA:

3. Consider the specialized housing requirements of seniors Senior citizen population is another important factor among buyers and renters that investors should consider. As per the U.S. Census Bureau, senior citizens may outnumber kids population by 2035, the first time in history. 4. Number of foreclosures are expected to decline Foreclosures have declined compared to the time of great recession. According to data given by Attom Data Solutions, the foreclosure rate was calculated at 0.51% in 2017, it was 2.23% in 2010. 5. Look out for larger trends Rebecca advised that real estate investors should do their own research before buying a property. It is best to know the grounds before investing in an out-of-town property. Investors should do proper research about the employment rate in the locality, the geographical information (about natural disasters), and the crime rate of that neighborhood. Let’s check out 2019 metrics for five major US markets Dallas/Fort Worth, TX The metropolitan area gives you a strong economy with steady population growth. The cost of living is low, and the growth of the labor market is good (4.3%) as the cost of doing business is also low.

New York/Brooklyn, NY New York is popular as an international housing market for foreign property investors. Cost of living is high, so it makes it difficult for booming new construction. But the “city government, the local real estate board, and the construction trade unions are finally working together to increase new supply.” The occupancy rate is high, and so is the rental income. It is a good option to buy a multi-family investment property. But there are few strict regulations on property investors renting out on Airbnb.

Raleigh/Durham, NC The housing market is balanced. It also has a strong, projected employment growth in 2019. The number of new residents is increasing as well as the population under the age of 44, which makes the housing market more beneficial for investors. The area is filling with new construction to the house. Job opportunities, affordable housing, and a diverse economy will be helping the real estate market to become profitable for multi-family homes.

Orlando, FL Orlando has beautiful scenery, high standard of living, and ambient weather. Orlando is having a population growth at a rate of 7.2%. The city is also becoming a business hub for young professionals with annual job growth of around 4.4%. Florida has no personal income tax. The housing market is much affordable than other states. Affordability and increasing rental income boost cash flow.

Nashville has higher demands for both long-term and short-term rentals. The city also has the lowest unemployment rate and a strong job market. Music City is the best place to invest in real estate short-term rentals. Overall, Nashville is an affordable, landlord-friendly housing market.

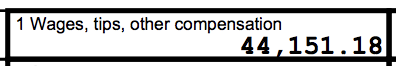

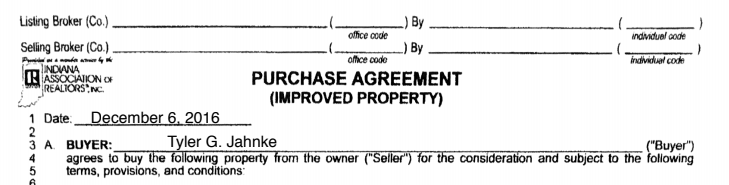

Data courtesy: mashvisor.com I spent $142,987 last year. I just did a 2018 personal financial recap (you should do one too!) and I spent well over 6 figures last year. That dollar amount includes living expenses, investment acquisitions, mortgages, business startup costs, EVERYTHING. And really....that number doesn't shock me at all. Why not??? Because I TRACK every penny that comes in and out of my accounts. I know EXACTLY where my money is going. And by TRACK, I mean.... I use Personal Capital (affiliate link) to automatically track my financial life. I don't have time to labor over spreadsheets, bank account statements, and credit card bills. And you probably don't either. The good thing is, Personal Capital links my accounts and does everything for me :) By logging on, I was able to determine within 20 seconds that: I spent $3,164 on Restaurants in 2018 I spent $940.23 on my cell phone in 2018 I spent $1,182 on groceries in 2018 Understanding these types of trends, and making adjustments is key to a healthy and successful future. Having these types of insights can exponentially increase your wealth. *Bonus Tip* After identifying my spending trends, I leveraged that knowledge and picked up a new credit card that rewards me for my highest expense categories. If you spend a lot on restaurants and groceries like I do, check out the new American Express Gold Card. You'll get 4x points on those categories and 40,000 points by using my referral link. I started tracking my finances in detail a couple years ago, and it's literally been a LIFE CHANGER. Just a couple years ago I was making $44,000 a year living in the San Francisco Bay Area. I knew that if I wanted to improve my financial situation, I had to understand my finances first. There's no coincidence that my income has more than doubled since I started educating myself and tracking everything. Before you Jump In to real estate, build that financial foundation! Educate yourself on your income, spending habits, and investments. Now, the cool thing is, not only does Personal Capital track your income and expenses, it also tracks Net Worth. Every couple weeks I check my Net Worth and it's been a game changer in building wealth. What exactly is Net Worth? Simplistically, it's your Assets minus Liabilities. It provides a snapshot of your financial situation in real time. Why is it important to track Net Worth? When you see your financial trends right in front of you, you're forced to confront the realities of where you stand financially. Knowing that, will cause you to be more mindful of your financial activities. Coincidentally, I just got this email from CNBC the other day... Glad to see that CNBC and I are on the same page :) If you don't keep track and understand your finances, you're ignoring them. You can't expect to improve your financial situation and grow your wealth if you don't have knowledge over your own finances. So, if you're the type of person that HATES talking about money... Or, you refuse to confront your bank account... Or, you need to step up your finance game... Or, you want to grow your wealth... The first step is to make a change and educate yourself in your own finances. Take charge. And face it now! Check out Personal Capital (affiliate link) because I HIGHLY RECOMMEND IT! And if you sign up using my affiliate link, you'll get a $20 Amazon Gift Card. #KnowYourMoney And Happy Investing! -Tyler I have to show you something real quick... That's a Purchase Agreement from December of 2016, when I purchased My First Property. WOW...I can't believe it's officially been 2 YEARS since I started investing in Real Estate. And it's been a crazy roller-coaster ride so far, to say the least. Here's a quick recap: I bought My First Property from a turnkey company in December of 2016. Everything went "smooth" for 11 straight months, until an unexpected vacancy and unacceptable management derailed the investment. With $16,000 in repairs needed, I decided to sell it. I bought My Second Property in March of 2018. I bought My Third Property in July of 2018. Then I invested in an 80-unit multi family property just this past October. I've had my fair share of bumps and bruises along the way. Tons of challenges, frustrations, and second guessing. And I know there's plenty more of that to come. But, I'll continue to learn every step of the way. And now it's my job, to share my knowledge with YOU. Here are my TOP 8 TIPS after my first 2 years in Long-Distance Real Estate Investing: 1. Network, network, network "Your Network is Your Net Worth" I live by this and truly believe it. The people you keep closest to you, create such a profound influence. You've got to be conscious of that and surround yourself with the best and brightest. I've met some of my best friends through real estate and I couldn't imagine my life without them. So, use the best real estate networking tool out there, Biggerpockets, and connect with locals that are just as ambitious and driven as you. Set up local events and meetups to chat with novice and experienced investors, agents, contractors. Business and LIFE are all about relationships. 2. Master How to Analyze Property The basics of investing start with understanding How To Analyze Rental Property. You MUST know how to quickly filter through potential investment leads, determine all expenses, and projected rents. You need an understanding of flood planes, school districts, neighborhoods, taxes, and much more. If you're looking to acquire a property, I challenge you to start analyzing 1 property a week. Then 1 property a day. Repetition will get you to a point where analysis becomes clockwork, so when that great deal pops up, you can JUMP ON IT! 3. Location, location, location When I first started investing in real estate, I didn't realize the importance of location. I just saw the numbers on paper, and assumed if the numbers on paper worked out, the investment would work out. Well, I WAS WRONG. Having a great real estate investment requires so many factors...and location is a huge one. You must understand neighborhood crime levels (I use Trulia crime maps), school districts, neighborhood classes, and neighborhood amenities (is there a Starbucks nearby?). Understand what type of tenant lives in the neighborhood (check out Neighborhood Scout). After all, your tenant is the primary source of income. 4. Interview and Vet Multiple Property Managers I've experienced working with the wrong people. And it SUCKS. Don't be like me. My first property manager decided to just NOT tell me that one of my tenants left. I only found out when my friend drove by the property and spotted a lock box on the front door. Then, I ran into $16,000 in needed repairs as the property manager never checked up on the property throughout the year. But, I take full responsibility for hiring the wrong people. And I learned real quick how to never make that mistake again! The key is to interview multiple property managers and really truly vet them. Check out my post on How to Hire a Property Manager. And if you want to work with my property manager, contact him HERE. 5. Always get an inspection Ahhhh...I was so naive a couple years ago. When I bought My First Property I admittedly was a little too trusting. In buying the property all cash, I didn't need to get a property inspection from a 3rd party company. Unless you really understand construction, rehab, and can see the property in-person, I'd say: ALWAYS GET AN INSPECTION! An inspection can and WILL save you from unexpected issues that'll cost you $. Lots and lots of $$$. 6. Don't ignore issues on the inspection report Well, I learned early on about the consequences of not getting an inspection report. But, I guess you could say I didn't learn the whole lesson. I had a relatively major issue pop up on an inspection report once...standing water in the crawlspace. I had a mold guy go out there and check it out, but I never decided to get a foundation expert to assess it. I ended up brushing it off the whole thing and tried to push it out of my brain because emotionally I really wanted the property and the numbers looked AMAZING! I eventually bought the property. Now, it's biting me in the A$$. Bottom line: don't ignore big issues on the inspection report. Take care of them or walk away. 7. Visit your market and meet your team in person Some long-distance real estate investors might disagree with me here, because technically everything can be handled remotely. BUT, having flown to my market multiple times, I can say it's an invaluable experience. You'll have a HUGE advantage if you take the time to get your boots on the ground, meet connections face-to-face, drive through neighborhoods, and really understand the culture and direction of the city. Real Estate Investing is a relationship business and meeting your team IN PERSON strengthens those relationships. Sitting down with your agent and property manager for a nice lunch goes a long way. Trust needs to be built if you're going to invest from afar, so get out there and understand your team on more of a personal level! 8. Keep a Positive Attitude and Move Forward You're going to fall down. And you might even get kicked while you're down. But, that's not only real estate or business...it's life. Being able to get back up from every challenge, move on, and LEARN is crucial to your development. This is much easier said then done, but get it in your brain, so when your next pitfall comes up, you're ready to move forward and grow. Well, as a final conclusion here, I've got some last things to touch on: A LOT has happened in the last couple years. Literally, my life has changed. My mindset has changed. My understanding of investing has changed. By the way: -I'm nowhere near "Financially Independent." This is a LONG game. I'm 2 years in. Let's chat in 20. -I'm continuing to learn each and every day. Books, Podcasts, and Meetups. Never stop. I'm excited for the future. Reach out if you have any questions, I'm always happy to help in any way possible. -Tyler Temperature: HOT Humidity: A LOT Where was I Labor Day Weekend? Indianapolis, Indiana. Home of my investment properties. My previous trip out there was a little over a year ago when I checked out My First Property after renovations were complete. Since that last trip in March of 2017, A LOT has happened. I sold My First Property, purchased and rented My Second Property, and acquired My Third Property (which is finishing up a light rehab right now). Suffice to say, I was super excited to get out there to see how the market has progressed, soak up the culture, actually see my new properties in person, drive neighborhoods, meet with my team, and shake hands with connections in the area! So, what value did I get out of the trip? HOLY CRAP...A TON OF VALUE: General Takeaways

If you can't tell by now, I HIGHLY recommend you visit your investment market. To be successful in this business, there are two major KEYS you need: 1. Strong relationships on the ground 2. An understanding of the market and its specific neighborhoods How do you master those two keys? Get your butt out to the market and see it for yourself. Peace and Happy Investing Jump In Nation! -Tyler Faced with a risky decision? Not sure if you should put that offer in? Scared to go for it? How do you, JUMP IN? *HINT* There is no art. You just have to do it. Yesterday, I had a conversation with someone while they were analyzing a property. When I brought up neighborhood crime stats she asked, “Do you think I’m rushing into it with this property? So many things I didn’t consider. I think I am just eager to get started…" I remember those days. The days of… “how old is the sewer line?” “Are the gutters galvanized?” “What type of soil is the house sitting on?” You know…the days of analyzing EVERY LITTLE THING. The days commonly known as, “Analysis Paralysis.” But, back to her question, “Do you think I’m rushing into it with this property?”

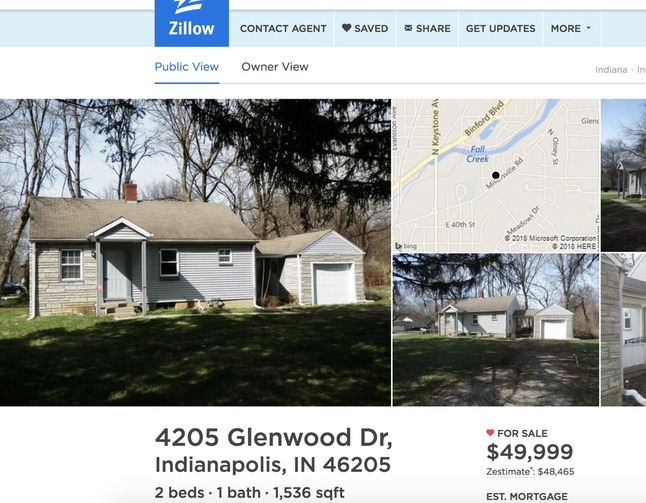

My answer? Honestly, I can’t answer that question. That’s a question you’ll ultimately have to answer yourself. At some point you’ll have to JUMP IN without knowing everything, make mistakes, maybe lose some money, learn on the fly, and get better. Otherwise, you’ll be sitting on the bench watching… I bought My First Property before I “should” have. I was very naive (didn’t even know how to properly calculate cash flow…), but was super eager and could see the amazing opportunity in real estate. LONG story short, I got burned. But, I got out of it. I walked away. Let that one go. Am now better prepared for the future. I wouldn’t trade that experience for anything. Here’s the bottom line: if you think you’re going to learn every little thing about real estate before getting your first deal…you’ll never BE a real estate investor. Learn from this community, meet connections, find a deal, and JUMP IN. Happy Investing All! -Tyler Featured OnWant to know the #1 question I get asked? I'll tell you. It's... "Why in the WORLD do you buy houses in Indianapolis?" Believe me, I understand why that question pops up all the time. Living in the San Francisco Bay Area and buying property over 2,000 miles away from home isn't the typical investing strategy. On the surface, it probably seems crazy. And, maybe it is. BUT, I'm sold on the city of Indianapolis. And aparently, many of you agree with me as well...having lost out on 4 deals this past week! Ahhhh the frustration! Anyways, I wrote an article for Roofstock: 10 Reasons I'll Buy More Rental Properties in Indianapolis. Check it out, give it a read, and let me know what you think about Indianapolis! After you read that article, take a look at the Indianapolis market overview below! Use my referral link below and GET $500 INSTANTLY applied to your Roofstock account!

closed on My First Property. It was a day full of excitement, optimism, uncertainty, and progress. It was Chapter 1, Step 1, of my long-term financial plan. It was my first taste of "passive income." And it was the first puzzle piece to building a life full of travelling, family, friends, #vanlife, and personal projects. 512 days later...I've officially turned the page on this chapter in my real estate journey. I closed a deal last week and sold My First Property. The past 512 days were full of crazy ups, downs, surprises, and wins. I was immersed in the greatest real estate educational course I could have ever asked for. It was a million times better than sitting around reading blogs, articles, interviews, and not taking action. And a billion times better than any guru course I could have taken. It wasn't easy, but I'm forever grateful I took a leap and decided to Jump In. So, let's get to the recap now that things have settled: In October of 2016, I decided to work with a turnkey company. Their job was to assist me in all aspects of acquiring, renovating, renting, and managing rental property. After a couple weeks of receiving property leads, I put one under contract and closed on it in December of 2016. I paid for it in cash to protect myself against a monthly mortgage payment, to avoid paying interest, and to drastically improve my monthly cash flow. If the numbers all worked out, I would be getting a 13% annual return. What's not to like about that?? Things were looking good! Renovation started! But, then there were numerous delays. Communication was more than frustrating with my property management company. Red flag, after red flag kept popping up, but I didn't take the indicators serious enough. I was focused on getting the property rented, cash flowing, and bringing in "passive income" for a Financially Independent future. More renovation delays came. Little progress was made, but with my demands I finally was able to kick the contractors into gear. Finally, the rehab phase was over and a huge weight was lifted off my shoulders. Then, I flew out to Indianapolis for a quick weekend trip. Early on, I honestly didn't have plans to fly out to Indy. I really wasn't concerned about seeing the property first-hand, but I am now grateful I pulled the trigger on that move. Why? Because I met my property manager, contractor, and most importantly, I met connections FOR THE FUTURE. I left Indianapolis confident. My property was officially on the market for rent and by the end of March, four weeks later, I GOT A SIGNED LEASE! Even though the renovation and leasing of the property took weeks longer than expected, at the end of the day, I was happy with my vision actually coming to fruition. I purchased a property. I had it renovated. And I got a signed 12-month lease for $750/month. I was well on my way to building a large real estate portfolio. I received my first rental payment while vacationing with friends in Vietnam. I was ecstatic. This was the definition of "passive income," right? Getting income deposited into my bank account while ON VACATION? Wow. Things were smooth. Literally, not much happened for 11 straight months, except the routine rental payments deposited into my account. I did a 1 year recap, where I broke down all income and expenses, and the numbers looked great! Then. Everything. Fell. APART. I got a tip online from someone that my property was vacant. So, I sent a third party property management company out there to investigate. Sure enough, the only person living in my house, was a squatter in the garage. Frustrated? Hell yeah. But, I had to tackle this head on, take control, and move forward. I put together a plan. I secured the property by installing new locks. I evaluated the damage and repairs needed (which came out to $16,000!!!). Ultimately, after a detailed evaluation, I decided to SELL My First Property. I didn't feel it would be worth it to pour more money into this low-priced asset. I pessimistically foresaw years of capital expenses piling up. I saw flaky tenants living paycheck-to-paycheck and unable to keep up with rent. Yes, the numbers on paper looked great for these low-priced investments, but by growing my knowledge in real estate every day, I knew I had to focus on a better class of property. This is where the greatest gift of My First Property came in to play. It gave me the chance to re-evaluate my investing strategy and adjust for the better. I had to let this one go. With my property listed, it sat on the market for over three weeks. In Bay Area terms (which I'm familiar with), that was an eternity. Those 25 days were brutal. Absolutely terrible. I questioned my strategies, my intentions, and MY DREAMS. Offers came in here and there in the beginning, but none of the buyers were willing to negotiate up to an acceptable amount. Then things went quiet for awhile. Crickets. I even began to forget that I was actually selling a property. BOOM. Out of nowhere, I got another offer. It was like sitting on a lake and fishing for hours, then finally feeling a little tug on the line. I had to pull this one in. Back and forth, back and forth, the negotiations teetered from one side to the other. Eventually, we agreed on a price that allowed me to not just break even, but bring in a small return on investment. We closed within a few weeks as it was an all cash purchase, and now I'm focused on the next move: managing My Second Property and purchasing My Third Property. So, what did these past 512 crazy days amount to? I'll tell you - they amounted to the greatest chapter in my life. 1. Over the past 16 months, I got a 3% return on my investment, which is better than any savings account I could have parked my money in. That's a huge win in my book considering the challenges I ran into over the past few months. 2. I re-adjusted my investing strategy in Indianapolis. I now only target houses in the $75k-$100k range that rent for over 1% per month. Higher rents = a better class of tenant. 3. I purchased My Second Property, which is a much stronger investment than My First Property. I bought it for $86,000 and it's currently rented to a quality tenant for $995/month in a B class neighborhood. 4. I now completely understand the importance of having a top notch and trustworthy property management company. Having vetted multiple companies, I can now teach you how to hire one. 5. I met some of my best friends through putting myself out there and networking. We all connected online because of our similar mindsets and passion for real estate. Your net worth is your network. 6. I started this blog and truly believe I can bring amazing value to Jump In Nation. I talk to investors daily and love it. I publicly posted my phone number on this site...so seriously....you can call or text and I'll get back to you My life has transformed because I decided to Jump In to real estate. I wouldn't trade this adventure for anything. If you haven't already, read the complete story of acquiring, renovating, renting, and selling My First Property HERE. If you have any questions, leave them in the comments section below or shoot me a message. Seriously, love you all! -Tyler

So, it's time to buy a rental property. You're probably feeling good, you're juiced up, and you're excited because with every property acquired you see yourself getting closer to your financial dreams. But, great deals aren't always easy to come by.

You have to be quick, concise, and really KNOW YOUR NUMBERS!

This post will teach you how to quickly analyze buy-and-hold investment property, so you can ultimately determine if you've got a good buy or a bad one.

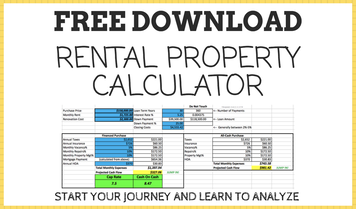

THE FIRST STEP? Download my free Rental Property Calculator HERE.

Now that you have my FREE rental property calculator, take a SUPER quick look at these three indicators of a good investment:

1. Does it meet the 1% rule? There's a good chance that if you can get at least 1% of the purchase price in monthly rent, you've got a cash-flowing property. For example: if you purchase a property for $100,000 it should rent for at least $1,000 per month to cash flow. 2. Can you get it for UNDER market value? Take a look at what properties are selling for in the area and what properties have sold for in the past 6 months. You can gather this info on Zillow, Trulia, or through your agent. That should give you a rough estimate of what the property is worth. Now, can you negotiate the purchase price down and acquire it for under market value? If yes, you've got yourself some built in equity and value! 3. Is it in a good neighborhood? Stay away from war zones! Don't buy in crime stricken neighborhoods. The financial numbers on paper might look great for that crack house on the corner, but believe me, you'll run into more issues than you can handle. I love the crime map overlay on Trulia. That's where I usually go first to scout out neighborhood safety. If the answer is YES to all three questions, you're well on your way to finding a great investment property. Time to dig a little deeper! Understanding Expenses We need to understand all the expenses that go in to owning the property. Typically, they'll look like this:

Take these amounts and subtract them from your expected rental income. Whatever is left over is "cash flow" baby! If you have NOTHING left over, or even worse, the expenses are more than expected rent, that's a pretty clear sign this property will not work out from a cash flow standpoint. Here's a breakdown of each expense and how to calculate them: Mortgage This first expense might look intimidating to calculate, but it's really not. I use www.Bankrate.com for a quick mortgage check. Enter the amount you wish to borrow (which is purchase price minus your down payment), enter the interest rate, and enter how many years the loan will be. Bingo! There's your estimated monthly mortgage payment. Property Taxes Sites like Zillow, Trulia, and others show historical data on property tax history, however, the most reliable source I count on is the local county website. For example: I invest in Indianapolis and use the Marion County property taxes site. Always verify using the county website! Insurance Finding the cost of insurance will require you to call a few agents. I recommend getting three quotes from different insurance providers and analyze how the rates compare. Once you start getting familiar with your market you'll better understand the general costs depending on square footage and specific neighborhoods. Property Management Fees Property managers typically charge 6% - 10% of monthly gross rent and a one-time fee when a new tenant moves in. I would also recommend interviewing multiple companies and reading this complete guide on how to hire a property manager. Vacancy This is the amount in rent you expect to lose during a vacancy. As a little cash flow "buffer," it's comforting to save some of your monthly rental income for an unexpected vacancy, or if there's a vacancy during the turn-over of a unit once a renter leaves. I usually build in 5% of gross monthly rent for this category. Future Repairs This is one of the toughest expense categories to determine. Random repairs can come up in bunches, or you could go months, even years, without major maintenance needed. Be conservative when you're new to investing and save anywhere from 10% - 20% every month for repair expenses. Home Owner's Association Dues These expenses are not applicable for all properties. They're typically a monthly fee charged by an association for providing value to a condo or town home community. Some HOA's come with pools, community rooms, gyms, or other amenities. A quick call is all that's needed to find details on this expense category and how much it'll put you back per month. Understanding Income Now, we'll cover the income side of the things, which for a single-family homes, is usually just one category. RENT. Rent In order to determine what your property will rent for it's best to gather data from several different sources and average them out. I recommend taking a look at these four resources: 1. www.Rentometer.com - great website for comparing your rent with other local properties. Simply enter the property address, number of bedrooms, and see what the low, median, and high rents are in your area. 2. Reach out to property managers - email or call local property managers and have them assess your property. Their job is to understand the rental market and they should be able to give you accurate data. 3. Craigslist - scour Craigslist and see what similar properties are renting for in the area of your targeted investment. If you want to take it a step further, you can even post a fake ad on Craigslist for your potential rental property and see what kind of feedback you receive. For example: if you list a property for $1,000 and get crickets, you probably won't be able to receive that amount in monthly rent. You'll have to update your projections to a lower rent amount. 4. Zillow or Trulia - I tend to NOT rely on these for monthly rental estimates, but it's always a good tactic to at least take a look.

So there you have it...it really isn't quantum physics. These are the typical expenses and income categories you can expect from single-family rental property. Subtract your expenses from your income and you've got your cash-flow number. I personally will never buy a property that doesn't "cash flow," but everyone has their own investment criteria. So, have a strategy and stay firm with it.

Need help analyzing a deal? I'd love to help! Shoot me a message and let's chat!

Want to sharpen and take your property analysis skills to the next level? Then, The Jump Pack is for you. I created this package of digital resources to improve your property analysis skills. It includes: a property analysis guide, analysis checklist, analysis calculator, over 1 hour of videos, an investing glossary, plus more.

Now, before I conclude this post, I have a challenge for you: start analyzing 5 properties per day. Just do it! Get in the hang of looking up expenses and estimating rents.

ALSO - read this post on the nuts and bolts of calculating Return on Investment (ROI). I'll literally show you the exact formulas and equations needed to calculate ROI. Best of luck! -Tyler I'll get straight to it. This post has nothing to do with real estate. But, it's #FinanceFriday and I want to spread the knowledge I wish I had in 2014. Over the last four years of my life, I spent over $31,000 and learned a ton when it comes to understanding the HUGEEEEE difference between a performing asset and a depreciating one. In March of 2014, I was sitting on top of the world. I remember driving across the Richmond Bridge on a clear afternoon, stereo blasting, sunroof open, and a 300 horsepower engine purring beneath me. I just bought a BMW 335i 2-door coupe. It was glorious. It was fast. It was sexy. And wow, it was A HUGE step up from my 1995 Toyota Camry (in hindsight, damn I miss that car). Little did I know, I just made the worst financial decision of my life. Let's break it down.

TOTAL: $31,604.58 Clearly, I poured a ton of money into this car. All while only driving 12,000 over those 4 years (avg 3,000 per year). So basically, I traded a downpayment on a house (remember, I invest in the Midwest) for a car I barely used. Fast forward to March of 2018. I officially paid off my car (YAY for no car payments!!!). And then I sold it IMMEDIATELY. For $7,000.... Breaking down the simple math: Car acquisition and expenses: $31,604.58 Sold For: $7,000 Net Loss: $24,604.58 THAT. IS. PAINFUL. TO. LOOK. AT. Especially when I already had a paid off 1995 Toyota Camry I bought for $3,500. Now, I get it. Some people actually need a car whether it's for their work commute, to load up on groceries, or to drive the kids down to soccer practice, etc. but, I'm still going to beg you to listen to me: If you require a car, buy something affordable that's within your needs. Most importantly, pay for it in cash and don't pay that damn interest. Toss ego aside. Don't think about how people will perceive you with a "less sexy," but more affordable/economical/functional car. If you want to improve your financial outlook and future, these are the types of decisions you'll have to make. It's all for the long-term. So, if you're looking for a car, or you're reading this post with a nice Mercedes in the driveway, it's time to evaluate your situation. Here are some amazing tips (from the help of Mr. Money Mustache) that'll help you find and be efficient with your next car: 1. Don't borrow money to buy a car According to Mr. Money Mustache, around 73% of new cars in the US are financed. YIKES. Here's the problem with that: after years of owning the car, it's very likely it'll be worth less than you owe due to depreciation. That's clearly the definition of a terrible financial situation to be in. Also, who likes paying interest? No one. Who likes paying a monthly bill that cuts into your cash flow? No one. Be smart and pick up a car in cash for $3k-$6k that'll last you years and allow you to have a higher savings rate. 2. Buy a car that suits your needs the MOST Your car should be optimized to fit YOUR NEEDS, while burning the minimal amount of gas. If 90% of your drives include you and one passenger...there's NO NEED for a 7-seater SUV. If you live in the middle of an urban city, don't even think about getting that full-sized pickup truck. 3. Cars aren't for that quick 1/2 mile trip to the store Every time you start up your car, put it in drive, and head to the store 2 minutes down the road, you're really helping out depreciation. Depreciation REALLY loves every time you press that gas pedal. Next time, consider walking, or hopping on your bike for those quick trips. Everything counts! 4. You don't look ridiculous driving that small car, but you do look ridiculous paying for that oversized car every month. Screw your insecurities, say "bye bye" to your concerns about style. Here's a great quote from MMM, "Your job is to pick the (car) that enhances your life the most, and unless you are already financially independent, you'll get a lot more enhancement from getting some cash in your 'stash than you will from having 20" wheels and three rows of leather seating." 5. Cars cost you money PER MILE Because a lot of people aren't thinking long-term, folks assume that since their car is just sitting in the driveway, they should be used with reckless abandon. WRONG! Bottom line: the more you drive, the more you're burning gas, oil, tires, the engine, and YOUR CASH! Become aware of your car use, and minimize it! Best used cars under $10,000 according to US News and World Report 1. 2010 Toyota Prius 2. 2009 Honda Fit 3. 2011 Honda Civic 4. 2013 Honda Fit 5. 2012 Honda Civic 6. 2012 Honda Fit 7. 2011 Toyota Prius 8. 2012 Scion xB 9. 2009 Scion tC 10. 2009 Scion xB 11. 2009 Toyota Prius I'm beginning to see a theme... With that, I'll leave you a few articles from Mr. Money Mustache about cars that are sure to leave you with some value and entertainment. Leave a comment below! What's been your WORST financial decision EVER? How to Come Out Way Ahead When Buying a Used Car Curing Your Clown Like Car Habit New Cars and Auto Financing: Stupid or Sensible? Peace and happy investing! -Tyler |

Investing |

Jump In |